- Calving

- Farm Business Management

- Cow Calf Operation

- Cattle Market Outlook

- Livestock Management

- Cattle Pricing

2018 heifer calves could become your most profitable cows

Will a heifer calf born in 2018 become, along with her herdmates, the most profitable cow in your herd? An analysis of past and present cattle cycles suggests this could be the case.

July 30, 2018

Last month, we looked at the production trends during the first seven years of the current cattle cycle for four different states. The general conclusion was that production did not change much during the first seven years of the current cattle cycle. I concluded that ranchers, on the aggregate, did not change their production systems much during, or as a result of, the cattle cycle.

This month, let’s look at some economic performance factors over the first seven years of the current cattle cycle. Again, this article is based around the farm business management data from four states — North Dakota, Nebraska, Minnesota and Utah. The focus here will be on the combined economic summary of beef cow herds from these states.

Remember, this data is not presented as being representative of these four states. Rather, it is the summary of 1,766 herd-years of data in the database from these states from 2009 through 2015. The data source is the FINBIN database of the University of Minnesota.

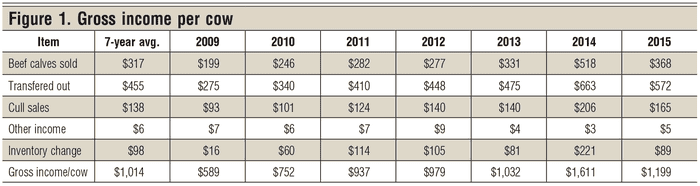

Gross income per cow: When you group producers, gross income per cow becomes the sum of several different income categories. Some ranchers sell their calves at weaning, while other ranchers’ calves are transferred to backgrounding and/or retained ownership enterprises. Some calves are also transferred to heifer development enterprises. These cow herds are all credited with the market value of the weaned calves produced, regardless of how the final calves are marketed.

These herds also receive income from cull cow sales and cull bull sales. We also have a very small “other” catchall income category. Finally, an inventory change value is included, as some ranchers are building their breeding herds and others are reducing their breeding herds. Annual inventory changes in cow numbers can be positive or negative, depending on that year’s specific herd management programs.

Figure 1 presents the combined gross income summary for the study herds over the seven-year period of 2009-15. The seven-year average annual gross income per cow for these four states from 2009 through 2015 was $1,014 per cow. The lowest gross income was in 2009, and the peak gross income was in 2014. Gross income increased every year for the first six years of the current price cycle.

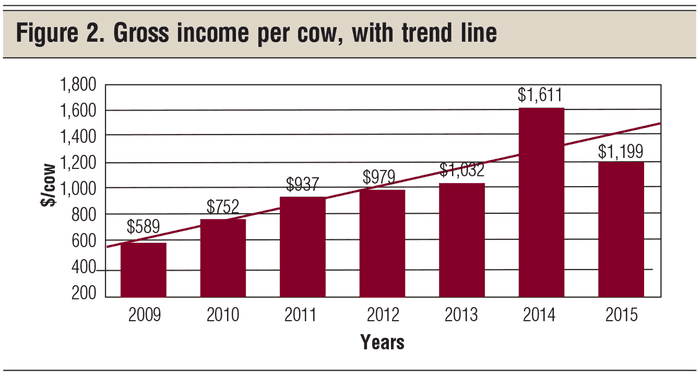

The statistical trend in gross income over these seven years was a plus $130 per year (Figure 2); however, gross income in 2014 was far above the trend line. Ranchers will not experience many 2014s in a lifetime — at best they could experience one such year during each cattle cycle, and maybe they will experience three cattle cycles in a lifetime.

Probably more important is that calf prices trended upward from the low of the last cattle cycle (2008) through the peak of the current cycle (2014) (see Figure 2). A productive cow during this time period increased her generated gross income in each year of this phase of the cattle cycle. This increase in gross income halted in 2015 as we entered the downward phase of the current beef price cycle.

In general, we can expect an upward phase and a downward phase of the same beef price cycle. Year 2009 marked the beginning, year 2014 marked the top, and year 2015 marked the beginning of the downward phase in the current beef price cycle. Projections are that the downward trend could continue into 2019.

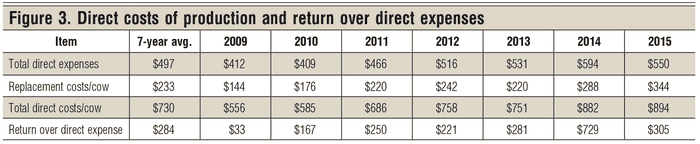

Direct costs of production: Direct costs of production include raised feed (valued at market price); costs for protein, minerals and pasture (at rental rates); breeding fees; veterinary; supplies; fuel and oil; repairs; hired labor; custom hire; livestock leases; and operating interest. Herd replacement costs, including bull replacements, are also included. Figure 3 presents the four-state combined direct costs with a seven-year average and an average for each of the seven individual years.

