Is a market recession looming? Maybe not

There’s reason for optimism in the cattle complex as we approach year-end.

November 7, 2019

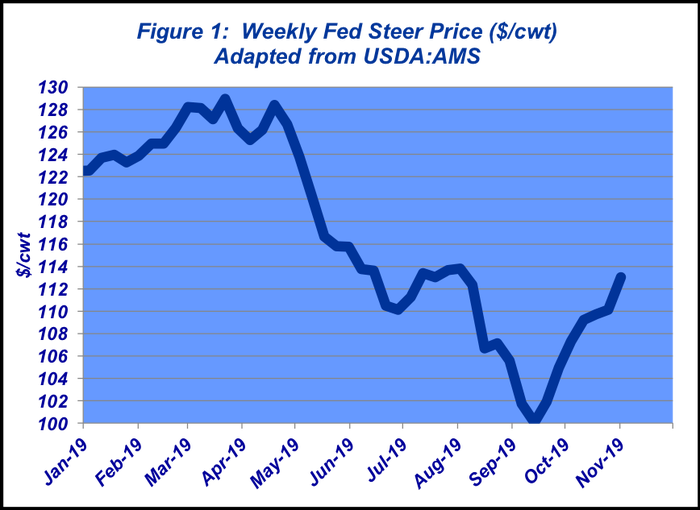

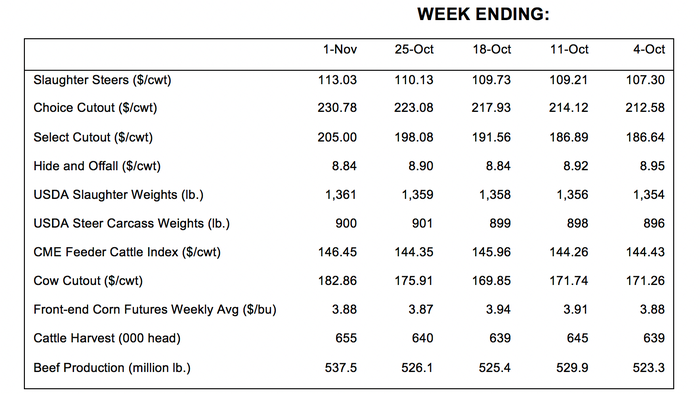

The fed cattle market, now three months out since the Tyson fire, is seemingly on solid ground. On the live side, the fed market has clawed its way back from the post-fire deficit. The market ended October with sales at mostly $113 per cwt—that’s even better than the week of the fire (Figure 1). Business has apparently adjusted to the new normal with the Holcomb plant out of commission.

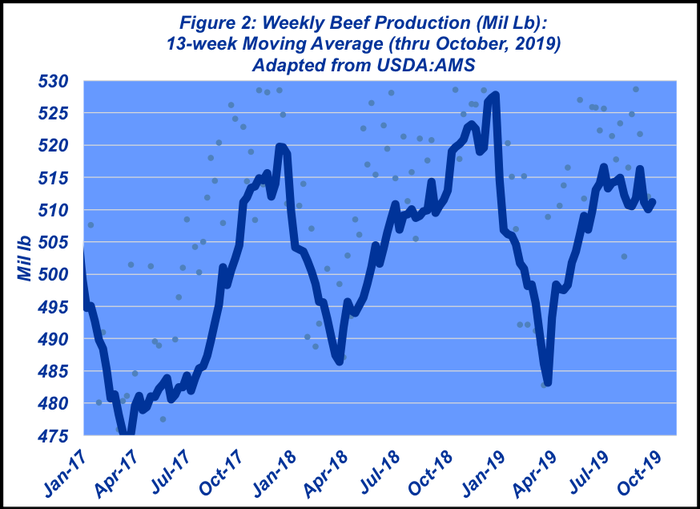

Most important, beef throughput has barely skipped a beat thanks to ramped-up Saturday kills across the complex. The three-month production average is about even with last year (Figure 2). Extra work on Saturdays has helped ensure that cattle keep moving and prevent sizeable back-up—especially significant for those feedyards that regularly ship cattle to Garden City.

That reality was reflected in USDA’s October Cattle on Feed report. Fed cattle marketings have remained on pace with last year. Better yet, while the front-end supply (4.1 million head) is somewhat higher than last year, the 120-day inventory pattern is right in line with seasonal expectations.

Implications on two fronts

First, it’s enables the feeding sector to avoid an inordinate backlog of market-ready cattle. Therefore, subsequent market leverage going into early spring should remain relatively intact. Moreover, the Holcomb plant is expected to be back online within the next 60 days. That means the industry should be able to absorb bigger supplies in the coming months.

CME’s fed cattle contracts have priced in those dynamics. For example, the April ’20 contract is trading at lifetime highs ($124-125 per cwt) with some analysts calling for $130 before the rally begins to meet some resistance.

Second, those Saturday kills and subsequent slaughter pace also benefits the feeder market. That is, steady marketings on one side translate into systematic placements on the other side. Therefore, feedyards have remained regular purchasers of feeder cattle. September arrivals were pegged at nearly 2.1 million head—just slightly bigger than 2018—and with a pace right in line with the normal seasonal pattern.

