Industry At A Glance: A Look At Regional Fed-Market Price Differences

A look at the regional dynamics (north vs. south) within the fed cattle market.

July 28, 2014

Last week’s “Industry At A Glance” chart focused on the recent strong shift in corn basis between Omaha and the Texas Triangle. Last year at this time, this column focused on the regional dynamics (north vs. south) within the fed market. Since then, the shift in the fed market has stretched even further and deserves a second look – all in an effort to better understand the differences between the southern and northern tiers of the feeder/packer complex.

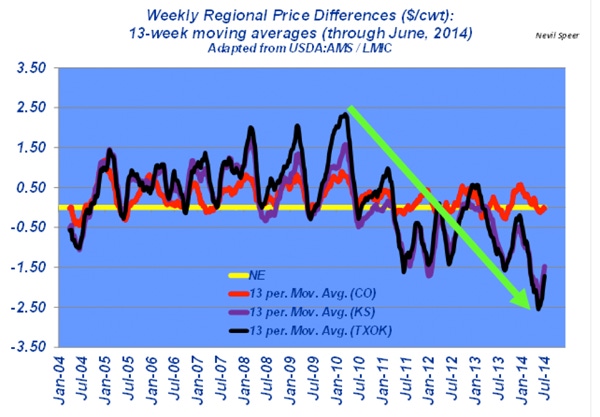

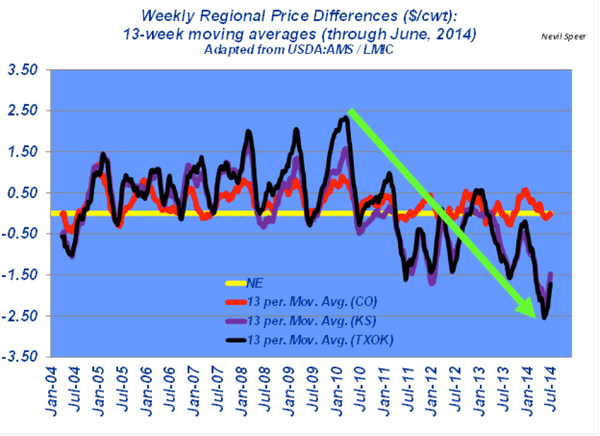

The accompanying graph represents regional fed-price deviations (basis Nebraska) over time. These were largely consistent and predictable between 2004 and 2011. Historically, the positive deviation in the southern region occurred during the early part of the year, and it subsequently diminished as the market transitioned into spring.

That reliable seasonal pattern primarily resulted because of seasonal discrepancy between supply (show lists) and demand (capacity) across the regions. The southern premium became larger in the winter with waning fed cattle supply; excess packing capacity in the south drove the market higher in order to pull cattle into the region. That price difference proportionally declined as supply increased into late spring/early summer.

As indicated on the graph, the southern basis peaked in March 2010. However, that long-run pattern unexpectedly shifted in 2011, when the southern premium not only disappeared but inverted. The northern market has largely outperformed the southern market ever since, with the southern discount reaching a low point in May 2014. All combined, the shift from peak to peak represents a difference of nearly $5/cwt. – or about $65-70/head.

The shift may be explained by any number of factors, but whatever the cause(s), the outcome has some important implications.

What do you see as the driving force behind this overall shift? What effect might it have on the feeding sector over time? Where do you see all of this headed in the future? Leave your thoughts below.

Other popular online stories:

Take A Virtual Tour: World's Largest Vertically Integrated Cattle Operation

Ranch Management: Quick Tips For Easier Weaning

How To Prevent & Treat Pinkeye In Cattle

Fencing? Avoid These 7 Common Mistakes

Cows Out On Pasture | 80+ Grazing Photos From Readers

What's The Best Time To Castrate Calves? Vets Agree The Earlier The Better

6 Pasture Weed Control Tips For The Fall

7 U.S. Ranching Operations Honored For Top Stewardship

60+ Stunning Photos That Showcase Ranch Work Ethics

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)