Industry At A Glance: How does captive supply impact the cattle market?

The argument over the effect of captive supply in price discovery continue.

May 21, 2015

Last week’s Industry At A Glance featured a historical perspective of fed market volatility. That’s an especially important consideration when discussing the influence of captive supplies on the market—an enduring and often contentious issue for the beef industry.

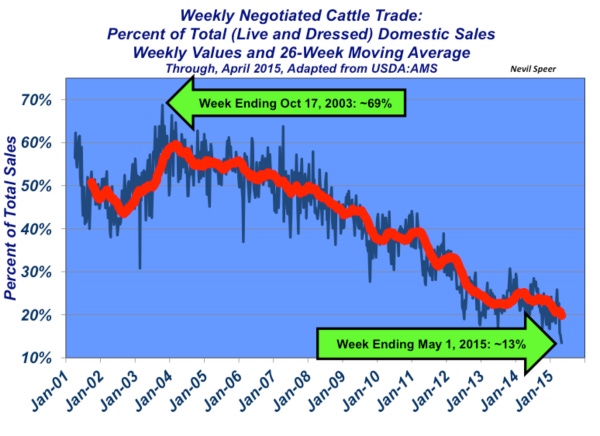

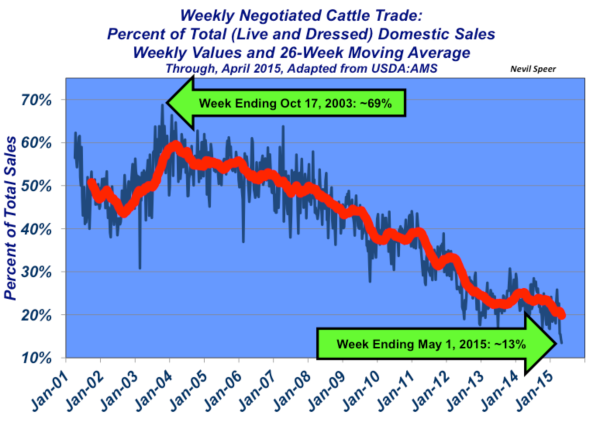

This week’s graph highlights the long-term trend around negotiated sales in the beef complex. The graph represents the overall percentage (from both a dressed and live perspective) of cash negotiated sales—and reflects both weekly values and the 26-week moving average.

As background, captive supply is defined as sales that include formula-based sales, packer-owned, forward-contracted and/or grid-marketing transactions. These non-negotiated arrangements stir concern over thoughts that prior commitments enable packers to assimilate supply needs independent of cash negotiation. The logic concludes that as those commitments increase, subsequent action in the cash market subsides. The concern, then, is that packers are able to largely remain on the sidelines, except to fill in spot shortages, which allegedly allows for manipulation of the market on any given week, especially those weeks in which much of their supply is met through previously committed cattle.

Regardless, weekly negotiated sales continue to decline over time. The last week of April represents the lowest level of cash negotiation within the series. As the graph illustrates, that’s follow-through of a much longer trend in which packers and feeders are decreasingly reliant on the spot market. Both sides are using out-front commitments to manage capital and ensure business continuity. So, while there’s lots of grumbling about the sufficiency of a true test of the cash market from week to week, seemingly no one wants to step up and establish the market test.

Where does the industry head from here? Will the cash market continue to erode? What’s your overall perspective of this reality on the market and the business? Leave your thoughts in the comments section below.

You might also like:

60+ stunning photos that showcase ranch work ethics

Q&A: Nutrition author says dietary recommendations are shockingly unscientific

Don't bid away future profits by overpaying for cows

Pricklypear control helps replenish pastures

6 steps to low-input cow herd feeding

10 negative reviews of the Food Babe worth reading & sharing

About the Author(s)

You May Also Like