As we wind up our look at the basics of futures and options and how a cow-calf or stocker operator can use them as part of their risk protection plans, let’s look at how much these are used by beef producers.

July 10, 2019

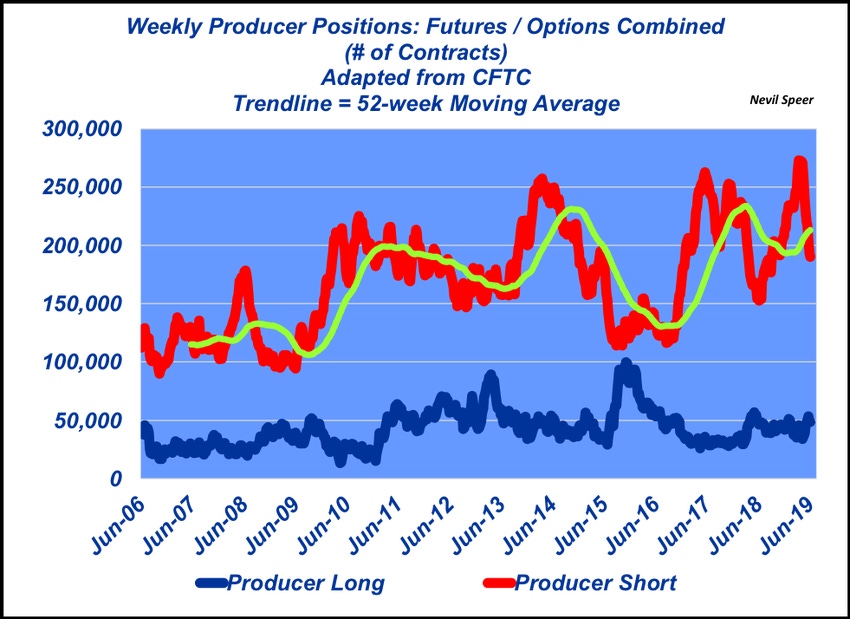

During the past several weeks, we’ve been reviewing some of the basics around futures markets – with a primary focus on the cattle markets. One of the questions that often comes up surrounds the level of hedging that occurs within the cattle sector. This week’s illustration helps address that question.

Many people just assume it’s a function of open interest. They do the math across the total number of contracts and the associated number of pounds and then subsequently translate that into some function of the number of cattle on feed. For example, one commentator recently remarked, “Everyone’s pretty much hedged up. If you go and look at some of the reports that come out of the CFTC (Commodity Futures Trading Commission), you can pretty much estimate that around 75% of the cattle are hedged. I would say it’s probably more than that.”

I’m not sure why anyone would want to extrapolate beyond the CFTC. But nevertheless, we’ve demonstrated during the past several weeks that there are different types of participants in the market – as such, the method just described, and the commentator’s guesstimate, overshoots what happens in reality.

The more appropriate approach is to dive into the detailed reports provided by CFTC. These provide precise breakdown of both short and long positions for four distinct categories:

Producer/Merchant/Processor/User: entities that use the futures markets to hedge the physical commodity to which they’re tied.

Swap Dealers: entity that deals primarily in swap (derivative contract) transactions.

Money Managers

Others

For the purpose of our discussion, our interest is primarily in the “producer” classification. And for Live Cattle, a short position represents cattle feeders using futures contracts to hedge a selling position. A long position represents packers attempting to hedge their respective buying positions.

Producer positions

As the illustration highlights, it’s clear that cattle feeders (producer short) are increasingly hedging over time – nearly doubling the 52-week moving average since 2006 from 100,000 contracts to roughly 200,000. That said, 200,000 contracts represent 8 billion pounds of cattle (at 40,000 pounds per contract).

That translates to approximately 5.9 million head of cattle at any one time—or just about half of the total cattle on feed population—a far cry from “75% of the cattle [being] hedged.” Meanwhile, the packing industry has remained fairly consistent in their use of the futures market over time

Amidst this discussion, there’s lots of lessons to learn when looking at the patterns surrounding 2014 and 2015—but those are probably best saved for another time.

Speer serves as an industry consultant and is based in Bowling Green, Ky. Contact him at [email protected]

About the Author(s)

You May Also Like