Corn futures contracts: Position changes over time

In our ongoing series of how futures work, here’s a look at corn futures, an important part of your overall risk management program.

July 25, 2019

Typically, the July World Agriculture Supply and Demand Estimates (WASDE) report turns out to be fairly uneventful for the grain markets. However, this year’s report didn’t follow along with those expectations.

That’s because USDA surprised the market by revising ending stocks upwards from 1.675 billion bushels to 2.010 billion bushels. Accordingly, USDA revised the average farm price down from $3.80 per bushel to $3.70 per bushel. The average trade estimate was roughly right in line with the June WASDE number and even the highest trade estimates didn’t have carryover exceeding 2 billion bushels.

That sort of upward revision would normally see the market trading into negative territory. However, the market seemingly ignored the USDA numbers and countered by working higher.

In the two days that followed, both the September and the December contracts added 19 cents on sizeable volume. That was followed by some moderation back the other way, but the market sent a clear message: Traders don’t have a lot of confidence in USDA’s July estimates.

Therefore, the market is operating with a high degree of uncertainty. And as explained several weeks ago, relative positions in the market provide some indication about the general consensus around the market.

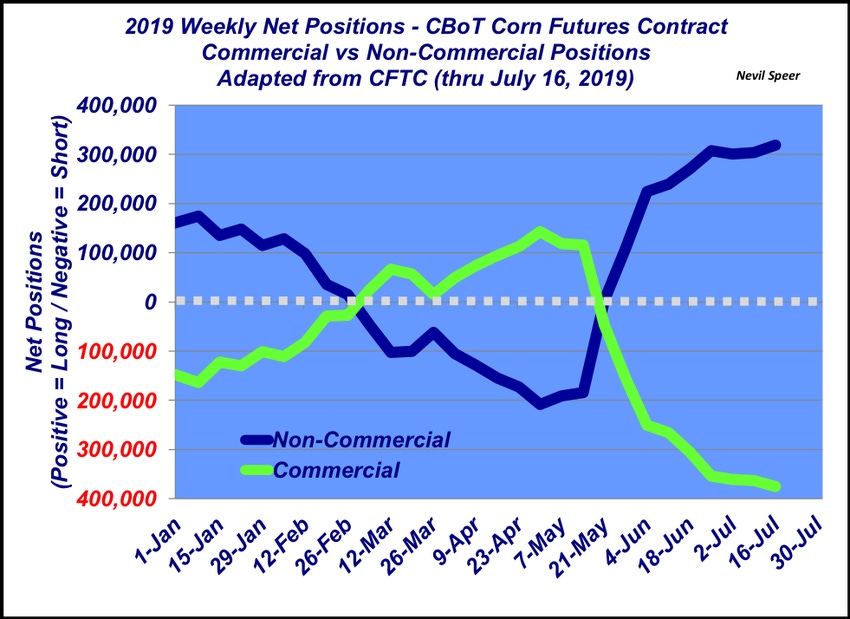

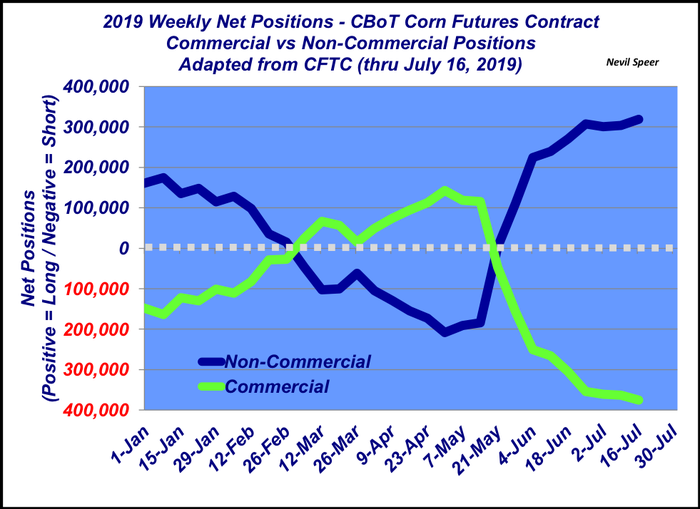

Accordingly, this week’s graph depicts net positions (commercial versus non-commercial) for the Chicago Board of Trade’s Corn Futures contract. The positions are recorded through July 16 – the first assessment since the July WASDE report.

As review, the net position is simply the sum of the short and long positions for each category of traders, commercial and non-commercial, respectively. What’s more, some basic definitions are helpful to better understand the graph:

Long: An initial buy position (obligation to accept delivery)

Short: An initial sell position (obligation to make delivery)

Speculator: Entity assuming price to potentially profit from price change (non-commercial)

Hedger: Entity using futures/options market to manage price risk (commercial)

With that in mind, this week’s graph reveals the positioning that occurred because of concerns about the crop back in May. Speculators were net short 200,000 contracts at the end of April and are now net long 320,000 contracts.

Meanwhile, on the other side, the commercial position (hedgers) were glad to begin making sales along the way; the commercials were net long approximately 140,000 contracts at the end of April and now net short nearly 380,000 contracts.

That brings us back to the WASDE report. Following the report, USDA noted: “In July, USDA’s National Agricultural Statistics Service (NASS) will collect updated information on 2019 acres planted, and if the newly collected data justify any changes, NASS will publish updated acreage estimates in the August Crop Production report.”

That statement underscores the broader uncertainty surrounding this year’s crop – it’s all subject to change. It’ll be important to monitor this positioning over the course of the next few months. Stay posted!

Speer serves as an industry consultant and is based in Bowling Green, Ky. Contact him at [email protected]

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)