History repeated? Beef leads pork/poultry in consumer spending

Domestic and international beef demand are essential for producer profitability.

July 9, 2020

Given some recent industry commentary, it’s valuable to hone in on the historical perspective of beef’s place in the market relative to its competition. Specifically, lessons learned going into the new millennium are enduringly valuable; indeed, those who don’t learn from history are doomed to repeat it. Unfortunately, current noise around the market makes it easy to score political points and that is inherently distractive from the long game.

The industry commentary mentioned above opens with the following declaration, “For the past three decades the packer-controlled U.S. beef industry has conditioned America’s cattle producers to focus exclusively on beef demand and opening new export markets.” The implication being that investment into growing beef demand (i.e. Beef Checkoff) has been flawed strategy.

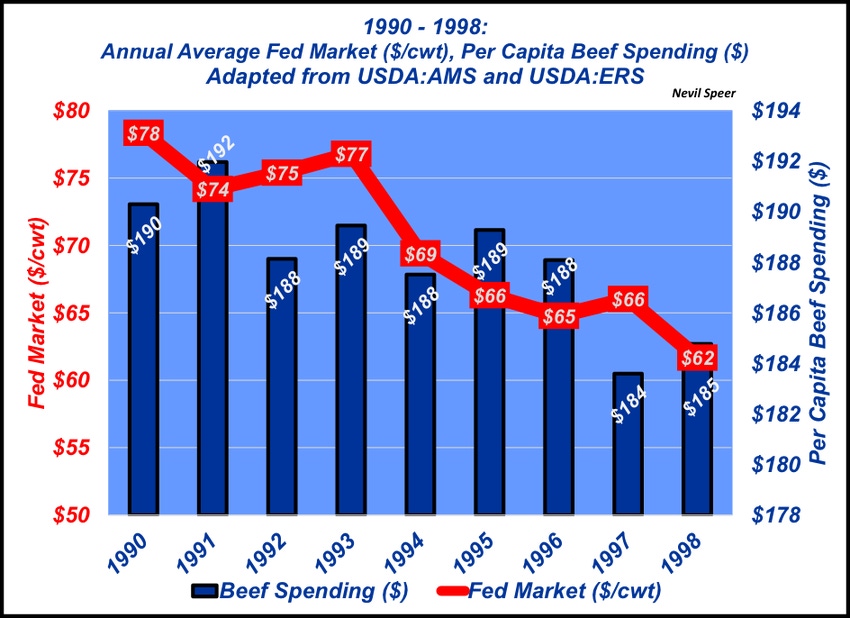

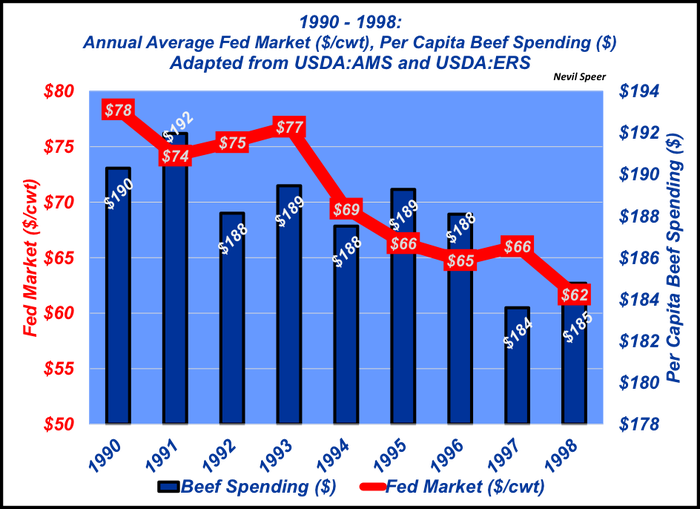

This week’s illustration addresses that perspective, with focus on the first part of three decades mentioned in the commentary. The graph outlines annual consumer beef spending and average fed market between 1990 and 1998. Beef demand was eroding while the competition was gaining market share.

Beef spending declined $7 from the ’91 peak while pork and poultry grew their business by more than $35 per capita in new spending during the eight-year period.

The beef industry had to respond or else face becoming irrelevant in the protein market. So, the industry got to work and established a remarkable turnaround. Research, education and promotion has been a game-changer: beef’s quality and consistency, along with consumer awareness and favorability ratings, are better than ever. And as noted last week, “…beef has gained market share…and demonstrated its ability to successfully capture new spending at an increasing rate.”

Perhaps the best indicator of what better demand means to the business is represented by producers themselves. Beef cow inventory in 2019 was pegged at nearly 31.7 million head. That means since the drought-induced liquidation of 2012 and 2013, the cow-calf sector added nearly 2.75 million head.

That’s equivalent to inventory growth of nearly 9.5% over a five-year period, sufficient time to mark real intentionality. Expansion of that magnitude hasn’t occurred since the early ‘70s. And it has occurred in an era of historically high capital investment in terms of both cows and ensuing operating costs.

Jim Collins’ great book, Built to Last, outlines key principles for long-term success: in a world of constant change, successful companies and industries manage to, “preserve the core” while at the same time work to “stimulate progress” along the way.

That sort of commitment is vital to maintaining and growing final demand – customers voting with their dollars. In the end, it’s the only measure of business success that matters.

Nevil Speer is based in Bowling Green, Ky. and serves as director of industry relations for Where Food Comes From (WFCF). The views and opinions expressed herein do not necessarily reflect those of WFCF or its shareholders. He can be reached at [email protected]. The opinions of the author are not necessarily those of beefmagazine.com or Farm Progress.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)