August’s fed cattle market: Was the glass half full or half empty?

The August fed cattle market gave ground, but not without a fight.

September 6, 2018

Assessment of August’s market action is largely a matter of perspective. The glass-half-empty side focuses on the fact that prices slipped during the month. Meanwhile, glass-half-full people argue that it could/should have been even worse and we’re now trading above year-ago levels for the first time since March. That’s even with summer beef production being up nearly 15 million pounds per week versus 2017—a good sign of demand.

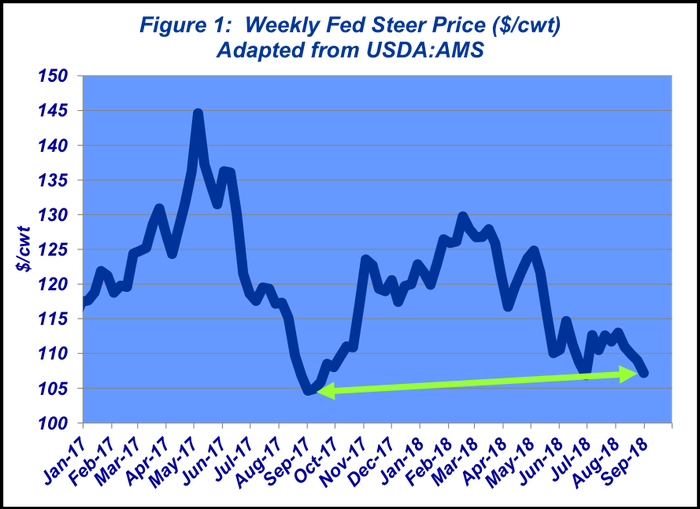

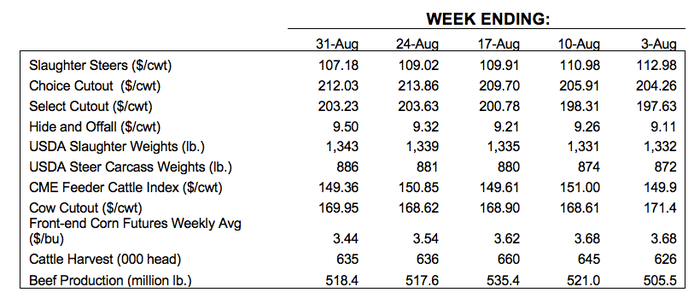

Whatever your perspective, fed trade did give up some ground in August, but not without some fight along the way. Feedyards began the month trading selling cattle at $111-$113 per cwt. Inevitably, though, ample front-end supplies pushed back and cattle traded mostly $109-$111 during the middle three weeks in August. Trade ultimately finished the month at $107 (Figure 1).

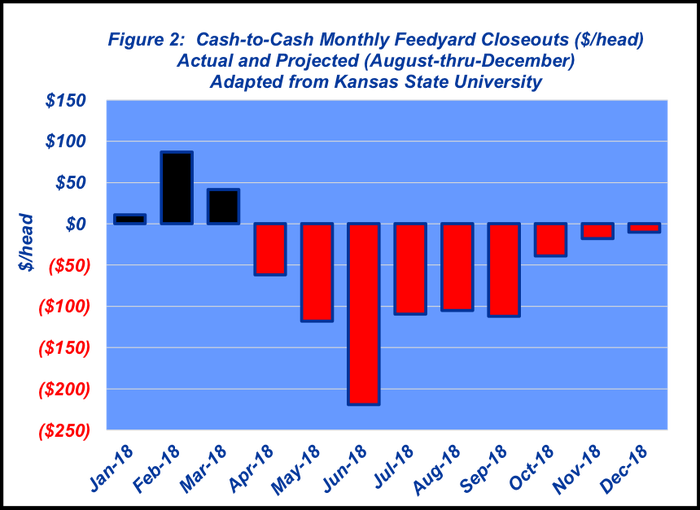

If you’re a cattle feeder right now, you’re likely focused on a couple of factors. First, every dollar in the market matters, especially when you’re fighting a string of negative closeouts (Figure 2). Second, you know that supply is more than ample: USDA’s August Cattle on Feed report indicated feedlots are sitting on nearly 4 million head that have been on-feed 120-days or more. That’s a new record in the series history exceeding 2015’s previous record by 16,000 head.

