Beef export markets continue to change

A look at beef exports over the past five years.

April 12, 2021

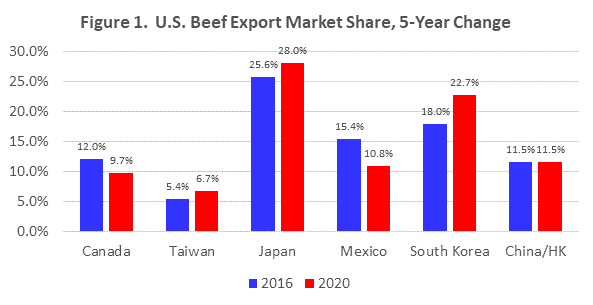

Beef exports have evolved significantly in recent years in a very dynamic environment of global politics and trade policies; direct and indirect impacts of animal disease outbreaks; and growing beef preferences and consumption. Compared to five years ago, total beef exports in 2020 were up by 15.6 percent over 2016. Total U.S. beef exports dropped 4.2 percent year over year in 2019 from the all-time peak level in 2018 with decreased exports to most major export destinations. The COVID-19 pandemic significantly disrupted global beef trade in 2020. Total beef exports dropped a further 2.3 percent year over year in 2020 as a result of the pandemic. Thus far in 2021, the two-month total of beef exports for January and February is down 1.1 percent year over year. However, total annual beef exports for 2021 are forecast to increase modestly over last year. Figure 1 shows the market share of beef exports to major destinations in 2016 and 2020.

Japan has been the largest U.S. beef export market since 2013 (and was for many years prior to 2004) with the 2020 market share at 28 percent of total exports. Beef exports to Japan grew at an average rate of 9.7 percent annually from 2016 to 2020 with peak exports in 2018 and a decrease in 2019 before rebounding modestly in 2020, despite pandemic disruptions. In the first two months of 2021, beef exports to Japan are down 11.5 percent year over year.

South Korea has been the fastest and most consistently growing major U.S. beef export market in recent years. South Korea became the second largest beef export market in 2016, moving ahead of both Canada and Mexico. Beef exports to South Korea have increased by an average of 17.4 percent in the last five years, pushing the country to a nearly 23 percent market share in 2020, just behind Japan. In fact, in the first two months of 2021, beef exports to South Korea are up 15.1 percent year over year pushing South Korea just ahead of Japan as the number one beef export market so far this year.

The combined China/Hong Kong market is the third largest U.S. beef export market. Though the data is reported separately, it is important to look at the net total since the two really represent a single market. Reported separately, Hong Kong has been a major export market for U.S. for more than a decade. However, it has been recognized for a number of years that some of the exports to Hong Kong were ultimately transshipped into China. It was expected that, as exports to China began to grow, some of the increase would likely offset decreased exports to Hong Kong. Exports to China began at a very slow pace following access in 2017. Only in 2020 did beef exports to China jump sharply and, as expected, exports to Hong Kong have decreased. The market share of beef exports to China/HK was 11.5 percent in 2020; the same as in 2016. However, in 2020, the total included 35 percent exports to China with the balance to Hong Kong; compared to 2016 when 100 percent of the exports were to Hong Kong. In the first two months of 2021, the China portion of the China/HK market is up 998 percent year over year while Hong Kong is down 18.3 percent with the China portion making up 67 percent of the two-month total. Total exports to China/HK in January and February 2021 are up 115 percent year over year.

Mexico is currently the third largest U.S. beef export market. Mexico’s economy has taken a serious hit since the last federal election and, combined with the pandemic impacts the past year, resulted in a 24.7 percent year over year decrease in beef exports in 2020. As recently as 2019, Mexico was the number two beef export market with a 14 percent market share. Recovery of beef exports to Mexico is likely to be slow with limited chances for improvement in 2021.

Beef exports to Canada have decreased an average of 2.3 percent annually in the last five years dropping the country to the number five beef export market currently. The market share of beef exports to Canada has declined from 12 percent to less than 10 percent (Figure 1) from 2016 to 2020. In the first two months of 2021, beef exports to Canada are down 7.5 percent year over year and the country has an 8.9 percent share of total exports thus far in the year.

Beef exports to Taiwan have increased an average of 13.5 percent annually since 2016, increasing the country’s market share to 6.7 percent in 2020 (Figure 1). However, total beef exports to Taiwan were essentially unchanged in 2020 compared to the previous year and are down 23.8 percent in the first two months of 2021.

Source: Oklahoma State Universityl, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)