All that has underpinned the feeder market

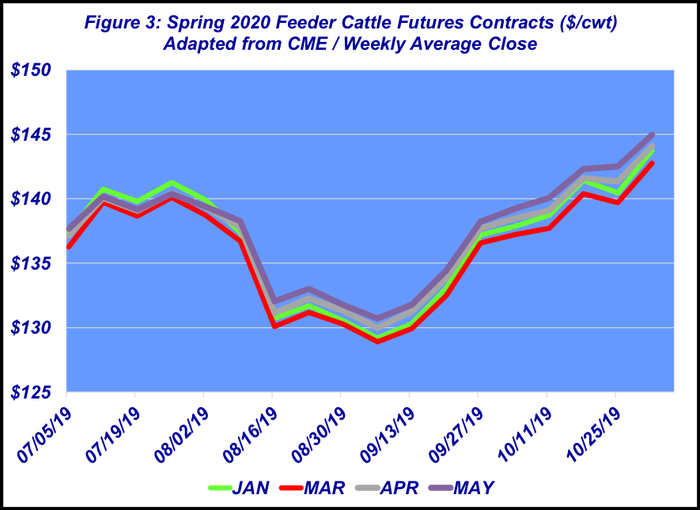

The feeder cattle index has also steadily climbed higher since August and now back above $145. Simultaneously, Spring ‘20 feeder cattle futures have also reached those levels—well off the lows following the August fire (Figure 3).

With that in mind for those producers backgrounding cattle through the winter and looking to sell next spring, the deferred feeder futures are providing a good opportunity to price at least a portion of one’s inventory.

No doubt the best news of the month revolves around the economy. The November jobs report was interpreted as being mostly favorable. Even with ongoing international turmoil (i.e. China trade negotiations and Brexit), it seems that indicators of imminent recession have been pushed down the road. The economy continues to advance in steady fashion.

The jobs report, along with another interest rate cut, spurred the S&P 500 to a record-high close as November opened for business. Better, or at least sustained, economic growth leads to better consumer confidence, consistent spending and should help reinforce beef demand along the way.

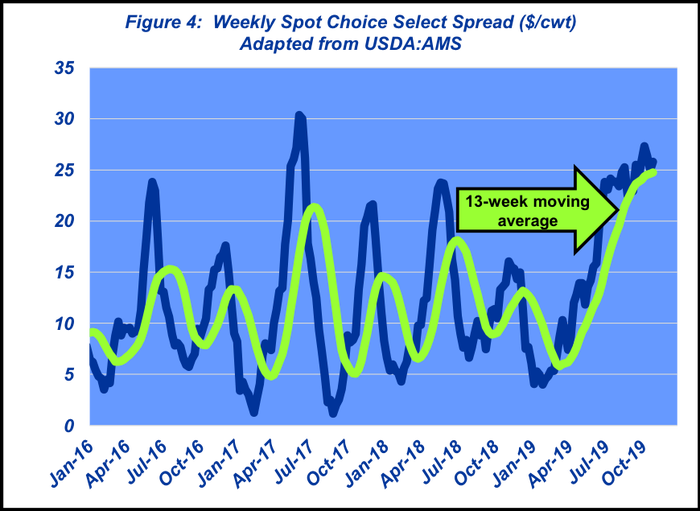

To that end, the Choice-Select spread remains nothing short of phenomenal. The spread has sustained a sharp divergence since early July—by far the most extended period the beef complex has experienced. The 13-week moving average is now at $25 (Figure 4). That trend highlights the importance of beef quality to the industry

Stephen Koontz, professor of ag and resource economics at Colorado State University, explains it this way: “A typical Choice-Select spread for this time of year is closer to $10 per cwt. Thus, it is clearly the retailer that has helped the cattle market turn the corner on any pessimism from summer supplies and slaughter disruption. And there does not appear to be any push-back from the consumer.”

From a business perspective, the market’s sharp decline following the Tyson fire draws attention to the importance of risk management in the feeding sector. Understandably, the subsequent equity loss has been a primary area of focus for many producers. However, there’s also the reality that a good portion of cattle (roughly half) have been marketed in the past three months that have never been subject to that decline.

To that end, the market decline provides a real-life case study as to the importance of risk management. Several weeks ago, Industry At A Glance highlighted the advantage of using the futures market in a consistent manner. The column noted that:

Placements purchased in 2019 began to be marketed in June (based on a ~160-day feeding period). The illustration features the selling price of closeouts on a hedged basis versus a cash basis through the week ending Oct 4…Thus far, the value of hedging 2019 purchases is equivalent to $11.50 per cwt.

The average slaughter weight during the respective marketing window is 1,330 pounds, based on USDA data, thereby providing the disciplined hedgers a $150+ per head advantage versus selling in the cash market only.

Clearly, that has huge implications for the entire feeding sector. And that value difference will ultimately translate back upstream to backgrounders and cow-calf operators. In other words, risk management is an invaluable tool that possesses implications for the entire industry.

Finally, the African swine fever outbreak in China has been the focus in recent weeks in Industry At A Glance. The shortfall in 2020 is expected to approach 22-25 million metric tons—an impossible hole to backfill. It will leave a huge deficit in China’s total meat supply and will clearly impact world protein flow.

It’s yet another scenario that’s unprecedented and needs to be monitored carefully. With that, producers are always encouraged to remain informed, obtain objective information and avoid emotion in their respective decision-making process.

Speer serves as an industry consultant and is based in Bowling Green, Ky. Contact him at [email protected]

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)