Industry At A Glance: Cropland & Pasture Values

December 9, 2012

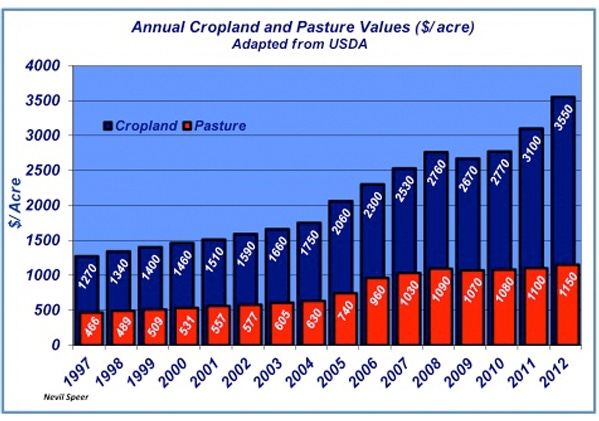

There’s one issue that is hugely important to the future of production agriculture – estate taxation, commonly referred to as the death tax. If Congress doesn’t act, the tax will revert to a $1-million exemption level and subsequently rise to the 55% rate on anything above that level. Clearly, this will prove highly detrimental to the production sector (not to mention, despite favorable rhetoric, being the single most important blow to the advancement of vibrant, family businesses all across America).

Given current land values, it certainly doesn’t take very large holdings for any farm and/or ranch to surpass $1 million worth of assets. Congress needs to do several things:

Extend the current exemption immediately to ensure seamless transfer of assets.

Establish moving exemptions over time adjusted for rising land values in agriculture.

This is especially true given that government-induced ethanol mandates have been a primary driver of higher land values in recent years.

Congress needs to hear from you immediately! What impact would Congressional failure to extend the exemption have upon your business operations and estate planning?

Leave your thoughts in the comments section below.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)