Beef demand vs. beef consumption: What’s the difference?

Beef consumption and demand reflect two very different things.

March 31, 2016

Industry At A Glance recently highlighted annual per-capita protein spending trends from 1990 through 2015. What that analysis showed is that beef spending was flat between 1990 and 1998 (when beef demand bottomed out). However, since that time, the beef industry has captured new spending at a faster clip than pork or poultry. Beef spending in 2015 eclipsed a new record at $340 per person – an increase of $155 per capita since 1998 and up nearly $80 in the past five years.

The discussion also revolved around market share, noting that beef’s market share is approximately 48% of total dollars spent on protein – up from 44% back in ’98. However, some might argue that number isn’t fully representative. That is, from a volume perspective, beef’s market share is actually declining – pork and poultry have been able to increase sales volume versus beef during those 10 years.

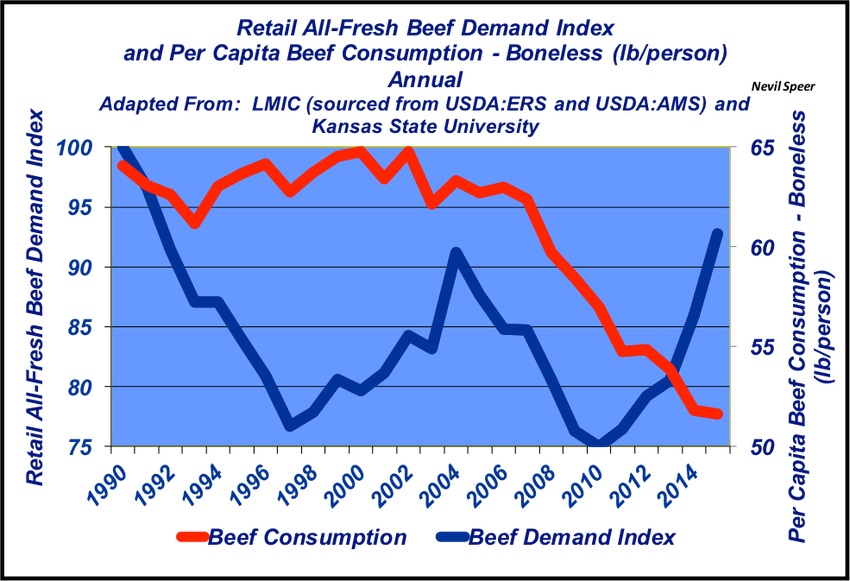

This week’s illustration provides some context around the focus on market share from the volume standpoint. Indeed, beef consumption (reflective of disappearance) has steadily declined since 2005 and conventional wisdom often attributes higher prices, and consequently greater spending, to declining supply.

However, consumption (sales volume or tonnage – not dollars) doesn’t reflect consumer perception of beef or beef products in the market place. It is a function of production and disappearance. As such, sales volume doesn’t account for decision-making about the price-value relationship when consumers make comparisons between beef, pork and poultry.

The most accurate measure of beef competitiveness is reflected by the beef demand index. Demand reflects both supply and price. Stated another way, even with low supply, if consumers don’t perceive beef as a favorable product, there’s little pricing power to clear the market of existing supply.

This week’s graph illustrates the difference between consumption and demand – they reflect two very different things. Most importantly, declining consumption does not reflect declining demand. In fact, consumption has declined during the past several years while demand has improved.

Stated another way, supply has helped stretch the market to a series of new record highs in recent years. However, higher prices can’t be passed on if consumers favor the competitors – pork and poultry. Beef’s pricing power has been formidable during the past several years – the direct result of better demand. That all translates into real expenditures.

How do you perceive the importance of beef demand on for the beef industry during the past 10 years? What’s your assessment of potential for demand growth in coming years? Leave your thoughts in the comments section below.

You might also like:

Get to know the 2016 Seedstock 100 operations

5 tips to make bull buying easier

Cow prolapsing? Here's what to do

March cattle markets In like a lamb and out like a lion

Why the USDA suspension of the midyear Cattle report is troubling

Here's how attaining zero calf sickness is absolutely possible

About the Author(s)

You May Also Like