However, big supply isn’t a new story. That’s something the feeding sector has been tussling with all summer. Cattle feeders have been busy; feedyard marketings during May, June and July totaled 5.935 million head—the biggest total since 2011. And they kept up that harried pace in August, too.

Nevertheless, there’s continued work ahead to ensure the business doesn’t repeat 2015. Marketings need to remain active to prevent the negative cascade of uncurrentness.

Demand has held the market together

That said, there’s been favorable action on the demand side. The comprehensive boxed beef load count (load = 40,000 pounds) has averaged 6,665 loads per week during the past three months. That’s about 188 loads (or about 7.5 million pounds) better on a weekly basis versus the same period last year.

Amidst all that supply, the industry has been successful in moving product through the pipeline. Much of the recent buildup in cold storage was lean trimmings as cull cow slaughter has also picked up.

On that front, Bloomberg ran an article just ahead of Labor Day titled, “Americans Are Grilling More Steaks for Labor Day With the Economy Humming.” The subline noted that, “Consumers snub chicken, pork for more premium beef cuts.” And indeed that’s been the case for some time now. Beef has positioned itself in a very favorable position.

That favorable positioning within the industry was a focus for Industry At A Glance several months ago. First, the column noted that, “Demand is the differentiator. Consumers are sending the signal they desire Prime and branded products and the market is able to clear that product in easy fashion.” And second, it’s clear that, “The industry has proven very successful at producing more high-quality beef. … It highlights just how far the industry has progressed at the very top end.”

Those are key indicators to an important outcome, best illustrated by some observations I made in this column in July:

…coming back to the earlier reference regarding beef’s favorable perception in the marketplace, and the underpinning of beef demand. The June 29 edition of Iowa Public Television’s Market-To-Market included commentary from Naomi Blohm. She was asked about the potential foreign tariff assignments to U.S. pork and if trade slowdowns would mean more product remains here in the U.S. – and ultimately what impact that might have for the beef industry. Will consumers opt to buy pork instead of beef? Her response: “There’s not a substitute for beef.”

All that brings us to current events during the past month—most notably the recent broadening challenge to the industry’s checkoff program. Most troubling is R-CALF’s organizational explanation for the challenge: “The checkoff program has weakened the U.S. cattle industry by helping importers capture a greater share of our domestic market.”

From a business and market standpoint, it’s important to unpack that assertion. Substantiation by industry data would indicate otherwise:

The discussion above regarding beef’s favorable position in the marketplace highlights the outcome of consistent gains in beef demand during the past 20 years, largely the result of the long-term commitment to beef research and promotion funded by the beef checkoff. To that end, Harry Kaiser, a professor at Cornell University, reported in 2014 the return to the beef industry for every dollar of investment underwritten by the Cattlemen’s Beef Board activities equals $11.20.

Moreover, this week’s Industry At A Glance illustrates that since beef demand bottomed in 1998, revenue derived by the production sector has more than doubled. Meanwhile, checkoff revenues have actually declined during the same period. As such, any claim the “checkoff program has weakened” the industry is unfounded.

Industry At A Glance recently focused on international trade. With respect to imports, this year’s import contribution is projected to fall below 9% of total supply – down over 2% from the recent peak in 2015 and below the overall average of 9.3% dating back to 2000. There again, the data doesn’t support such claim that “importers [are capturing] a greater share of our domestic market.”

It’s also important to note the overwhelming bulk of imports are comprised of lean trimmings. That’s best evidenced by the relative value of imports coming into the country. Going back to 2000, the correlation between average import value and the U.S. lean trim market equals .98. And those imports facilitate blending with 50-50 trim to make hamburger. From that perspective, the imports actually create value for the beef industry, versus any perception of weakening the industry.

Lastly, an essential fact that’s often overlooked is that importers pay their fair share to the beef checkoff; $1 per head equivalent on imported cattle, beef and beef products.

These are important topics for producers to understand. As always, producers are encouraged to be attentive to all details around the market and the business—being certain to obtain and review information in an objective manner versus soundbites and press releases. That process helps to ensure more successful decision making along the way.

Speer serves as an industry consultant and is based in Bowling Green, Ky. Contact him at [email protected]

About the Author(s)

You May Also Like