What's the economic impact of the current cattle cycle?

Even with today’s large beef cows, though, cow numbers are still changing in response to cycling beef prices caused by changing beef cow numbers. What's that mean on the economic level? Harlan breaks it down in his new series within his Market Advisor column.

September 25, 2018

USDA data show that the change in beef cow numbers throughout the current cattle cycle is not as large as it was in cattle cycles before the year 2000. Due to the size of cattle now being harvested, we just do not need as many beef cows now in the U.S.

Even with today’s large beef cows, though, cow numbers are still changing in response to cycling beef prices caused by changing beef cow numbers. Yes, I am arguing that the cattle cycle and beef price cycle have again returned. In this series of articles, I will illustrate the economic impact of the current cattle cycle — albeit a smaller cycle.

In Part 1 of this series, I analyzed the gross income in North Dakota’s beef cow herds from 2009 through 2017. I then looked at direct costs of production over the same nine years and reviewed the costs of breeding females and replacement bulls in the current price cycle.

In this Market Adviser, I will take a look at the average overhead costs per cow in North Dakota over the first nine years of the current cattle cycle, and then look at the earned returns to labor and management per cow over the same nine-year period. Again, I am using North Dakota’s Farm Business Management Records summarized in the University of Minnesota’s FINBIN database as my data source.

Overhead costs. Beef cow overhead costs are just those overhead costs associated with the beef cow herd. Other overhead costs from growing weaned calves, finishing cattle or farming are left out.

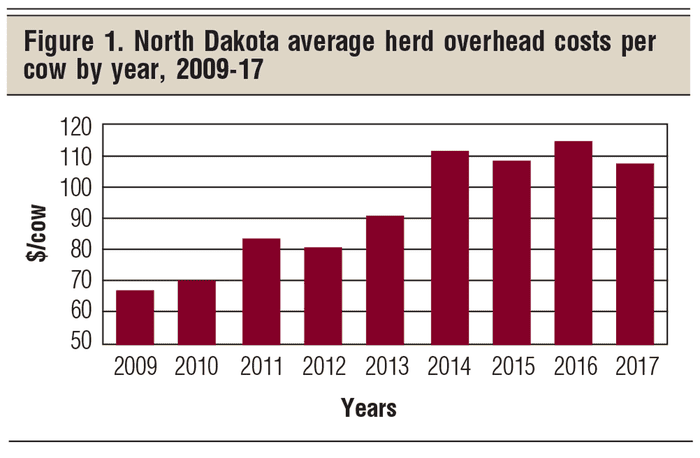

The beef cow average overhead costs used in this study are the averages of each cow herd’s share of hired labor, farm insurance, utilities, beef cow interest cost, beef cow machinery and beef cow building deprecation, and beef cow miscellaneous costs. The nine-year average overhead cost per cow for all study herds came to $91 per cow but varied among the years studied (Figure 1).

Beef cow overhead costs have increased steadily over the nine-year study period. Increasing overhead costs are calculated to have increased $6.36 per cow per year each and every year over this nine-year study period.

This is not a serious problem as long as gross income is trending upward. But, since 2014, gross income is now trending downward.

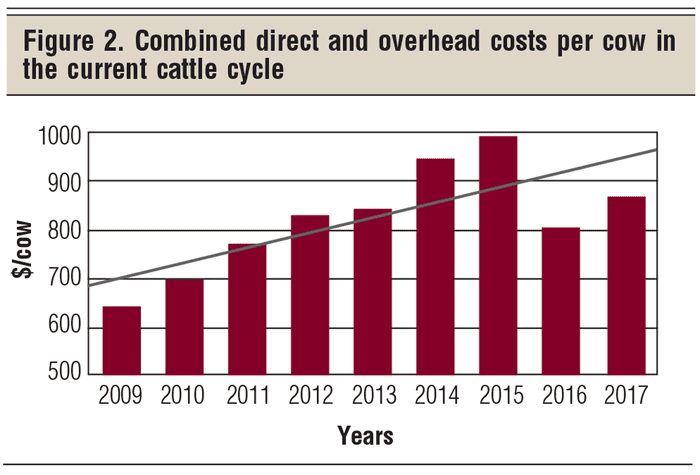

Combined direct and overhead costs. Figure 2 combines the direct and indirect costs allocated to these beef cow herds. Remember, feed costs were allocated at fair market value, not costs of production.

The nine-year average combined direct and overhead cost averaged out to $814 per cow. At the same time, the combined direct and indirect costs per cow went up, on average, $30 per year over this nine-year period.

As indicated last month, gross income per cow trended upward $53 per year over this nine-year period, while total direct and indirect costs trended upward $30 per cow per year. The problem is that since 2015, gross income has started to trend downward as we complete the last part of the current cattle cycle. The management challenge is how to lower production costs in the downward phase of the beef price cycle.

