Here’s how feedyard structure changed: 2019 vs. 2006

Feedyards were adapting to changing dynamics in the beef business long before COVID-19 was a household word.

May 28, 2020

This column has been focusing on the influence of COVID-19 on the beef industry. COVID-19 has seemingly heightened debate about and within the industry in recent months, drawing the need for broader context across a variety of topics.

Last week’s column highlighted a state of the industry comparison between 2019 and 2002: an apples-for-apples assessment given equivalent levels of beef production (27.3 billion pounds). The discussion noted that: “The industry has been trending in a positive direction for nearly two decades and remains on solid footing. That’s largely occurred because of free market forces and voluntary exchange. And all the while, the Beef Checkoff has been successfully solidifying the industry’s competitiveness in the marketplace along the way.”

Meanwhile, even before COVID-19, the Tyson fire brought renewed attention on the inner workings of the fed cattle market. That’s not surprising. Whenever markets begin to trade in a negative fashion, the issue of price discovery comes to the forefront.

That interest has gained even greater traction in recent weeks amidst the COVID-19 crisis. The two events back to back (the Tyson fire and COVID pandemic) have predictably revived momentum to implement new measures to boost the level of cash negotiation in the fed market.

Once again, to better understand what may or may not be occurring within the industry, it’s useful to step back and look at the larger picture. The last time the fed market possessed a 50% or greater level of weekly price negotiation was 2006. Since then, it’s been on a steady decline all the way down to 21% in 2019.

There are some key reasons why feedyards have willingly moved away from selling on a negotiated cash basis, including:

Taking advantage of value-added opportunities including quality grids and/or specialized program cattle (e.g. NHTC).

Facilitation of more consistent and synchronized throughput, improving overall feedyard efficiency.

Avoidance of the weekly negotiation, thereby escaping the time and hassle commitment and enable management/administrative focus on other matters of importance.

Enhanced ability to implement disciplined risk management strategies.

Conversely, those advocating for greater cash trade argue that alternative marketing arrangements and reduced cash trade have led the industry down the wrong path by:

Artificially depressed prices

Lower feedyard profits

Inflated packer profits

If these three points are consequential, then the feeding sector would be unduly disadvantaged and there’d be inherent structural change over time.

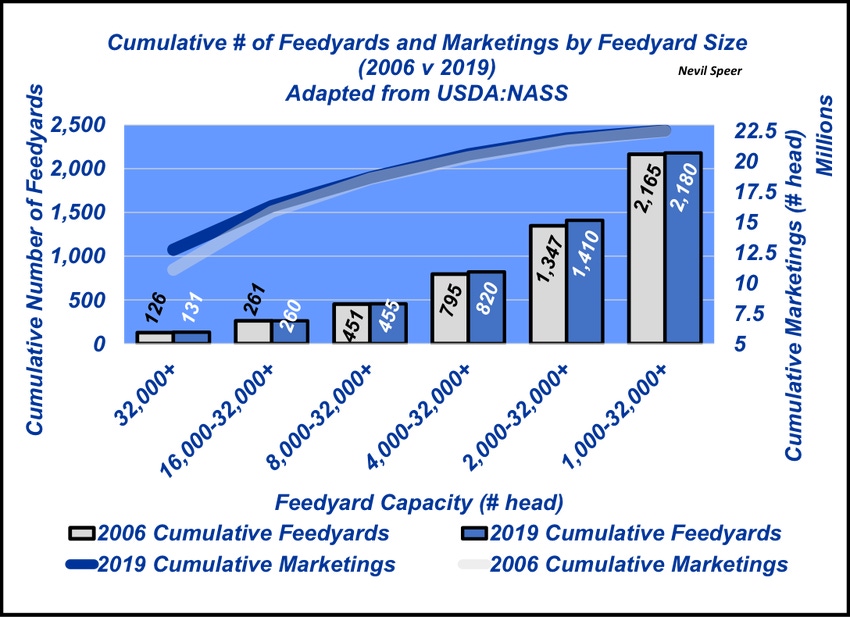

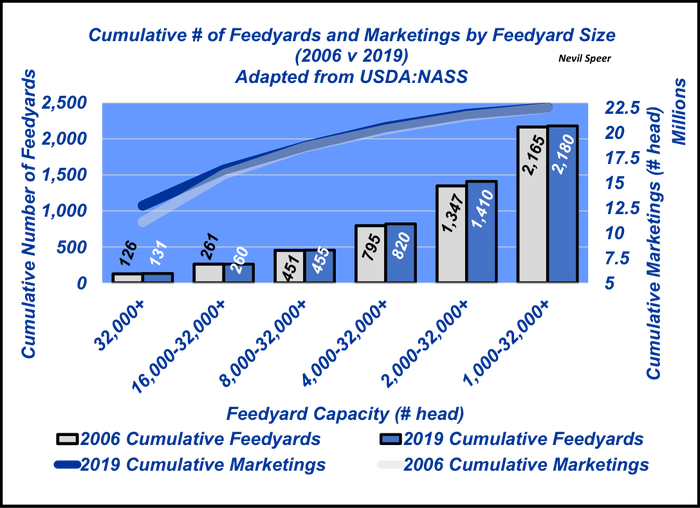

This week’s graph addresses those concerns. The illustration outlines the relative composition of, and subsequent marketings in, the feeding sector – comparing 2019 vs. 2006, the last year cash trade equaled 50%. The data are presented according to USDA categorizations in 2006. The agency now provides additional granularity – but is easily translated to make the year-over-year comparison.

Bottom line: Market share by feedyard size hasn’t changed since 2006. The relative number of operations by size and subsequent marketings in 2019 is essentially identical to 2006. Certainly, there’s been a shift in ownership across some key feeding entities over time, but nevertheless, the same number of feedyards are still operating, at relatively the same size and contributing to the overall supply at the same pace they were in 2006.

Simultaneously, amidst this discussion, it’s useful to look at several other key indicators that provide further context with respect to the feeding sector. Two items are of special importance in terms of the broader story:

Risk management: There’s an ever-increasing number of cattle feeders utilizing risk management – they’ve increasingly traded price risk for basis risk and remained more competitive – especially in the face of severe black swan events.

Feedyard revenue: Becoming more consumer oriented has improved beef demand (domestic and international) and subsequent consumer spending. That’s made more dollars available to the production sector. Revenue growth facilitates new opportunities for individual businesses in any business. Stagnant, commodity-oriented industries don’t provide those opportunities.

All industries evolve over time or else become obsolete. The beef industry’s evolution during the past 20 years is a significant case study in business. The industry managed to move away from a commodity mindset: That meant implementing more cooperation, better synchronization and increased responsiveness to consumers.

The outcome being greater competitiveness in the marketplace and evolution of new opportunities for cattle feeders and all beef producers along the way. Lest we forget the period between 1980 and 1998 when that wasn’t happening—beef spending grew by only $6 per person over the span of 18 years – while pork and poultry grew by $110.

Undoubtedly, the current situation is very challenging. However, as noted last week, “…turning back the clock won’t rectify the current challenges due to COVID. To the contrary, that’s an exercise of missing the forest for the trees.”

Nevil Speer is based in Bowling Green, Ky. and serves as director of industry relations for Where Food Comes From (WFCF). The views and opinions expressed herein do not necessarily reflect those of WFCF or its shareholders. He can be reached at [email protected]. The opinions of the author are not necessarily those of beefmagazine.com or Farm Progress.

About the Author(s)

You May Also Like