COOL report to Congress: How did it affect producers?

Research shows COOL does not increase consumer demand or producer profits.

October 8, 2019

We’ve highlighted country-of-origin labeling (COOL) the past several weeks in this column, providing some perspective on the influence of COOL on meat demand, feeder prices and feedyard profits.

Meanwhile, with respect to the topic, it’s important to highlight the work of Drs. Tonsor (Kansas State University, Schroeder (Kansas State University) and Parcell (University of Missouri) on the subject. Their findings are included in the 2015 Report to Congress: Economic Analysis of Country of Origin Labeling.

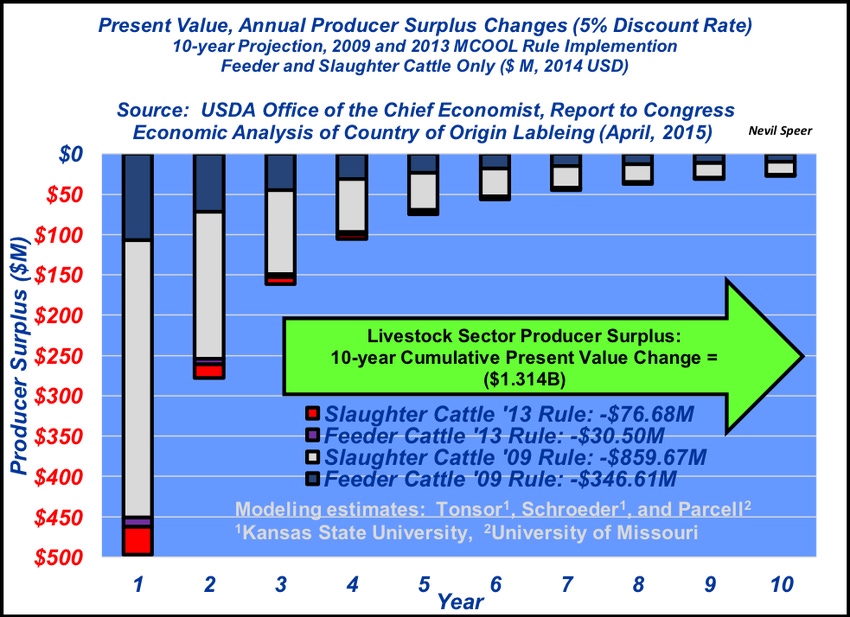

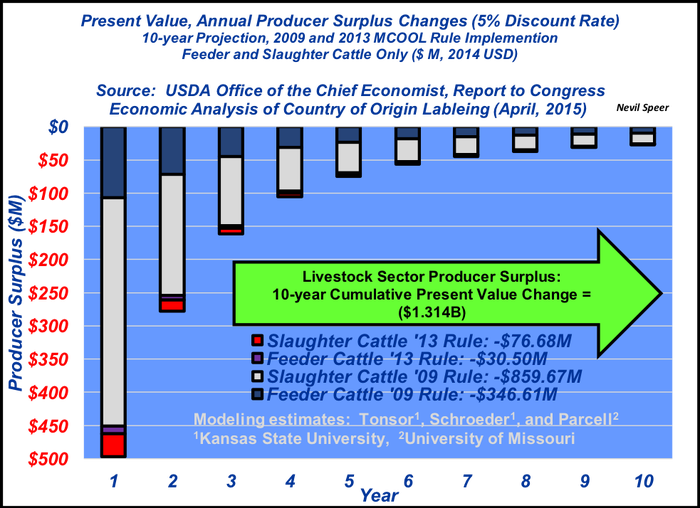

The report features analysis of the long-run economic impact of the rule. Accordingly, this week’s illustration features COOL’s impact on producer surplus over the span of 10 years. The graph segregates impact of the 2009 rule and additional impact from the 2013 rule, respectively, on the livestock sector.

For clarification, the report explains, “Producer surplus is an economic measure of the net gain that producers receive for producing and selling a good. It is the difference between the actual amounts that producers receive for selling a good versus the lowest amounts that they would be willing to accept for selling the good. As such, producer surplus is a measure of the economic welfare or benefit that producers collectively receive for selling a good in the marketplace.”

Based on the modeling estimates, implementation of COOL results in producer surplus declining $1.3 billion in the cattle sector over the span of 10 years. The decline is largely attributable to increase in compliance costs (record keeping, documentation, logistics, segregation, etc…) that must be absorbed by cattle producers over time. As outlined in the illustration, implementation would result in the brunt of those costs being incurred on the front end.

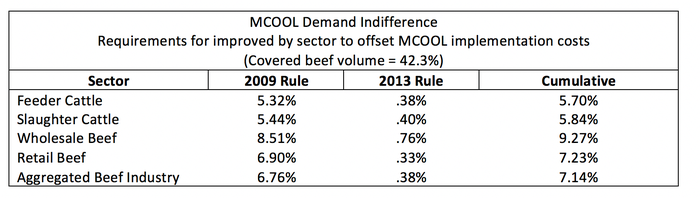

On the other side, to have a beneficial economic impact there must be an associated increase in demand to offset the marginal costs associated with compliance. The levels of demand improvement required to make each sector indifferent to COOL implementation are outlined in the table below.

However, the report notes that, “Based on a review of academic research, we found no evidence that consumer demand for beef or pork has increased because of MCOOL. Thus, our economic analysis finds no measurable benefits to consumers as a result of the MCOOL rules.” For clarification, MCOOL or mandatory COOL refers to the time when COOL was in effect in the U.S. COOL refers to the concept in general.

In other words, such gains are unlikely to be realized, leaving the industry to incur the costs with no appreciable advancement on the demand side.

That reality is reinforced by recent work from Tonsor addressing impact of MCOOL on domestic beef and pork demand indices. The outcome being that, “…both beef and pork demand were lower, both economically and statistically, when MCOOL was in place than for the pre-MCOOL (base timespan) period. This finding is consistent with the research summarized in the 2015 USDA report to Congress.”

Bringing all this full circle, despite some of the popular rhetoric, producers are worse off with COOL. The Congressional report summarizes the balance between marginal costs and marginal benefits this way (emphasis mine): “..economic modeling indicates that producer surplus over the longer run declines for beef and pork producers, packers, processors, and retailers due to the costs of COOL implementation. While prices are estimated to increase for both retail and wholesale beef and pork over the longer run due to increased costs for COOL implementation, quantities decline by proportionally greater amounts, leading to net reductions in producer surplus…Without a commensurate demand increase, higher costs attributable to COOL implementation result in decreased producer surplus at each level of the production and marketing chain.”

Speer serves as an industry consultant and is based in Bowling Green, Ky. Contact him at [email protected]

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)