The facts on the live to cutout price spread

There’s been plenty of chatter, some of it wrong, about packer profits and the live-to-cutout price spread.

September 5, 2019

Since the fire at Tyson’s Holcomb, Kan., beef plant, there’s been a plethora of coverage relative to market reaction. Most significant, the divergence between boxed beef and live cattle prices have emboldened those inherently critical of the packing sector. There’s been no shortage of rhetoric – including outright accusations of fraud, collusion and price gouging.

All that aside, it’s seemingly the live-to-cutout spread that’s captured the most attention. That was especially evident following coverage by the Daily Livestock Report (DLR). Unfortunately, some of the DLR discussion was subsequently misinterpreted and/or misrepresented by some market commentators. As a side note for clarification, the DLR is published by the Steiner Consulting Group - NOT the CME.

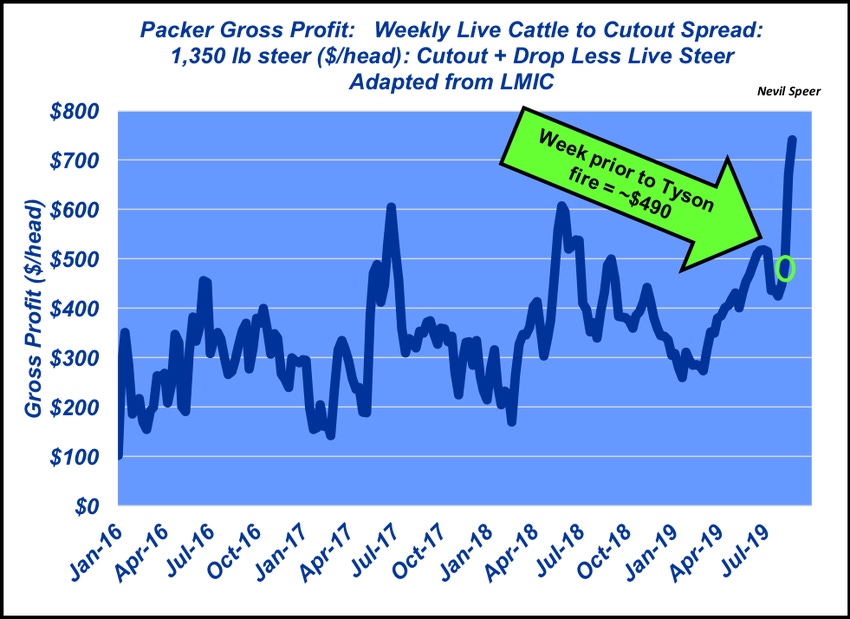

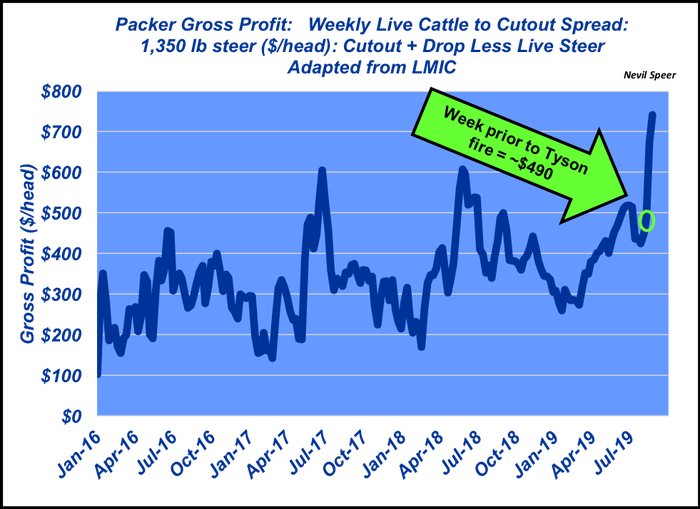

Nevertheless, DLR provided some excellent discussion about changes in the live-to-cutout spread since the fire. DLR references the Livestock Marketing Information Center (LMIC). The agency reports the number on a 1,000-pound live steer basis; again, another misinterpretation as some have discussed this being a carcass basis calculation. In that discussion, DLR notes that:

Ahead of the Tyson fire, packer margins averaged weekly $287 per 1000 pounds through July. Summer values were slightly higher than earlier in the year, hitting the high $300s in June. The week of the Tyson fire, LMIC calculated the weekly gross margin to be $361 per 1000 pounds of steer. The first week after the fire, the margin jumped $136 per 1000 pounds to $497.70, followed by last week’s increase of over $50.

Most important here, DLR correctly points out that the calculation represents gross margins or gross profit.

In line with last week’s discussion around operating margins, it’s important to note that gross profit doesn’t account for operating costs (wages, salaries, administrative expenses, utilities, insurance, depreciation). In other words, it’s not a “net profit” number – despite being discussed that way by some.

For some perspective, this week’s calculation depicts weekly gross profit for a 1,350-pound steer versus LMIC’s base 1,000-pound steer scenario. Just prior to the fire, that number was running right around $490 per head. Clearly, it has jumped sharply higher in the two weeks since the fire. However, it’s interesting to note that during each of the previous two years, packer gross margins surpassed $600 in early summer.

Last, it’s important to note that all this discussion around gross margins is based on spot markets. As noted, it doesn’t account for operating costs. Neither does it account for hedging positions (e.g. packers hedged at higher purchasing prices) nor contractual obligations.

Nevertheless, packer gross profits will likely be discussed at length in the industry in the weeks and months to come and it’s important to have some broader perspective about what all that means.

Speer serves as an industry consultant and is based in Bowling Green, Ky. Contact him at [email protected].

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)