Hedged cattle win, again

Two recent “black swan” events have proven the value of a hedge.

April 8, 2020

The beef industry has had to absorb a one-two punch the past year. First there was the disruption caused by the fire at Tyson’s Holcomb plant. And now the markets are reeling from fallout due to COVID-19. In both cases, the market reaction underscores the importance of risk management.

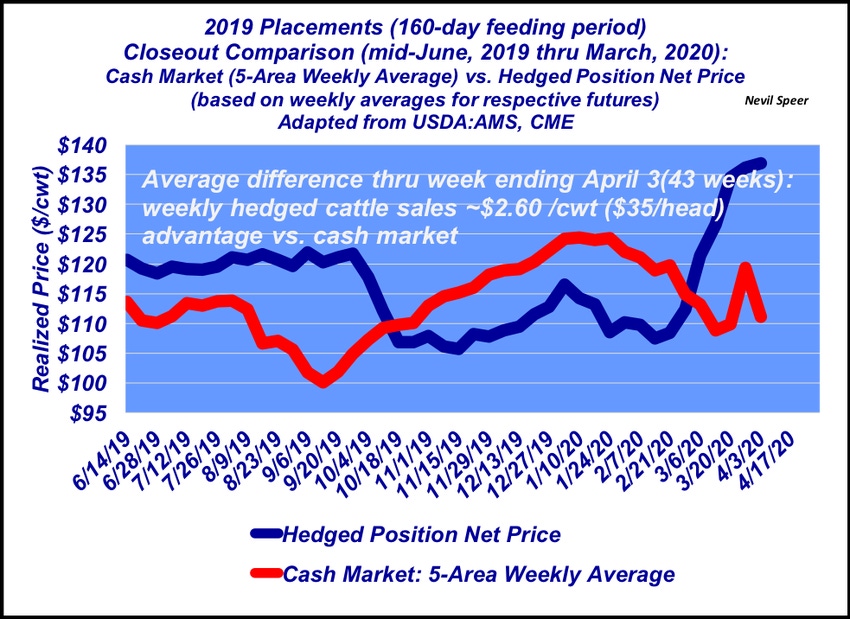

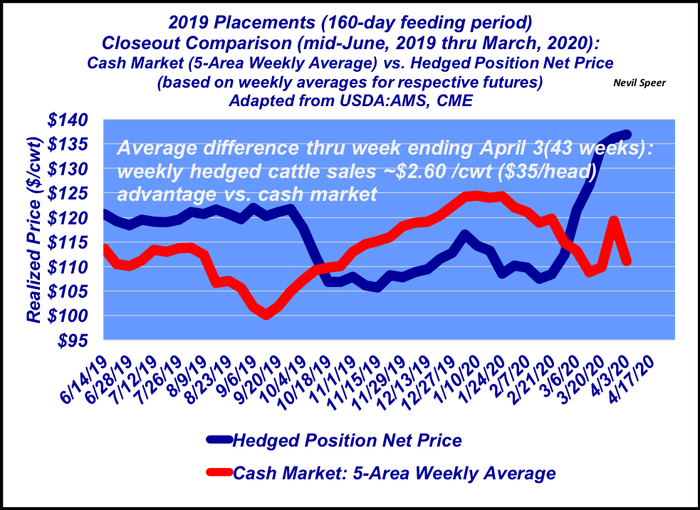

Following the fire, this column provided a look at the net difference between the cash market versus systematic hedging. The discussion was based on placements made beginning in 2019 and were hedged at time of placement, independent of whether the hedge was profitable or not. Those placements began to be marketed in mid-June.

We’re now 43 weeks into the marketing of 2019 placements. This week’s illustration is an update of last fall’s cash-versus-hedged comparison. Clearly, there’s been some ebb and flow along the way. But bottom line, over that time, the hedged cattle possess an advantage of about $35 per head, based on a 1,350-pound steer.

That’s a significant number. Assuming a feedyard with just 10,000 head capacity markets about 400 head per week, that $35 per head adds up quickly! It represents an additional $14,000 per week. Over the course of 43 weeks, the hedger would have generated $602,000 more revenue versus the cash seller.

Unfortunately, there are some industry observers who are critical of those feedyards who utilize risk management. One recent discussion noted they were, “…what’s wrong with this industry…they have no care what the price of cattle is…they’re hedging those cattle all the way…they’re ruining this industry.”

But isn’t that the point of hedging – to be buffered against sharp declines in the cash market? In fact, futures and options have proven critical to facilitating resilience against these two unforeseen events that have hit the business back to back. It’s hard to understand why anyone would argue utilizing risk management works to the detriment of the industry.

To the contrary, as noted last fall, utilization of such, “….highlights the value of risk management when unexpected black swan events occur (e.g. plant fires) – the hedged cattle aren’t affected by sharp downturns in the market…Clearly, that has huge implications for the entire feeding sector. And that value difference will ultimately translate back upstream to backgrounders and cow/calf operators. In other words, risk management is an invaluable tool that possesses implications for the entire industry.”

Please leave your thoughts in the comments section below.

Nevil Speer is based in Bowling Green, Ky. and serves as director of industry relations for Where Food Comes From (WFCF). The views and opinions expressed herein do not necessarily reflect those of WFCF or its shareholders. He can be reached at [email protected]. The opinions of the author are not necessarily those of beefmagazine.com or Farm Progress.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)