Food industry job recovery in COVID-19’s wake

While 60% of the food industry job loss has recovered, there’s still hard work ahead for full recovery.

September 17, 2020

…the Choice cutout closed the gap [versus 2019] by $8 and finished August at nearly $230 (just $4 behind on a YOY basis). Not only did the cutout close the gap since mid-July, but that happened on bigger beef volume – with 2020 weekly production up roughly 3% versus 2019. And best of all, that’s happened without much buying support from the HRI sector.

There’s no real way to accurately depict how sharp COVID’s impact has been to the food service—it’s challenging to put an aggregate number on the loss of that business the past several months. However, the alternative is to look at job losses; it essentially provides a real-time look into the relative impact of COVID across industries – including food.

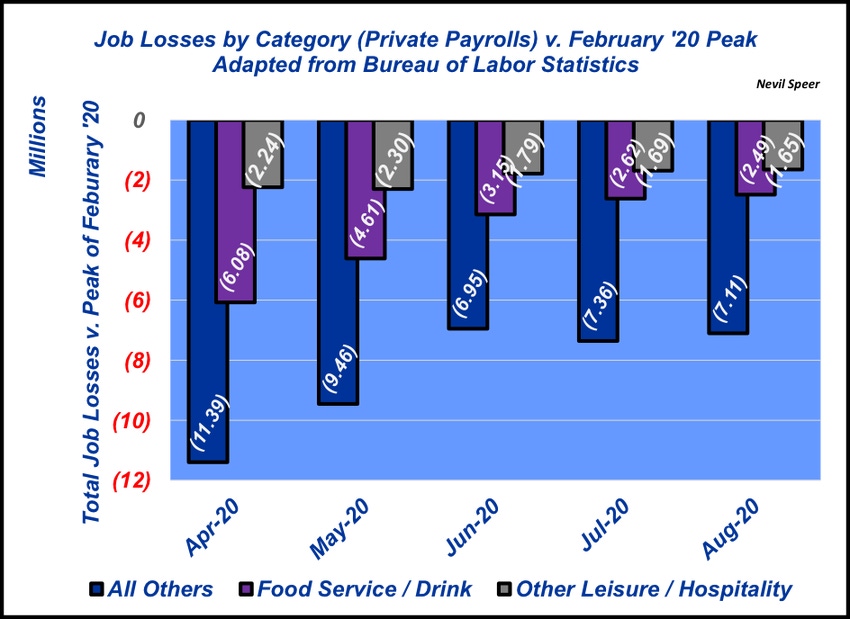

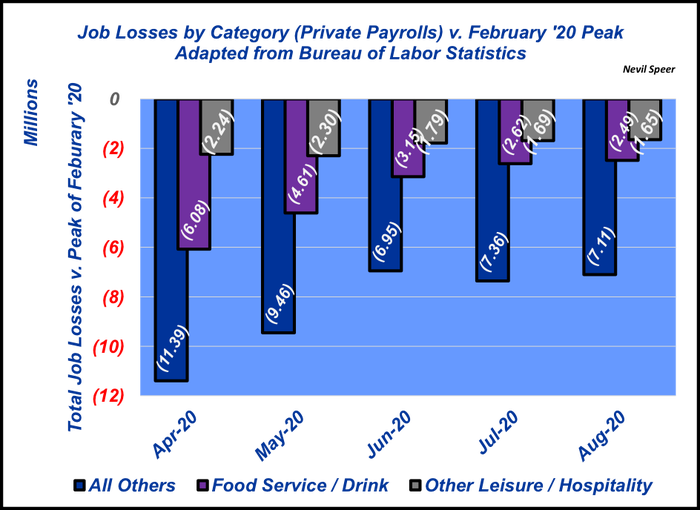

Since that previous article was submitted, the Bureau of Labor Statistics (BLS) provided the most recent jobs report. Monthly data from those reports show just how hard the food industry has been hit by COVID-19. This week’s illustration depicts some of that monthly data—as it’s pertinent to the beef industry—and illustrates the overwhelming influence COVID has had on the food service sector.

Here are some of the highlights:

Peak employment in the United States occurred in February (just prior to COVID). BLS data indicate 129.44 million people were employed in the private sector.

13% of those people (16.87 million) worked in leisure and hospitality.

And of those 16.87 million people, 12.3 million were directly employed in food service/drink.

Fast forward to April, total job loss (across all industries) equaled 19.71 million persons.

Nearly a third of that job loss (6.08 million) were employed in the food service/drink sector—the sector representing the single largest loss of jobs in the data series.

There’s been a large recovery since April. However, the gap from February stands at 11.25 million people.

Stated another way, the economy has added 8.5 million jobs since April—including 3.59 million people in food service and drink.

There still exists, though, roughly 2.5 million people in the food/drink industry that remain unemployed. Thus, food service/drink has recovered roughly only 60% of the original hit (6.08 million people).

To the final point, now comes the hard part in terms of rebuilding the food service sector. Social distancing requirements, coupled with reluctance to dine out and sharp cutbacks in travel, mean recapturing some sense of normalcy in the near future is unlikely.

All that underscores the importance of beef quality and consistency, and all the hard work to achieve those improvements that’s been done in recent years. Throughout the pandemic, retail beef sales have served as a major shock absorber to the market in the absence of food service.

As noted in the previous column, improved beef quality/consistency has, “…paid dividends at the most challenging time, enabling retail to backfill much of the load that’s often carried by the HRI sector.”

Nevil Speer is based in Bowling Green, Ky. and serves as director of industry relations for Where Food Comes From (WFCF). The views and opinions expressed herein do not necessarily reflect those of WFCF or its shareholders. He can be reached at [email protected]. The opinions of the author are not necessarily those of beefmagazine.com or Farm Progress.

About the Author(s)

You May Also Like