Consumers continue to keep beef on their plates

Beef demand stays strong and consumers continue to keep beef in their mealtime plans.

January 25, 2016

While speaking at a recent cattlemen’s meeting, several questions arose around the relationship of retail pricing power, the 2015 market plunge and beef demand. Primarily, the questions focused on whether or not beef demand in the U.S. remains solid. Clearly, that’s an important concern given weak market action during the second half of 2015.

As a reminder, aggregate demand is a function of both quantity and price. For any product, demand stems from five key factors: population, income, tastes/preferences, expectations and the price of other goods. For beef, the last item, price of other goods, refers to potential price substitution where consumers trade down to pork and poultry.

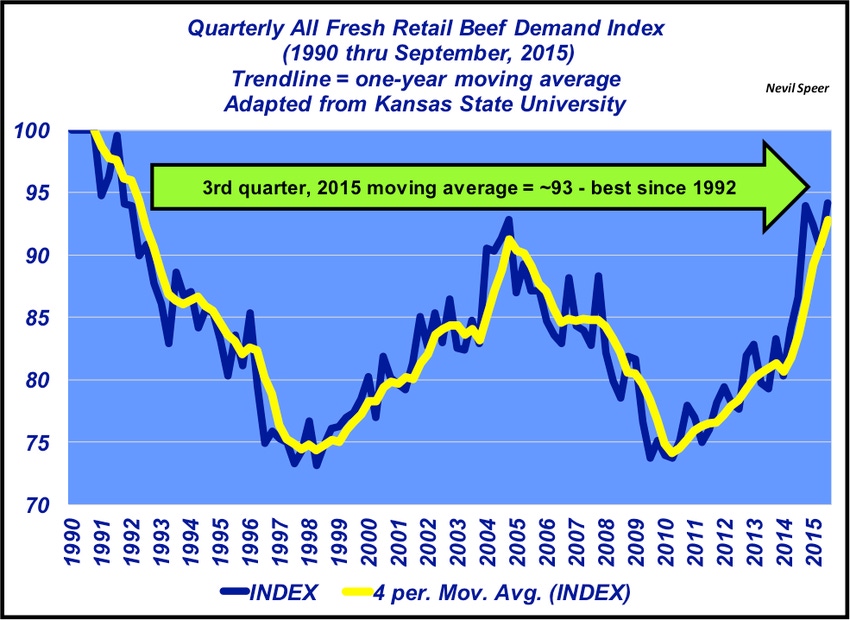

Specific to that discussion, the graph below highlights quarterly beef demand since 1990. Beef has had a solid run of improving demand since it bottomed during the third quarter of 2009. In fact, December 2009 was the last time we traded fed cattle at sub-$80 and marks the cycle low/turning point of the rally leading up to the highs established in 2014 and early-2015. Since that time, beef demand has improved almost 25%. More importantly, the 12-month moving average for 2015 now stands at nearly 93 – the best mark since 1992.

That’s somewhat counter-intuitive in light of recent market dynamics. However, market action of 2015 underscores how important the supply side has been in the sharp decline. That said, it also underscores how critical the efforts of maintaining and growing beef demand are to overall prosperity For some alternative perspective see the discussion on the reversal of direction in feedyard revenue.

What are your perceptions around beef demand and its influence on the overall market? What type of market might we have had if demand were weakening? Given consideration of the five factors outlined above, where do you foresee demand going forward?

Leave your thoughts in the comments section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

15 best winter on the ranch photos

2016 market outlook: Here's what to expect

A voice of reason in the Bundy-Hammond debate

7 ranching operations awarded top honors for stewardship, sustainability

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)