Industry At A Glance: Stocker Cattle Inventory Shifting To Southeast States

Since 2000, stocker cattle inventories have progressively moved from the northern states to the Southeast.

March 27, 2013

Slightly more than 60% of the nation’s stocker cattle inventory in 2013 (steers and non-replacement heifers weighing more than 500 lbs.) were located in the key states that are included in USDA’s monthly Cattle on Feed report. This includes Texas, Kansas, Nebraska, South Dakota, Oklahoma, Iowa, California, Colorado, Idaho, New Mexico, Washington, and Arizona.

Meanwhile, a full one-fourth of the nation’s 2013 stocker cattle inventory (just slightly over 3 million head) could be isolated to 10 states outside the key cattle-feeding areas. These 10 states include Missouri, North Dakota, Montana, Kentucky, Minnesota, Virginia, Wyoming, Tennessee, Oregon and Arkansas.

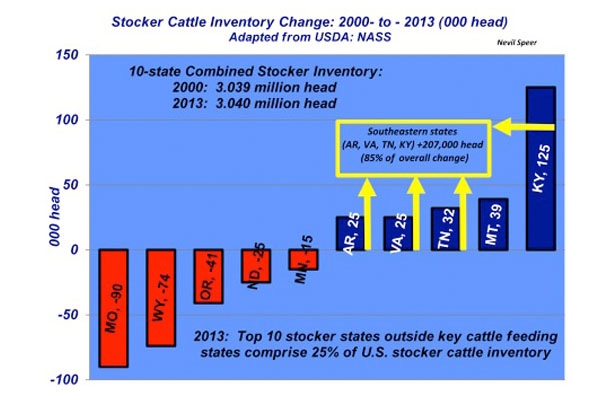

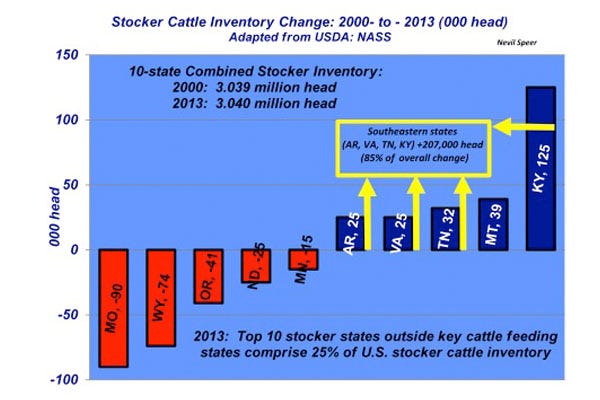

Interestingly enough, these 10 stocker states possessed 3.040 million head in 2013, nearly identical to the inventory in 2000 (3.039 million head), which was prior to BSE, ethanol, drought, and on the front end of ongoing cowherd liquidation. While the absolute numbers on a state-by-state basis are important, perhaps more important is the broader geographical shift over time.

Stocker cattle inventories have progressively moved from the northern states to the southeastern states. Arkansas, Virginia, Tennessee and Kentucky have captured an additional 207,000 head vs. the year 2000, and account for nearly 85% of the geographical shift in inventory. Meanwhile, Montana accounts for 39,000 head, or explains about 15% of the geographical shift.

Most important is that the rate of change far outpaces the land mass differences, as the four states of Arkansas, Virginia, Tennessee and Kentucky encompass just slightly over 176,000 square miles vs. Montana’s 147,000 square miles.

Clearly, the business drivers mentioned above have been an important influence on the stocker business. Are these trends consistent with your perception of what’s occurring in the stocker business? How do you perceive the long-term shift and its influence on the feeder cattle business? Will this trend reverse or does it portend even more change to come? Leave your thoughts in the comments section below.

You might also like:

Beef Industry’s Stocker Sector Is Vital But Fluid

Implant High-Risk Calves On Arrival

Virtual Feedlot Tour | Dean Cluck Feedyard

Cattle Market Weekly Audio Report for Saturday, March 23, 2013

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)