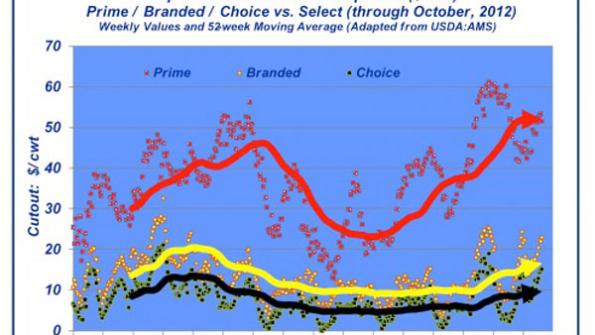

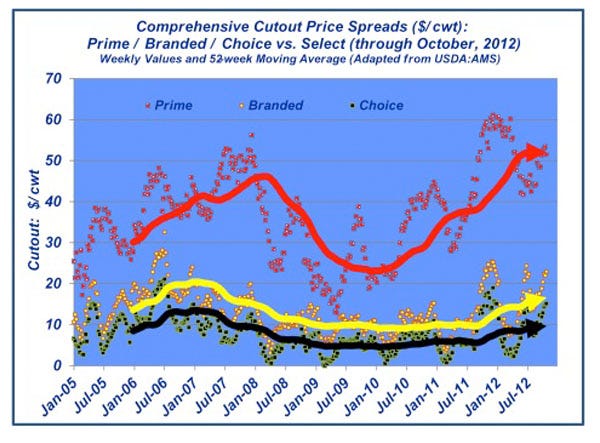

The Prime/Select spread, which has seen a dramatic uptick in the past several years, has now surpassed $50/cwt.

October 31, 2012

Monitoring market conditions from week to week is always important. However, from a long-run business perspective, influence upon the value chain requires sustained price signals. In other words, investing in change around management and marketing is futile if there’s no assurance of payoff over an extended period of time.

For instance, last week’s “Industry At A Glance” chart and discussion emphasized the importance of price signals in regard to the long-term increase in carcass weights over time. The market has also been sending some clear signals on the quality/program side. The Choice/Select spread encroached $20/cwt. last year and has now seasonally crept to $15 at the end of October; more importantly, the long-term (52-week) average is currently about $10/cwt.

Meanwhile, the branded program spread has surpassed $20 and the 52-week average is closing in on $17/cwt. (keep in mind, branded program premiums include both lower and upper Choice).

The real story, though, is in the Prime/Select spread, which has seen a dramatic uptick in the past several years, and the 52-week moving average has now surpassed $50/cwt.! These are encouraging signals from a final-demand perspective; consumers are increasingly emphasizing a willingness to pay for high-quality, program-backed beef products.

As such, the market is clearly trying to pull more high-quality product to meet that demand. What influence might these developments have on supply management decisions in the production sector in the months and years to come? Let’s have a discussion; leave your comments below.

About the Author(s)

You May Also Like