Industry At A Glance: How do net positions affect live cattle futures?

Recent volatility in the cattle market invokes questions about the primary drivers behind it.

February 19, 2015

Market action at the CME in recent weeks has been unsettling, to say the least, and it potentially sets up a scenario for challenging closeouts in coming months. Not surprisingly, the recent volatility in the market has received considerable media attention. Consider that the February 2015 contract peaked in November at nearly $173, and subsequently traded all the way back down to $148 on Jan. 26 – a $25 correction in the course of just eight weeks. The contract has managed to regain nearly half of that with the Feb. 13 close at $160.

Despite the recent gains, such volatility invokes questions about the primary drivers behind the market. No doubt, part of that discussion will revolve around the role of speculators in the market. And depending upon one’s perspective, they’re either viewed as essential entities when it comes to offsetting risk, or they’re perceived as detrimental players who create excessive volatility.

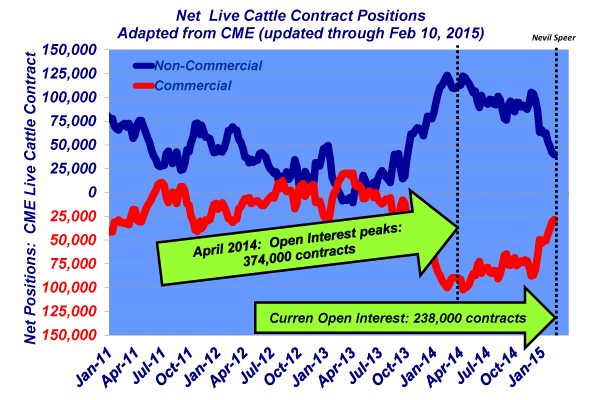

Whatever your view, the live cattle, non-commercial net long position has declined markedly in recent months. The near-term peak occurred in late-November at just slightly over 105,000 contracts; the position for the week of Feb. 10 stood at approximately 40,000 contracts. Meanwhile, on the opposite side, near-term net commercial positions peaked in November, shorting about 88,000 contracts and since declined to net short of 29,000 contracts. Accordingly, open interest has declined nearly 87,000 contracts during the same time frame.

The accompanying illustration reveals two important trends:

Non-commercial longs systematically built their position while the commercials (short hedgers) gladly obliged on the other side – putting their risk off on the speculator.

From the peak, the unwinding tells the opposite story.

All of that invokes much more discussion about the role of the futures market and the underlying principles of speculators and hedgers within the market (another topic for another day due to space limitations). Nonetheless, it’s a good opportunity to assess reader perceptions of the impact of speculators on the market.

Do you consider the non-commercial interest as driving market action or simply responding to the trend? Where do you see the market heading in the next few months? Leave your thoughts in the comments section below.

You might also like:

10 favorite tractors ranked in farmer survey

7 U.S. cattle operations honored for stewardship efforts

Prevention and treatment of cow prolapse

How Schiefelbein Farms made room on the ranch for nine sons

Meet the largest bull seller in the U.S.

8 tips for being a better ranch manager in 2015

9 ranch management concepts to improve your ranch

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)