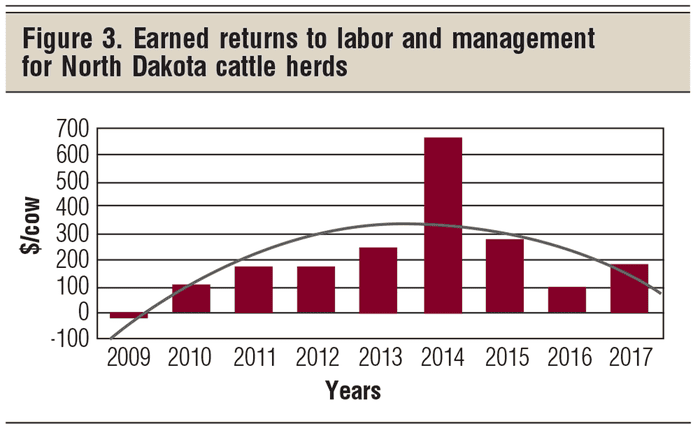

Earned net returns to labor and management. Ranchers typically do not charge a labor wage or calculate a management charge for beef cows. So, I like to calculate the earned net returns to labor and management per cow (Figure 3). The nine-year average earned returns to labor and management per cow were $214 per cow, per year — a favorable number. There was, however, considerable variation in the nine years (again, see Figure 3).

The earned net returns to labor and management went up each of the first six years in the cycle, peaking at $650 in 2014. This 2014 figure was high enough to set the beef cow industry afire. This could well be a lifetime peak annual earning year for most, if not all, of my readers.

In 2015, everybody wanted bred heifers or bred cows, and bred female prices went up and up! I got all kinds of phone calls from investors wanting to own beef cows. This became a problem as the beef price cycle had peaked and we now are on the downward side of the beef price cycle for at least through 2019.

It is a new ballgame now that we are on the downward side of the current price cycle, and it is projected to continue as we go into the first few years of upward phase of the next price cycle. The next price cycle is now projected to peak in 2026-27.

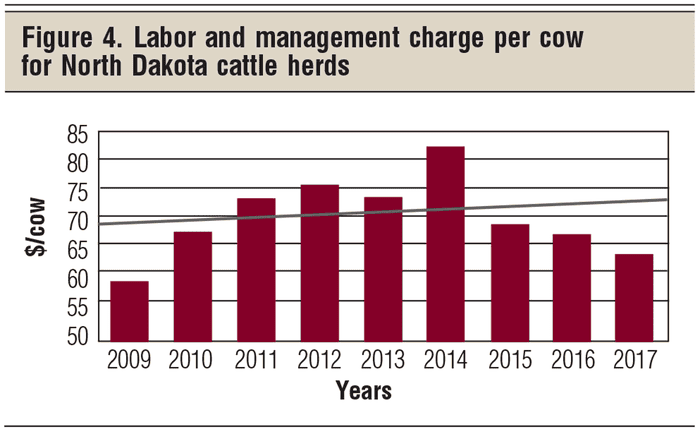

Earned returns after labor and management wages. In the� July Market Advisor, I illustrated how labor requirements of beef cow herds are calculated. Labor costs are based on the number of cows that a full-time employee can run. The larger the herd, the more cows per man-year, and the lower the labor and management wage per beef cow.

The nine-year average labor and management charge per cow for North Dakota herds averaged out to $71 per cow per year. The average annual labor and management charges per cow presented in Figure 4 did not change much through time. The trend line for these nine years was almost flat, varying more from changes in cow numbers than anything else.

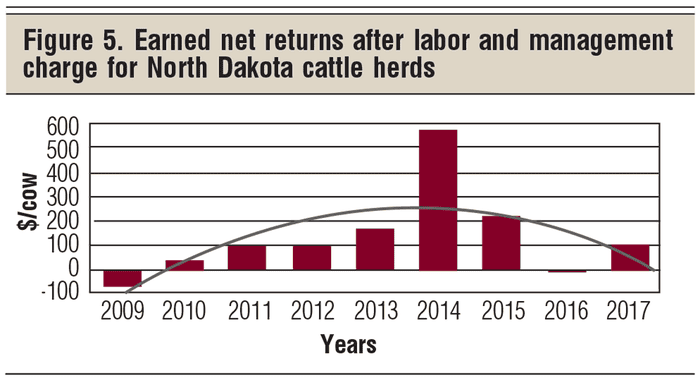

Net returns after a labor and management charge. The nine-year average net returns after a labor and management charge were $143 per cow but varied considerably through the nine years of the current cattle cycle (Figure 5). As you would expect, year 2014’s $577 stands out dramatically. That one year did a lot to increase the nine-year average. The average earned net returns per cow over the other eight years were $81 per cow. This is, indeed, a sobering number.

The average earned net returns after an annual labor and management charge for the first six years of the current cattle cycle were $176 per cow. The average earned net returns after a labor and management charge for the first three years of the downward side of the current cycle were $105 per cow.

Yes, all of this leads me to conclude that cow herds typically make more money on the upward portion of the beef price cycle.

Hughes is a North Dakota State University professor emeritus. He lives in Kuna, Idaho. Reach him at 701-238-9607 or [email protected].

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)