Is the cattle market whiplash over?

The September market’s decline was fast and furious.

October 8, 2015

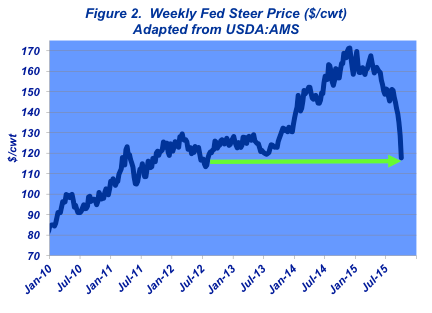

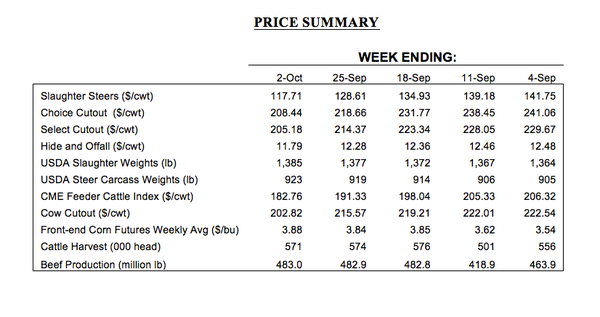

The chart tells the story; the story is the chart. Whatever your preference, the outcome is the same—the market has been under pressure since April, but September’s decline is unparalleled.

Starting from the beef side, the Choice cutout retreated $35 per cwt over the course of five weeks in September, stripping out about $315 per head of value from the beef complex. From that perspective, seemingly softer demand during the third quarter has trapped the market across several fronts.

First, international demand continues to falter. The strong U.S. dollar makes exports relatively more expensive for foreign buyers. Second, there are renewed signs the U.S. economy continues to sputter here at home. For example, the University of Michigan Consumer Sentiment Index finished lower in September at 87.2, the third straight month of decline – and the lowest reading since last November. Meanwhile, the U.S. added only 142,000 new jobs in September – sharply lower than expectations – coupled with downward revisions to the previous July and August numbers.

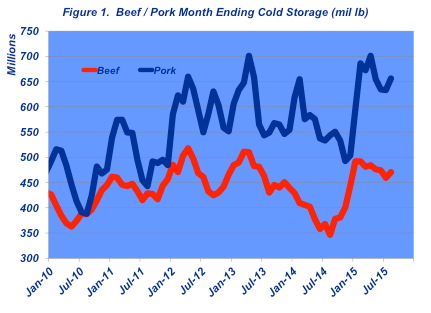

The beef market is also being pressured from the supply side of the equation. USDA’s September Cold Storage report revealed building inventories on the red meat side (Figure 1). Reported beef storage was pegged at 470 million pounds – nearly 36% higher versus 2014. Simultaneously, pork supplies are also ample with 656 million pounds in cold storage – 21% more compared with last year.

Beef has enjoyed tremendous pricing power in recent years. However, the combination of worried consumers and growing inventory will likely dampen that influence going forward. That reality spills over into the fed cattle market.

Feedyards got gut-punched in September. Steer trade finished the month at $117-$118, a decline of $27 per cwt in just five weeks and equivalent to about $375 per head during the month. From a broader perspective, fed trade has now backed up $50 per cwt since the April high. Moreover, the fed market has given up all the gains in 2014 and now trading at levels not seen since the 2012 summer lows (Figure 2).

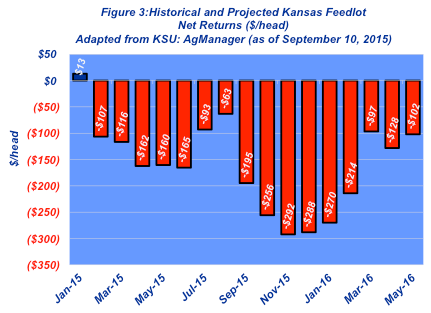

That’s clearly having a real impact on closeouts. As of mid-September, Kansas State University indicates closeouts have averaged negative $135 since February (Figure 3). Next month’s assessment will undoubtedly see further markdowns for September given the price plunge during the second half of the month.

All that said, market action is confounded by sizeable front-end supplies. Understandably, feedyards are fighting the market. But collectively and unavoidably, that ultimately pressures the market even more. Lack of currentness is a self-reinforcing phenomenon:

Cattle feeders are backed up with respect to the front-end supply;

The packer thus has leverage and able to force the market lower;

The cattle feeder subsequently becomes reluctant to market cattle; and

Cattle get even heavier, thereby even fewer head are needed by the packer and hastens the leverage disparity even further.

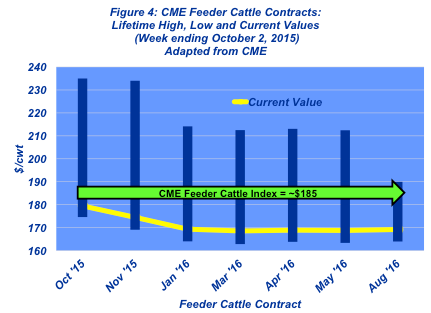

Clearly, this has all pressured feeder cattle prices too. The CME Feeder Cattle Index slipped nearly $25 during September. Simultaneously, the feeder cattle contracts also declined, all trading near all-time lows. Nevertheless, there remains work ahead to reconcile the discrepancy between current cash price and weaker futures prices (Figure 4).

The market’s whiplash of late is a reminder of how fast and how sharply markets can move. To that end, the CNBC ran an article in 2011 titled, “Black Swans Now A Regular Part of the Landscape.” The title is appropriate—what once was might have been perceived as a one-off event now has to be perceived as normal. After all, no one ever saw this coming on either side of the market action.

“When will the market recover?” That’s the enduring question out in the country as producers think about their respective marketing options. There’s no good answer. With that in mind, several times last year this column noted that, “Trying to outguess or outsmart this market is about like trying to outrun a speeding train. It’s nearly impossible to do and the consequences can be devastating. Given the continued pattern within the market, sharp moves are the primary challenge to be managed – both up and down.”

The cattle business is now in uncharted territory. As noted in prior months, the demand curve has enjoyed an extended positive run. However, that’s now being challenged, largely because of external factors far outside of the industry’s influence. Meanwhile, the beef complex is now forced to manage increased supply. And to cap it off, there’s an unprecedented level of capital at risk, which is now required to operate across all segments of the beef industry.

Now more than ever, this market serves as a reminder the importance of access to accurate, data-driven, objective information; and establishing time to adequately absorb and analyze that information. Both components are essential to making successful decisions amidst the turmoil, over the long run.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

4 experts weigh in on fall 2015 cattle prices

2015 BEEF Stocker Award Winner: Shovel Dot Ranch

Will beef demand keep up with cowherd expansion?

How to treat lump jaw disease in cattle

3 non-traditional feedstuff options to consider for your cow herd

About the Author(s)

You May Also Like