Industry At A Glance: U.S. Debt To GDP Ratio Is Concerning

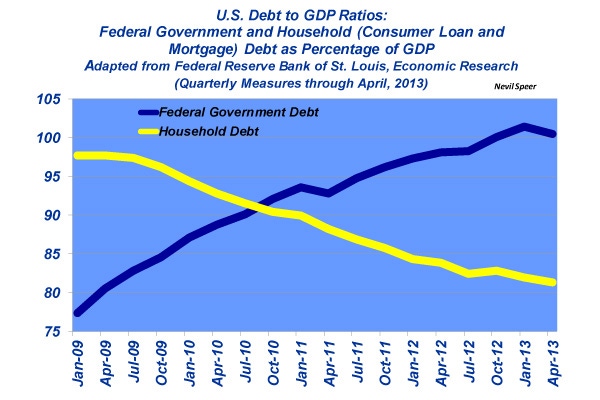

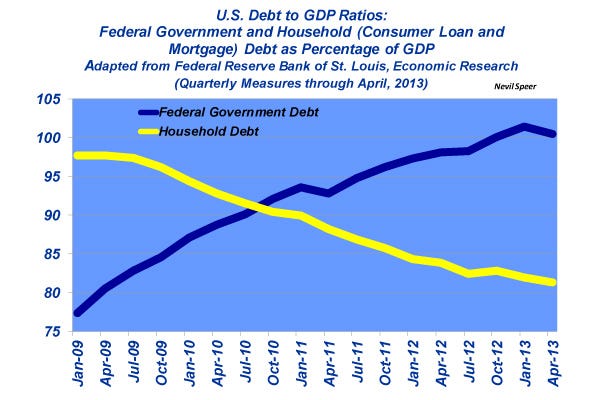

While household debt in the U.S. continues to shrink, federal debt continues to grow. What does that portend for the general economy and beef demand?

December 26, 2013

During the past several weeks, this column has emphasized various measures influencing consumers and beef demand. Along those lines, the past week held several major developments. First, Congress managed to approve a federal budget and, in a departure from previous years, did so with relatively little fanfare. Second, the Federal Reserve announced it intends to begin tapering back its purchasing of bonds.

On the budget side, it’s good for consumer confidence to be free of the enduring wrangling that’s become status quo in recent years. However, the budget passage also means that Congress simply kicked the can down the road when it comes to really dealing with governmental deficits and future debt service requirements. Meanwhile, over on the monetary side, the Fed’s announcement also helps boost confidence, in that they see the economy improving and thus don’t need to be as aggressive in attempting to stimulate the economy. However, that also means higher interest rates in the future and larger payments for debt holders – namely, the federal government.

Following the financial crisis and subsequent freefall in real estate values, consumers needed to shore up their personal balance sheets. And over the past several years, they’ve been successful in doing so. Conversely, though, the federal government has indirectly assumed much of that debt. That’s an important development.

While consumers are in better shape, individually speaking, the country’s balance sheet is in worse shape. Now, with the prospect of rising interest rates, there will be some additional drag on the economy – that’s likely to come in the form of higher taxes to ensure the government can meet its debt obligations and avoid defaulting on its loans. Therein enters the enduring revenue vs. spending debate in Washington.

However this plays out, it will likely exert an important influence on consumer spending going forward – both directly (taxes) and indirectly (confidence). And that will be especially important for consumer-oriented industries such as beef.

How do you see budget considerations and consumer spending being influenced in the years to come? How might that influence beef demand and beef’s pricing power in the marketplace? Leave your thoughts below.

You might also like:

U.S. Debt Clock Offers Frightening Economic Picture

Readers Favorite Spring Calves Photos

Crossbred or Straightbred? Tom Brink Says That's Not The Question

A Time Capsule Of 50 Years Of BEEF Magazine Coverage

Share This --> Connecting The Dots: Beef's Story From Gate To Plate

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)