Cash trade vs. fed cattle basis; what’s the deal?

Some are concerned that with only 25% of fed cattle trading on the cash market that the system is broken. Here’s what the numbers tell us.

January 31, 2019

During the past several weeks, Industry At A Glance has focused on cash trade trends in the fed cattle market. The discussion primarily stems from a recent petition filed by the Organization for Competitive Markets (OCM) against USDA regarding the agency’s plan to withdraw implementation of the GIPSA Farmer Fair Practices Rules (otherwise referred to as the GIPSA rule).

The petition has subsequently been denied. But as noted in previous weeks, given the long history of this issue, it’s likely additional legal challenges will occur.

As quick review, last week’s column highlighted the relationship between cash trade and volatility. The industry has seemingly found an extended equilibrium where cash trade represents one-fourth of all cattle traded on a weekly basis. And for some in the industry (e.g. OCM), that level is insufficient. They voice concerns that reduced price discovery subsequently causes artificial deflation in cash prices and increased price volatility from week to week.

Last week’s discussion noted that despite declining cash trade, in terms of absolute dollars, weekly volatility is the same now as it was when cash trade was more than double the current level. And from a percentage of total steer/heifer value, volatility has actually declined over time.

As noted above, though, there’s a second issue that needs to be addressed: Artificial price deflation. There’s no way to determine exactly what cattle should be worth—or would be worth if negotiation levels were increased.

However, if a distinct trend was developing it would most likely show up in the form of basis (cash minus futures). That is, cash price trends would begin to deviate sharply from what’s occurring at the CME—turning sharply negative IF declining cash trade was unduly influencing the market.

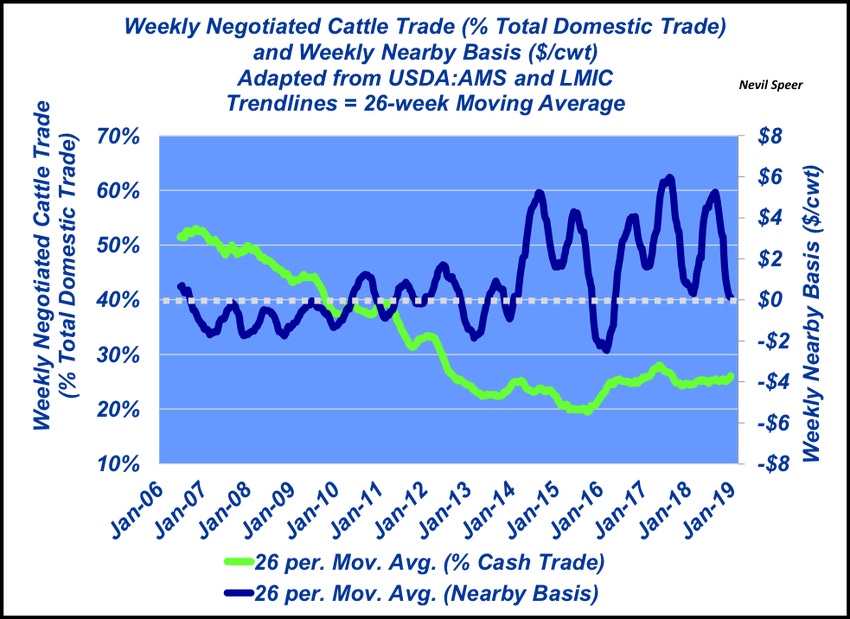

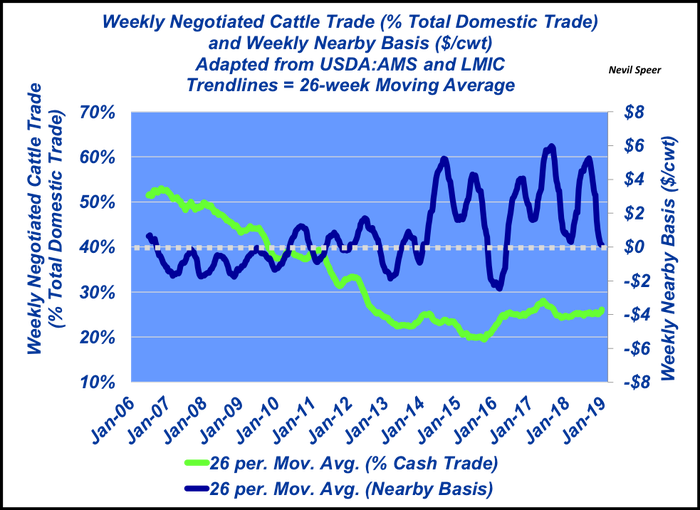

This week’s graph addresses that very issue. It outlines the relationship between nearby basis (cash less futures) and cash trade. Interestingly enough, while cash trade has diminished, basis has actually trended more in a positive direction (not the other way around), with runs up to +$6 along the way.

As such, it seems cash trade has worked well in tandem with the futures markets; actually benefitting sellers along the way as cash trade levels have declined.

Speer serves as an industry consultant and is based in Bowling Green, Ky. Contact him at [email protected]

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)