Fire fight: Negotiated cash trade and price discovery

The fed cattle market cratered and then rebounded sharply in the aftermath of the Tyson fire. What does that tell us?

January 21, 2020

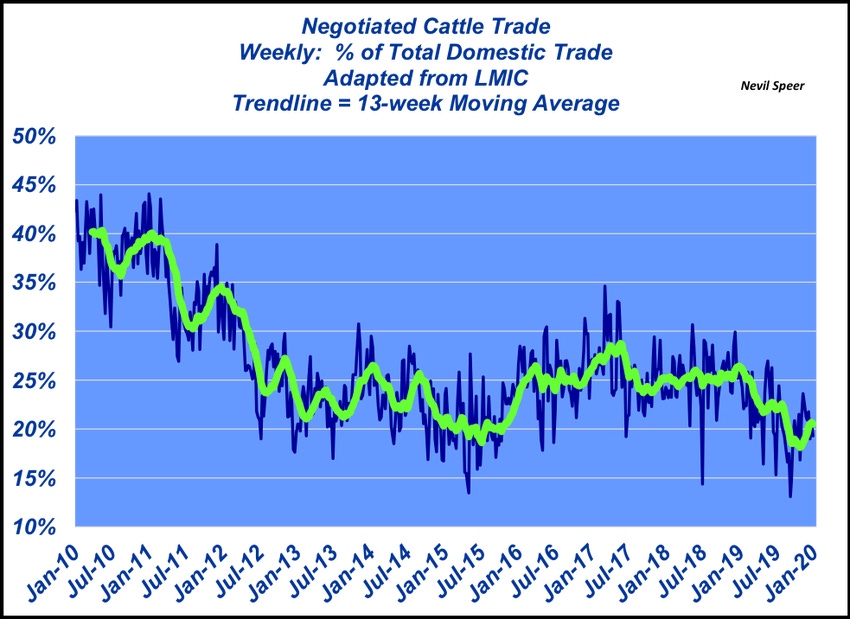

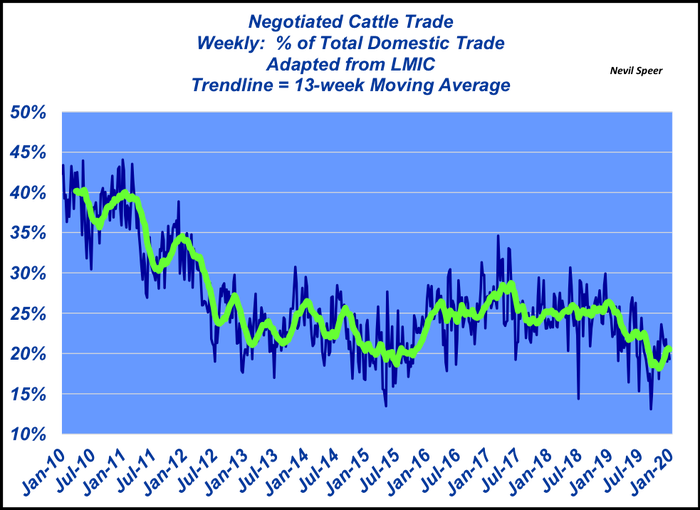

The fire at Tyson’s Holcomb, Neb. beef plant last summer renewed interest around price discovery and the cash market. Watching the market plunge to $100 over the span of just a few weeks heightened concerns in some circles about the general structure of weekly negotiations, or lack thereof. Those concerns were further compounded when cash trade plunged to just 13% of total volume in early September.

Since then, negotiated cash trade peaked to just 23% of all trade in early November but has hovered right around 20% through late 2019.

For more context, this week’s graph highlights weekly negotiated cattle as a percent of total domestic trade—i.e. cash trade. It represents the percentage of cattle traded on a weekly basis that are subject to actual packer-feeder negotiation. The remainder of the cattle not sold on a cash trade basis would be sold on some sort of grid, formula or forward pricing arrangement.

Seemingly, during the past three years, the industry has found somewhat of an equilibrium where cash trade represents roughly one-fourth of all cattle traded on a weekly basis, with the exception of the recent trend.

When markets begin to trade in a negative fashion, price discovery always comes to the forefront. There’s a general perception that thin cash trade inevitably causes softer prices, thereby benefitting the packer. And that trepidation was especially evident this fall as packer margins reached all-time record levels.

With that in mind, it’s also important to point out it’s challenging to establish a direct relationship between negotiated trade and the ensuing fed price. For example, despite very thin cash markets during the past four months, the market has made an incredible recovery; through December, fed prices tacked on $25 in just 15 weeks – and completely reversed the packer margin trend.

One of the most important aspects through the fall has been the beef industry’s ability to stay current. Closure of the Holcomb plant could have proved catastrophic, but instead, the feeding sector managed to avoid an inordinate backlog of market-ready cattle.

That’s partly the result of feedyards remaining disciplined in their marketings. That discipline is largely driven by pre-arranged contracts and formula arrangements.

Nevil Speer serves as an industry consultant and is based in Bowling Green, KY. Contact him at [email protected].

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)