2018 crop analysis: Is corn underpriced?

While analysts digest USDA numbers and try to guess the extent of this fall’s harvest, the corn market chugs along.

July 19, 2018

Several weeks ago, Industry At A Glance featured USDA’s most recent ending stock projections for the 2018/2019 crop marketing year, based on the June WASDE estimates. At the time, USDA was using early-season acreage numbers with trendline yield estimates of 174 bushels per acre.

However, mid-July now allows USDA to utilize updated acreage count of 89.1 million acres. Meanwhile, the World Agricultural Outlook Board maintained yield at 174 bushels per acre in the July WASDE report. Along the way, there were a few other tweaks to various sources of use. Besides yield, given the current trade environment, the export number will likely be the most debated estimate in coming months.

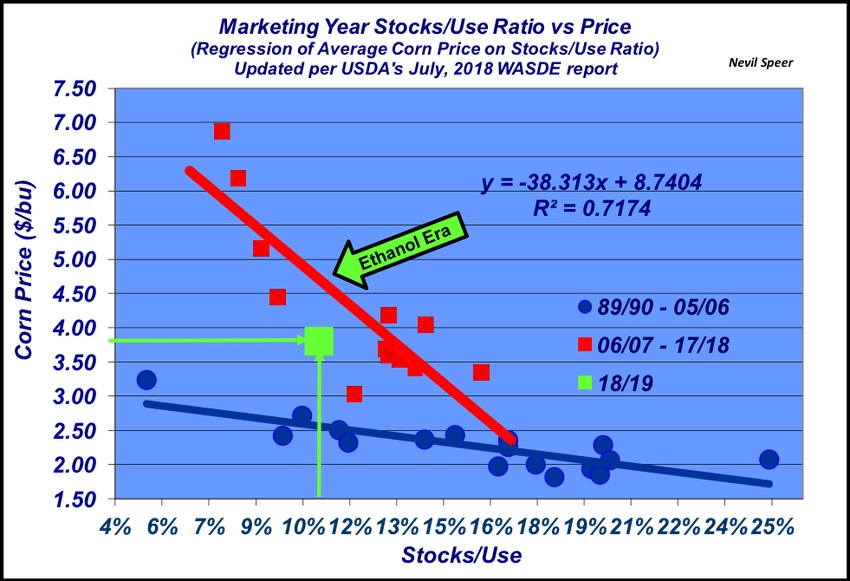

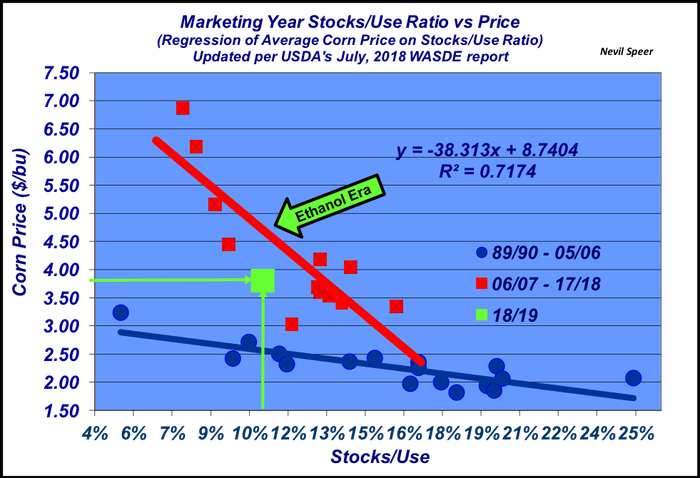

Bottom line: USDA now has the U.S. corn market working with total use at 14.755 billion bushels with carryover of 1.552 billion bushels. That’s equivalent to a stocks-to-use ratio of 10.5%, down sharply from last year’s 13.6%. However, USDA is also pegging the marketing year average farm price between $3.30 and $4.30 per bushel, with the midpoint being $3.80.

This week’s illustration highlights the 2018/2019 marketing year in comparison to previous years. Given the current stocks-to-use ratio, it would appear that corn is underpriced from a historical perspective. Moreover, it’s difficult to reconcile a December futures contract trading around $3.60 per bushel and a March contract hovering around $3.70, given the historical context.

As noted last earlier in the month, USDA’s WASDE report provides a baseline for ending stocks/carryover. There’s always lots of discussion and controversy around USDA’s projections, leaving the door open for variation in private estimates, thus, making a market.

Somewhere along the way, something will have to change to avoid an 2018/2019 marketing year anomaly. It would seem the market is currently betting on yields outperforming the WASDE estimate – thus production will have to be adjusted upward and subsequently making carryover more sizeable.

Where do see the corn market headed? Are conditions around you favorable to surpass last year’s record yield? Or will corn prices move higher as we progress into the fall? Leave your thoughts in the comments section below.

Nevil Speer serves as an industry consultant and is based in Bowling Green, KY. Contact him at [email protected].

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)