Price trends: Comparing cattle cash and formula prices

Here’s a look at fed cattle price trends and how cash and formula prices work together.

Much angst and discussion has occurred, particularly this year, about cash and formula prices for fed cattle. At times, the discussion has become emotionally charged. So let’s take a look at both the cash market and formula prices to see how each works.

To start the discussion, consider the feedlot cattle trades for the week ending Nov. 14. Cash prices were $3 to $4 per cwt higher than the week prior and the cash sales volume was about the same as the previous week with over 100,000 head.

The Five Area formula sales volume totaled 242,188 head that week, compared with about 228,000 the previous week. The Five Area total cash steer and heifer volume was 103,053 head, compared with about 101,000 head the previous week.

The USDA Five-Area region includes Texas-Oklahoma-New Mexico; Kansas; Nebraska; Colorado; and Iowa-Minnesota. This area represents a very big portion of the fed cattle market, usually over 80% of the national totals, so this is a very important number to watch.

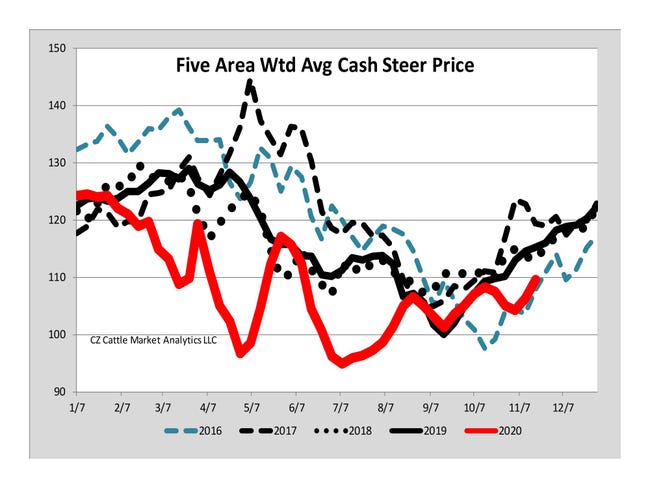

The Five Area weekly weighted average cash steer price for the week ending Nov. 14 was $109.62 per cwt, which was $3.29 higher compared with the previous week. The same week last year it was $115.19, which was about 60 cents higher than the week prior.

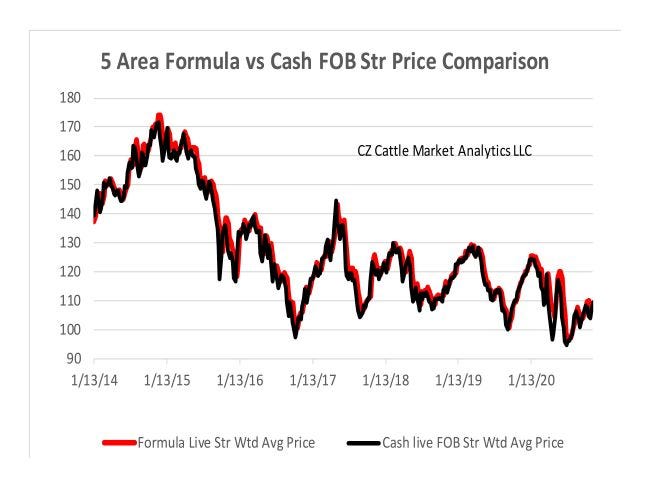

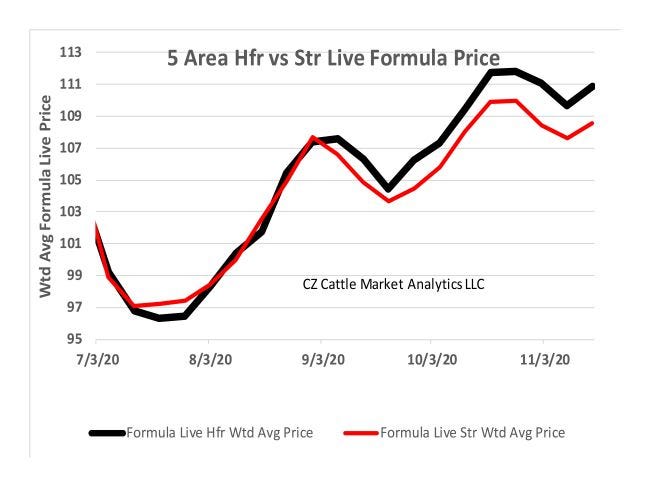

The current Five Area weighted average live steer formula price was $108.58 per cwt this week, but it has been $2 to $5 higher than the cash price for several weeks. However, cash cattle weights have been much heavier recently than formula cattle.

Weekly average dressed carcass weights for cash cattle have been more than 1,000 pounds lately and cash steer live weights over 1,500 pounds have crossed packing plant scales. Formula weights have run much lower.

That has put downward pressure on the cash recently because of the heavy weights, especially up in Nebraska, Iowa and Minnesota, where the bulk of the cash market exists. Also, the heavier weights always include more Yield Grade 4 and 5 that bring lower prices.

