Prime beef leads the pack

The premium for Prime beef is defying gravity as consumers look for the best beef of the bunch in the meat case.

September 24, 2020

Several weeks ago, this column highlighted the surprising strength in wholesale beef values – despite the overwhelming deficit of food service sales. The column noted:

Seemingly, the beef industry is benefitting from very strong retail pull. Consumers are actively purchasing beef at the retail level – including high-end product – and establishing solid support for wholesale beef prices. That observation is best reinforced by renewed divergence between rib/loin versus round/chuck values.

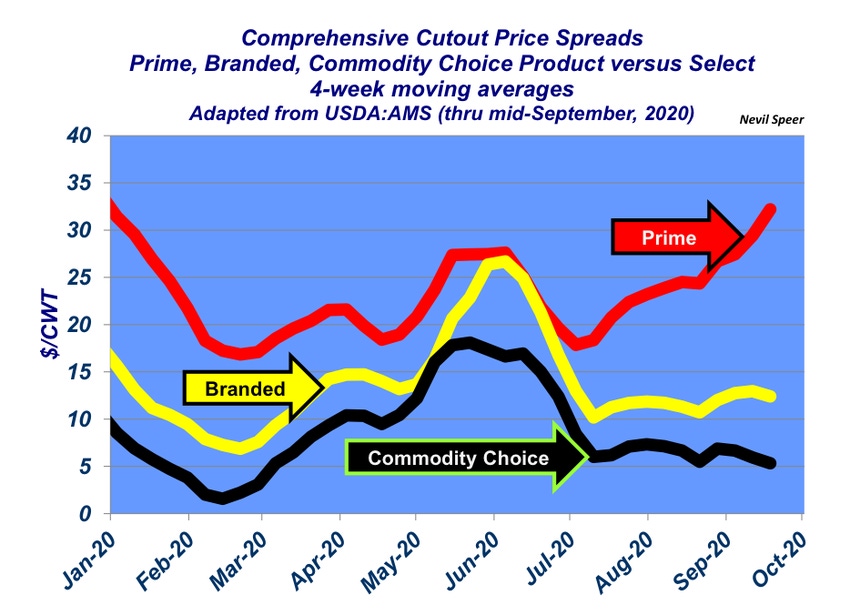

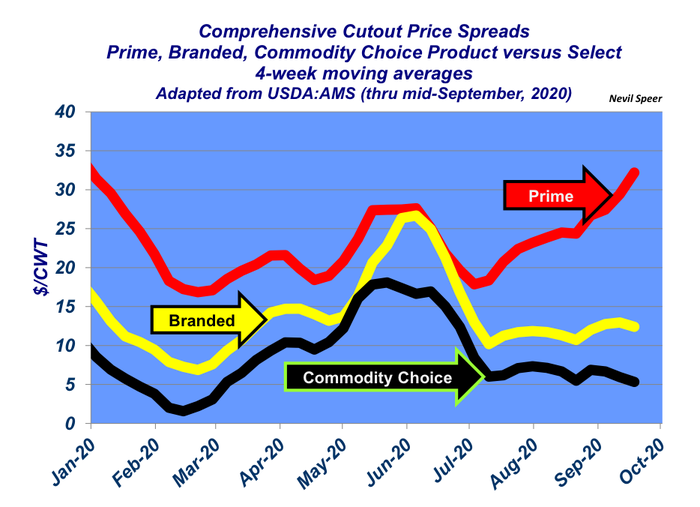

Solid demand at the retail level is further reinforced by the also-surprising strength at the upper end of the market with respect to quality grade. This week’s graph speaks to that trend, highlighting the four-week moving averages for cutout price spreads versus Select. Most important, the premium for Prime has been defying gravity – the moving average now stands above $30 and has been positively diverging from other categories in recent weeks.

The inherent question that arises surrounds the durability of this trend. To that end, EnsembleIQ recently surveyed 1,072 consumers about their perceptions of eating at home since March. Several highlights of interest:

Close to 70% said they enjoyed “a lot” the meals they prepared.

Roughly half said they got a lot of enjoyment out of cooking.

Roughly 42% said they prefer their household’s home cooking to that of restaurants.

With that in mind, it seems there may be some lasting structural shifts in terms of meat preferences and subsequent demand over time. In other words, perhaps consumers will begin to have higher expectations for beef quality and consistency when purchasing beef at retail.

Whatever occurs, as noted in the previous column on beef prices, “Regardless of how this plays out going forward, it reinforces the importance of beef quality and consistency. The advances the industry has made during the past 10 to 15 years is all-important to consumer behavior – else we wouldn’t be witnessing this sort of market action. And it has paid dividends at the most challenging time, enabling retail to backfill much of the load that’s often carried by the HRI sector.”

Speer is based in Bowling Green, Ky. and serves as director of industry relations for Where Food Comes From (WFCF). The views and opinions expressed herein do not necessarily reflect those of WFCF or its shareholders. He can be reached at [email protected]. The opinions of the author are not necessarily those of beefmagazine.com or Farm Progress.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)