Weaning and vaccination do get rewarded in the marketplace.

August 30, 2018

During the past several weeks, this column has focused on the feeder cattle market. The first part of the series highlighted the price spread between feeder cattle and the deferred fed market since 2016. Meanwhile, the second part of this discussion provided an overview of the relative value of fundamental attributes such as sex, region and breed.

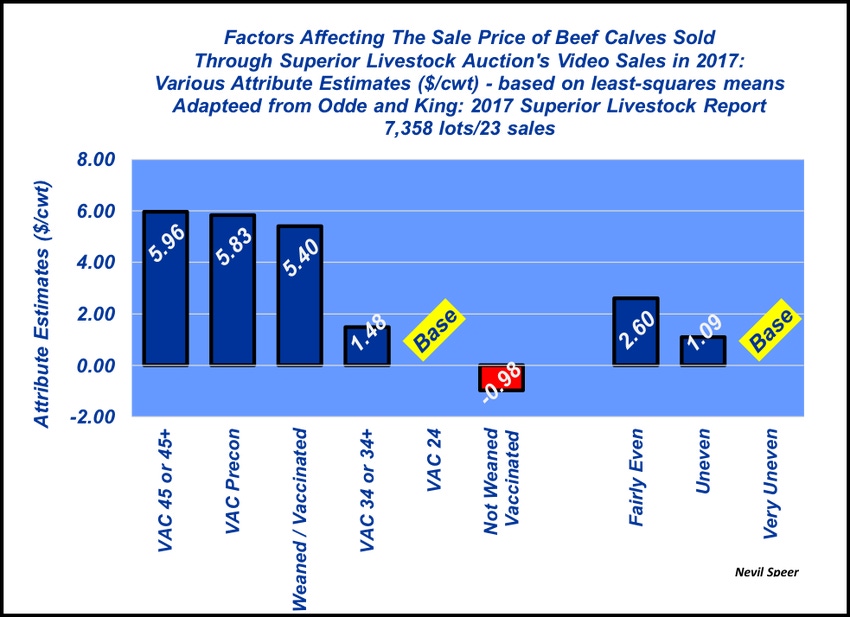

The data for attribute differences is derived from 23 Superior Livestock sales in 2017 representing 7,358 lots of cattle – and is based on analysis performed by Ken Odde and Kike King at Kansas State University.

This week’s illustration takes that discussion one step further – primarily focusing on the relative value of management inputs prior to sale. The data provides the ability to delineate between various health programs and value of putting together consistent loads.

Several items are of importance. First, it’s clear that whatever health program your operation commits to, weaning provides a large advantage in the marketplace. All three programs that included weaning as a core component received a minimum of nearly $4 per cwt compared to the VAC-34 or 34+ program—calves vaccinated on cows 2-4 weeks prior to shipment, but not weaned.

Second, cattle that were designated to be unweaned and not vaccinated at time of delivery were $1 per cwt back of the VAC-24 base—calves vaccinated on cows at 2 to 4 months of age. In other words, weaning and vaccination do get rewarded in the marketplace.

Additionally, it’s also important to note that buyers reward uniformity. Cattle that were classified as “fairly even” were priced $2.60 per cwt ahead of loads classified as very uneven. That speaks to the importance of being able to put together load lots of similar weight and type of cattle – it prevents the need for sorting upon arrival.

Similar to last week’s discussion, the Superior data, in combination with the CME Index trend, serves as a good baseline when it comes to pricing cattle. And it provides a good overview for relative expectations going into this fall’s marketing season.

How are you looking to price your cattle? How does this data fit your expectations as you enter the fall marketing season? Leave your thoughts in the comments section below.

Nevil Speer serves as an industry consultant and is based in Bowling Green, KY. Contact him at [email protected].

About the Author(s)

You May Also Like