Volatility aside, March turned in solid fed cattle trade

Should the spring high in fed cattle been higher? Here’s a look.

April 10, 2019

With April in front of us, there still is some hope for a stab at a new spring high in the fed cattle market. But don’t hold your breath.

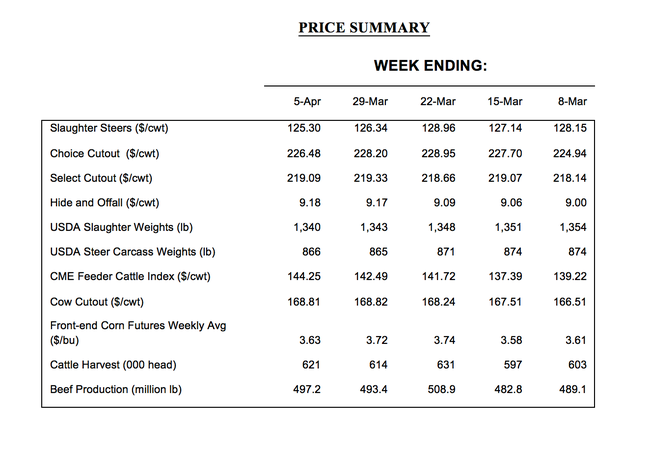

That’s especially true given that the month opened on a softer note – down $1 per cwt from the previous week, and that drop followed a $2-3 slide the week before that. Despite that, March proved to be a fairly solid month for fed trade.

Steers and heifers traded mostly $127-128 per cwt during the first three weeks of March. Then cattle feeders garnered another $1-$2 to jump the market up to $129. That all came as the Choice cutout began to push up against $229.

RELATED: El Nino intensifies. What's that mean for spring weather?

But then came USDA’s Cattle on Feed report.

Traders interpreted the report as mostly bearish. With that occurrence, cattle feeders were aggressive sellers the last full week of March. Accordingly, fed prices retreated $2-$3 to close out the month at mostly $126.

That move violated the upward channel that’s been in place since last September. And as noted above, April’s first week followed through by retreating another $1. Therefore, spring highs look to be in for 2019.

That’s disappointing for some observers and analysts, who have been grumbling that the fed trade languished during the first quarter. Most notably, they point to weather and concerns about China’s problems with African swine fever – those factors should have been more supportive for the cattle market.

In other words, they contend this year’s market should have eclipsed last year’s $130 mark. Let’s look deeper at those concerns.

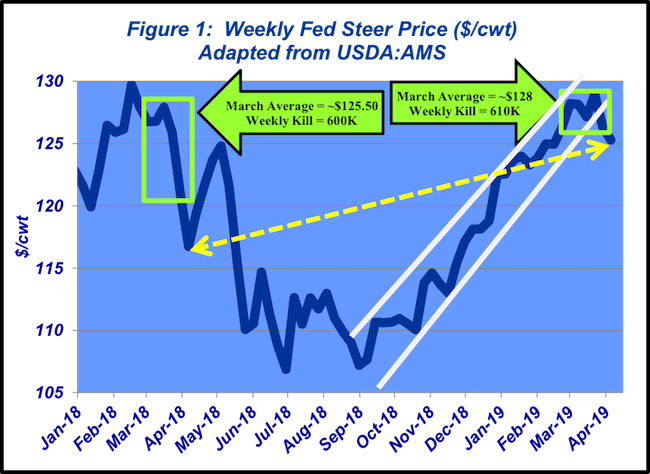

All-in, the fed market averaged $128 during March. So, while fed prices didn’t reach last year’s $130, that $128 average is $2.50 better than last year’s March average – and on bigger kills (Figure 1).

More important, fed prices are nearly equal year over year through the first quarter – despite weekly beef production running just slightly ahead of last year’s pace. Lastly, April’s open at $125 is $8-$9 better versus last year.

