How futures work: Margins and margin calls

Class continues. Here’s a look at margins and margin calls, a bugaboo for many futures neophytes.

July 3, 2019

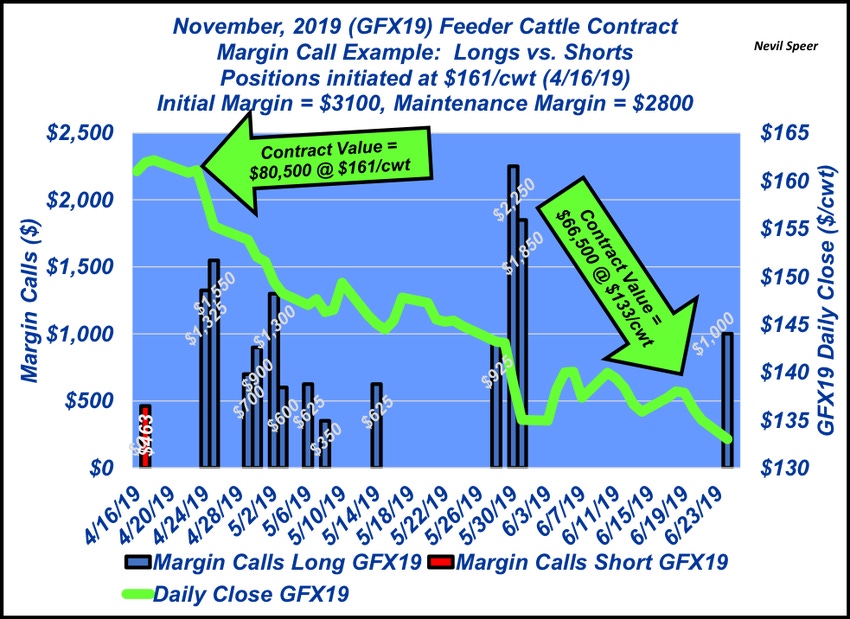

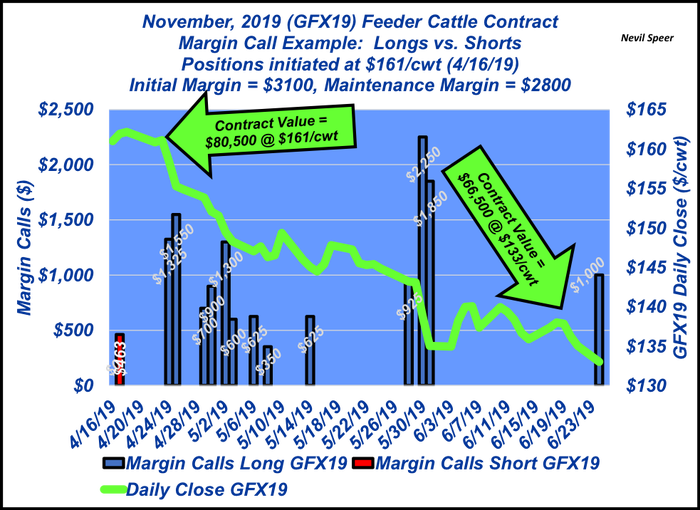

One of the most challenging aspects to understand around futures markets are the mechanics of margin and/or margin calls. As such, this week’s illustration highlights an example of margin calls during the past several months for parties on each side of November feeder cattle.

Several starting assumptions are important here. First, assume the contract was entered into at $161 per cwt, making the total contract value of 50,000 pounds equivalent to $80,500. Second, let’s also assume the contract closed on June 24 at $133 per cwt with contract value of $66,500 – a net decline of $14,000 from the starting point.

Here enters the aspect of margin; it represents a small portion of total contract value but represents a trader’s “skin in the game.” And as any seasoned trader will let you know; those margin calls can get very painful if you’re on the wrong side of the market.

Several key concepts are important to distinguish here:

Initial margin: The initial amount of up-front money required to buy and/or sell a futures contract. For this example, initial margin was $3,100. This can vary from broker to broker depending on the contract and the customer.

Maintenance margin: The minimum amount a trader’s account must carry tied to the contract position. This amount is established by the CME Group. Currently, the feeder cattle contract maintenance margin equals $2,800.

Margin calls: When maintenance margin falls below the minimum threshold (in this example, $2,800), the margin call represents the amount of money required to reestablish the margin account back to the initial margin level.

Ok, let’s jump in the game. Assume you went long November feeder cattle on April 19, 2019 at $161. Since then, the market has worked against your position. Your purchase has lost $14,000 in total value – and you’ve subsequently received 13 margin calls in the total amount of $14,000 to keep you in the game.

Meanwhile, if you were short the contract, the market has moved in your favor. You’ve experienced only one margin call for a total of $462.50.

At the end of this time period, margin accounts for the long and short trader would total $3,100 and $17,562.50, respectively. The long trader has deposited $14,000 in margin calls and has only $3,100 in his account. Meanwhile, the short trader has deposited the initial $3,100 plus one margin call of $462.50, which the market gave back over time. Hence, that short account is up the same amount the long account is down: $14,000.

Therein lies the fundamental principle of futures trading: For every winner, there’s a loser and for every loser, there’s a winner—a perfect zero-sum game.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)