Formula prices are very similar to grids but are usually based off the previous week’s cash price. The formulas include premiums along with big discounts, so they force feedlots to really micromanage feedlot performance and selling decisions. That’s because, if they overshoot the runway, they get a very big discount and loose the premiums.

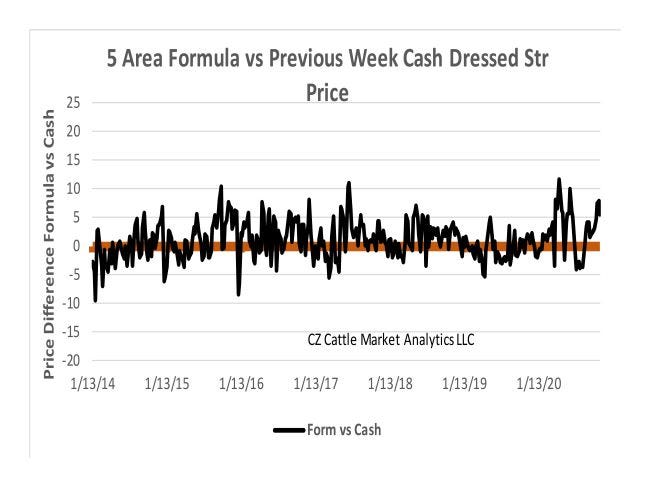

You can see on the “5 Area formula dressed steer price vs. previous week cash dressed steer price” graph just how much variation occurs. So the premiums and discounts both have big impacts. Also, every single animal is measured individually for these formulas and that impacts the average price.

The weighted average Five Area cash dressed steer price for the week ending Nov. 14 was $171.87 per cwt, which was $6.52 higher than the week prior. The Five Area weighted average formula price was $171.04, which was $1.26 higher.

However, the cash prices jumped higher than the formula for the week, but the formulas are usually based off the previous week’s cash price, so formula should jump higher next week.

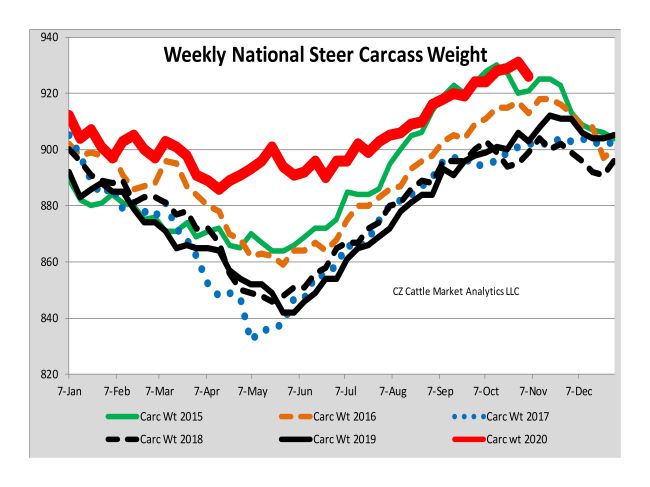

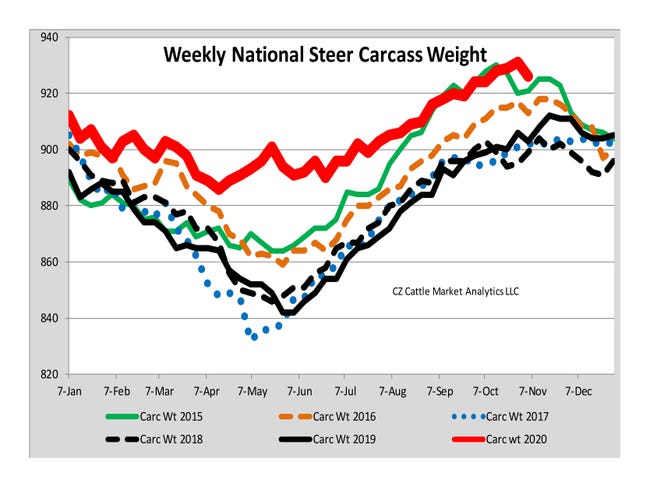

The latest average national steer carcass weight for the week ending Oct. 31 was 926 pounds, which was 5 pounds lower than the previous week and remains considerably above the 903 pounds the same week last year. The previous week set a new all-time record high at 931 pounds.

With the new all-time high carcass weights lately, the formula heifer price has been higher than the formula steer price recently. High steer carcass weights produce ribeye sizes that are too big and harder to sell, especially now when the rib primal has a big impact on the cutout because of demand for Prime Rib-type cooking. That fact has helped push the formula live heifer price higher than the formula live steer price lately.

The changes negotiated by NCBA members calling for increased numbers of fed cattle marketed via the cash market will be implemented in January. Will those recommendations change the dynamic for cash prices and formula prices? Will the cash market respond positively or negatively? Time will tell. So stay tuned.

Czerwien is a market analyst in Amarillo, Texas. From the heart of Cattle Feeding Country, Ed follows the fed cattle, feeder cattle, slaughter cow and wholesale markets to keep beef producers up to date on the market moves that affect them. He previously worked with USDA as a Market News Reporter and prior to that, as an auction market manager. The opinions of the author are not necessarily those of beefmagazine.com or Farm Progress.

About the Author(s)

You May Also Like