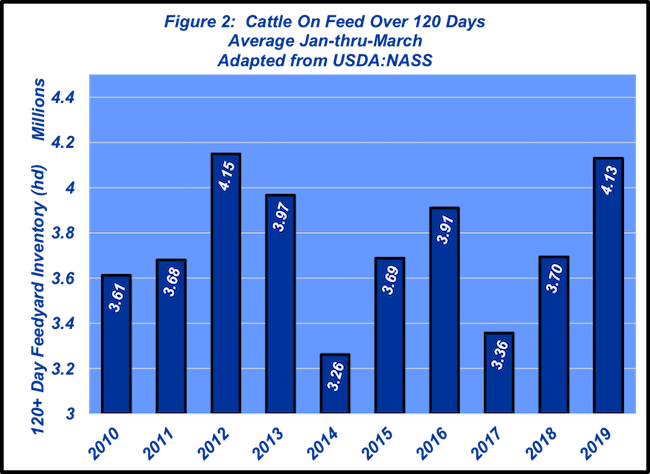

The market’s year-over-year performance is even more significant when considering feedlot inventories. Feedyards have consistently owned more market-ready cattle compared to 2018.

The January through March average inventory of cattle on feed for 120-plus days is 435,000 head bigger compared to last year – and nearly 550,000 head bigger than the five-year average (Figure 2). In other words, the feeding sector held steady money together in the face of bigger front-end supply.

To that end, showlists will continue to be sizeable in the weeks and months to come. There are a lot of cattle to work through on the front end, plus we’re entering normal seasonal increases for beef production.

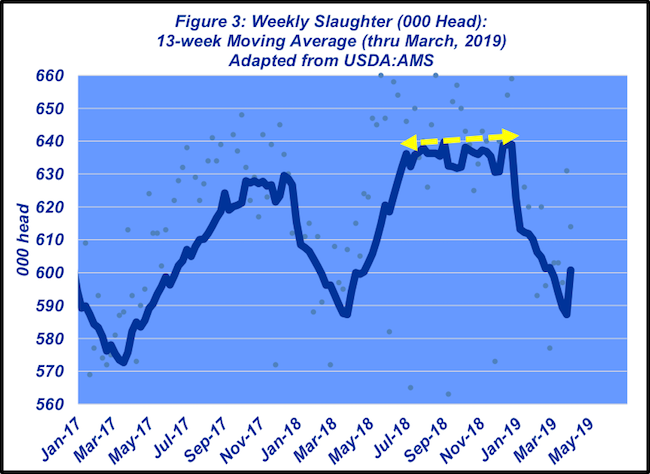

Last year’s slaughter pace was hectic. Moreover, weekly kills stayed at peak levels for an extended period of time (Figure 3). It’s likely we’ll witness a similar pattern this year, especially considering February placements far exceeded expectations.

On a more favorable note, beef demand should prove solid. The economy continues to hum along in positive fashion, helping to underpin consumer sentiment. The Wall Street Journal explained March’s reading like this:

“American households felt better in March about the current state of the economy and their earnings prospects, particularly lower-income households. The University of Michigan said Friday [March 26] its index of U.S. consumer sentiment was 98.4 in March, up from 93.8 in February. That was above the 97.8 that economists had expected and the preliminary reading reported earlier in the month.”

Meanwhile, the March jobs report reinforced that sentiment. All that should prove supportive for beef expenditures, and subsequently the beef cutout, going forward.

RELATED: Impact of beef imports on total beef supply

Shifting gears, this week’s Industry At A Glance features a recent column by David Lalman, beef cattle specialist at Oklahoma State University. Lalman’s work highlights, “…that trends for [weaning weight] WW in commercial cow-calf operations vary substantially by region of the country. However, there is considerable evidence that progress in WW may be limited by the production environment in commercial cow-calf operations.”

At the same time, this week’s column also notes that slaughter weights have substantially increased over the past 20 years. Lalman emphasizes that, “…efforts to enhance profitability should focus on reducing costs of production and/or capturing value of genetic potential for post-weaning performance and carcass value.”

In other words, working on maintaining cow costs is highly important. As noted last December in Industry At A Glance: “… the difference in cow costs over the years accounts for nearly 60% of the difference in return to management. The take-home message being, if you’re struggling with profitability, the place to start is on the cost side.”

Simultaneously, exploring new options to take advantage of better genetics post weaning is also recommended (i.e. retained ownership beyond weaning).

To close, Carl Richards (Behavior Gap™) has a simple drawing with “data & evidence” on the x axis and “chance you’re making a good decision” on the y axis. The line in the graph goes up and to the right; they’re positively related.

This column always encourages beef producers to invest time AND resources into obtaining objective information and reviewing that information carefully. Doing so ensures, “you’re making good decisions.”

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)