Packer gross margins vs. cow-calf profitability

Is cow-calf profitability correlated with packer profitability?

September 12, 2019

As noted in last week’s column, since the fire at Tyson’s Holcomb, Kan., plant, there’s been plenty of consternation about the direction of the markets. That is, live cattle prices have declined while boxed beef prices have surged. The outcome being sharply higher live to cutout spreads – all benefitting the packer.

Amidst that conversation, some commentators have argued that situation will prove detrimental to the cow-calf producer. Lower fed prices will ultimately mean lower calf prices – hence, packer margins are coming at the expense of producers. To that end, this week’s illustration addresses the relationship between packer margins and cow-calf returns.

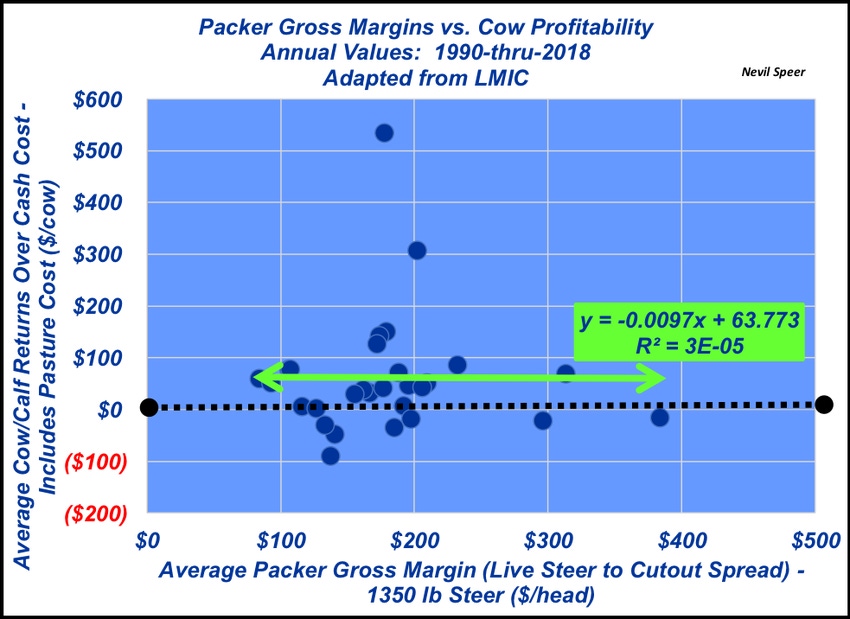

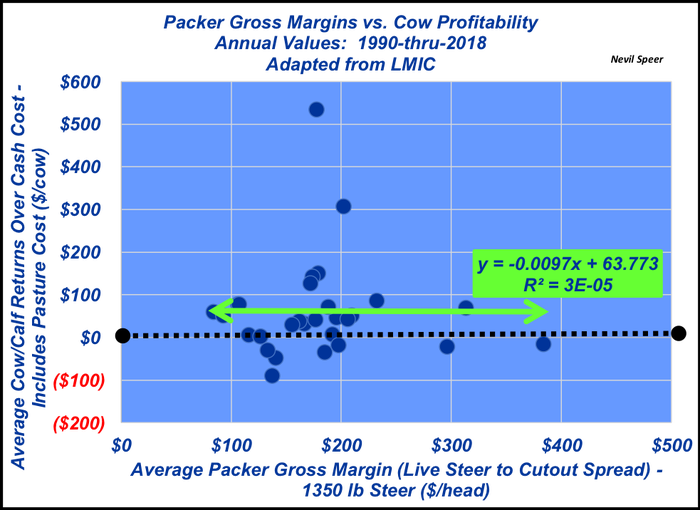

The data represent annual average packer gross margin for a 1,350-pound steer (live to cutout spread) versus average cow-calf returns since 1990. Between 1990 and 2018, packer gross margins have averaged $180 per head (ranging from $84 to $384 per head), while cow-calf operators have realized a mean return of $62 per head (ranging from negative $89 to $534 per head, not counting land appreciation).

Most important is the relationship between the two; the correlation over nearly 30 years of data is 0.00003 (basically zero). In other words, the data indicate that returns at the cow-calf level are not tied to packer margins. Stated another way, packer margins have not influenced profitability at the cow-calf level. Thus, trying to extrapolate the current gross margin trends up to the cow-calf sector is neither meaningful nor helpful.

Rather, it’s more beneficial to invoke some important principles for the cow-calf sector with respect to profitability and cost management – an item discussed previously in this column. KFMA data emphasize that production and selling price obviously impact profit – but the largest component in segmenting the differences among these groups are differences in cow costs. That is, the most significant difference among the groups isn’t an advantage/disadvantage in terms of weaning weight or marketing rate or selling price, etc…. Rather, the overwhelming driver toward determining the bottom-line – year-in, year-out – revolves around an enterprise’s cost structure.

Speer serves as an industry consultant and is based in Bowling Green, Ky. Contact him at [email protected].

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)