The seasonality of calf prices and factors unique to 2022 / 2023

Calf prices this time of year are largely determined by grain prices.

December 14, 2022

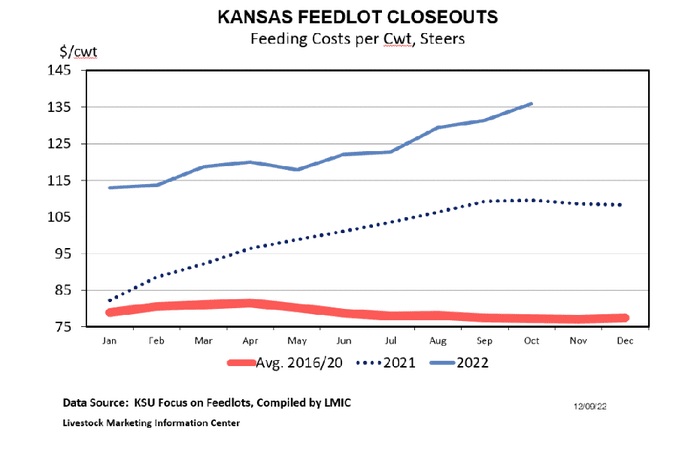

High grain prices have been the focus of much discussion in 2022. As I write this, CME© corn futures are trading in the mid-$6 per bushel range through next summer. This story is likely best told by looking at the chart below, which summarizes feed cost per lb of gain from Kansas State’s Focus on Feedlots data. The most recent feed cost of gain estimate from participating feed yards exceeds $1.35 per lb. And projected cost of gain is even higher for cattle that are currently being placed. As a comparison, the average feed cost per lb of gain was about $0.79 from 2016 to 2020. High cost of gain incentivizes the placement of heavier feeder cattle into finishing programs.

Current feed prices don’t make the placement of light cattle on feed very attractive, which is preventing calf markets from reaching price levels they would reach in a more normal feed cost environment.

I want to use this as a backdrop to discuss how feed price levels impact seasonal price patterns in calf markets. In most years, calf markets reach their highs in the spring as light weight calves are being placed into grazing programs. The lower cost of gain from grazing results in higher calf prices as stocker operators compete for calves.

As grazing opportunities disappear in the fall, feed prices become a major driver of calf values and we tend to see calf markets put in their seasonal lows. The more expensive feed becomes, the lower calf markets go. So, high feed prices tend to amplify the normal seasonal patterns in calf markets. The higher feed prices are, the larger the differential between the spring and fall calf prices.

As we think about this fall and the coming spring, I wanted to mention two other factors that are relevant, but more unique to this year. While grazing opportunities are primarily a consideration in the spring, grazing cattle on winter wheat pasture is certainly an exception.

Given the dry weather in the Southern Plains, one would reasonably expect that fewer calves have been placed on wheat pasture than normal, which has likely also hampered calf prices this fall / winter. Had wheat grazing conditions been more favorable this year, I think we would have seen a slightly higher calf market.

Secondly, the amount of carry in CME© feeder cattle futures will have an impact on price improvement between now and spring. Calves that are being placed into backgrounding programs now will be sold in the spring of 2023, while calves being placed into grazing programs next spring will be sold in the fall of 2023.

Currently, fall 2023 futures contracts are trading at a $10 to $15 premium over spring 2023 futures contracts. This is a significant difference in expected value that should also be reflected in higher calf prices this spring. Put simply, if normal grazing opportunities exist, a great deal of improvement should be seen in the calf market over the next several months.

Source: University of Kentucky

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)