Feeder cattle market rebound!

Despite two black swan events, bigger supply and sharp losses, the feeder market has staged a solid recovery and is encroaching the top side of a well-established trading range.

August 13, 2020

This past weekend marked the one-year anniversary of the fire at Tyson’s facility in Holcomb, Kan. Market participants then took another gut punch again in March with COVID-19.

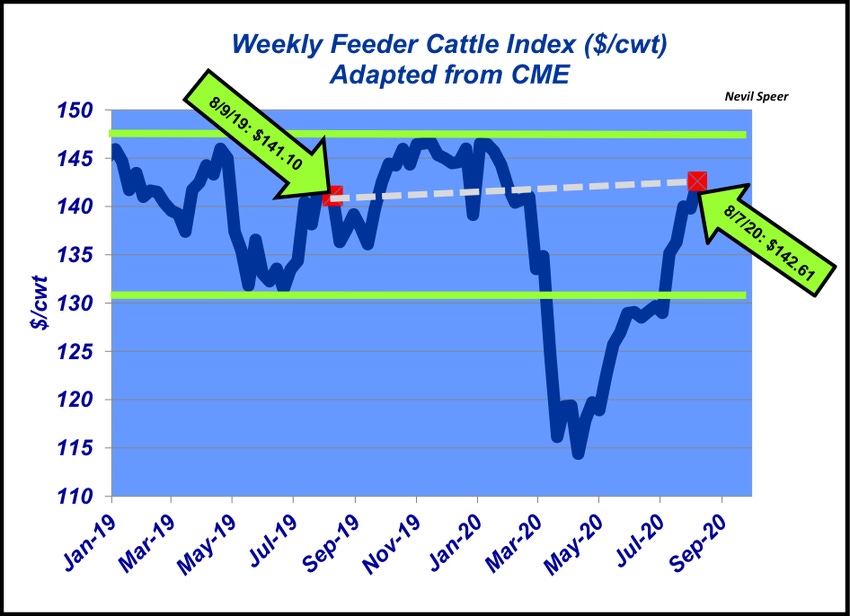

Business has now returned to some pattern of normalcy. At this point, it’s useful to review the market and provide some broader assessment of the current situation. This week’s illustration provides an overview of the CME Feeder Cattle Index since January 2019. The index finished the first week of August at $142.61 - $1.50 per cwt, better than August 9 of last year (the Friday before the fire at Holcomb).

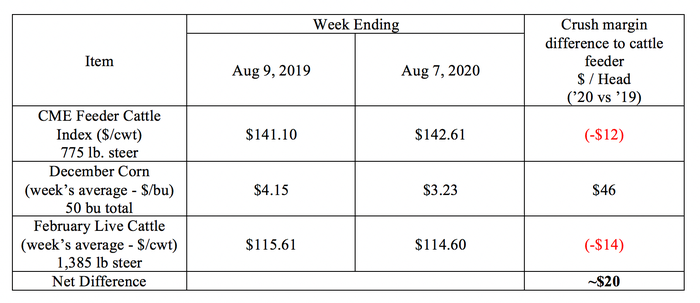

With that in mind, the table below highlights the year-over-year margin comparison respective to December corn and February live cattle futures (essentially a crush). The net difference is roughly $20 per head. At that point, the feeder market is just $2-$3 per cwt short of last year’s relative valuation prior to the 2019 fire.

The runup in feeder cattle prices over the past several months has occurred despite larger feeder supplies in 2020. USDA pegs it 300,000 head bigger versus ’19 – likely at the low end of the scale given placements through June are running behind 2019 by 1 million head. And then there’s consideration of sizeable closeout losses in recent months among unhedged feedyards operating on a strictly cash-to-cash basis. In combination, both of those factors clearly pressure the feeder market to the downside.

All this inherently invokes the issue of price discovery, the argument being the fed market is broken. That is, fed cattle prices are being negatively influenced by packers and/or absence of cash trade. In turn, the feeding sector becomes less aggressive when purchasing feeder cattle, thereby negatively (and disproportionately) influencing the feeder market.

That reasoning has been especially prevalent during the past year amidst intra-industry debate around the cash market, or absence thereof.

However, that logic seemingly hasn’t materialized in the market. Despite two black swan events, bigger supply and sharp losses, the feeder market has staged a solid recovery and is encroaching the top side of a well-established trading range.

It seems there’s plenty of optimism in the feeding sector about the general state of business and available capital to chase cattle for the next turn of replacements. Or else we’d likely be witnessing softer prices in the feeder market.

Nevil Speer is based in Bowling Green, Ky. and serves as director of industry relations for Where Food Comes From (WFCF). The views and opinions expressed herein do not necessarily reflect those of WFCF or its shareholders. He can be reached at [email protected]. The opinions of the author are not necessarily those of beefmagazine.com or Farm Progress.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)