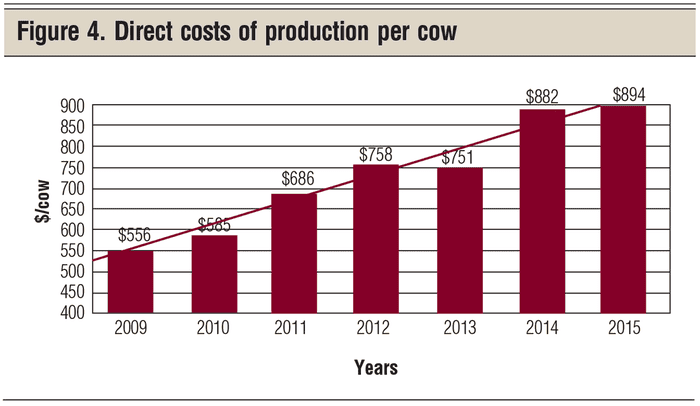

The seven-year average direct costs of production for all study herds was $730 per cow. Again, the direct cost trend is more informative than the seven-year average (see Figure 4). The statistical trend for cost of production increased an average of $60 per year over this seven-year period. Some of the increased gross income over these years went for increased costs. Direct costs of production actually peaked in 2015 at $894 per cow.

Note that replacement costs of cows and bulls also peaked in 2015. I wonder how many new beef herds were started in 2015 as a result of the high calf prices in 2014?

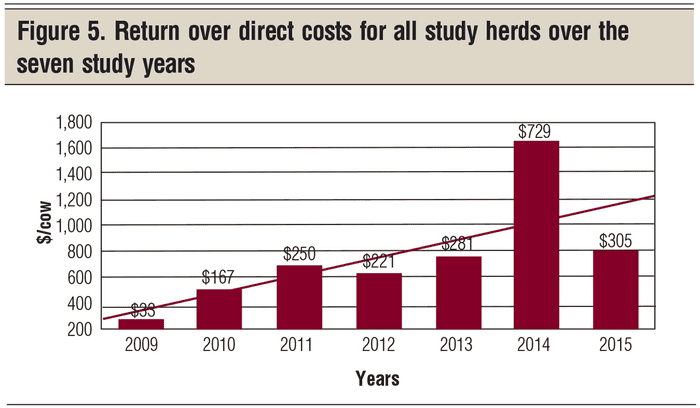

The seven-year average return over direct costs was $284 per cow. The seven-year trend was a positive $70 per cow per year. As you would guess, 2014 was by far the peak year, with a $729 average return over direct costs per cow (see Figure 5).

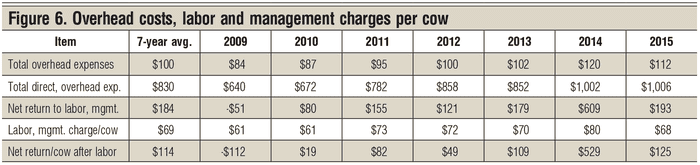

Overhead costs, labor and management charge: Space limitations require that I quickly summarize overhead expenses, labor and management costs, and get to the implications of the bottom line of these beef cow herds.

Overhead expenses include hired labor, farm insurance, utilities, interest, machine and building depreciation, and miscellaneous costs. The seven-year average overhead expenses for these herds was $100 per cow. The seven-year total direct and overhead expenses came to $830 per cow (see Figure 6).

After deducting the direct and overhead expenses, the earned net return to labor and management for the seven years averaged $184 per cow per year. After a seven-year average labor and management charge of $69 per cow, net returns per cow after the labor and management change generated a seven-year average of $114 per cow.

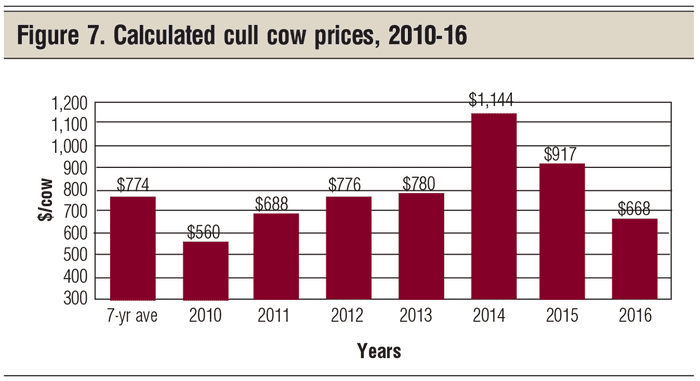

The largest bottom-line number for these beef cow herds is the $529 per cow for 2014. Cull cow income accounted for $206 of this average return over direct costs in 2014. I calculate that cull cows sold in 2014 for more than $1,100 (see Figure 7)! The cull cow price at the time a cow ends her productive lifetime is very critical to that beef cow’s lifetime earned net income.

Economic value of a beef cow: The economic value of a beef cow in any rancher’s herd is the sum of her annual earned net returns after the labor and management generated from all of her lifetime calves produced while in that herd, plus her cull value when sold from the herd.

Let’s look at one particular cow. It turns out that a cow culled in 2014 became quite a profitable cow. Why? She produced several relatively high-priced calves, and then brought a premium as a cull cow! She had a seven-year productive life span: She was born in 2006, developed in 2007 and produced her first calf in 2008. During her productive lifetime, weaned calf prices generally went up from $116 per cwt in her early productive life to $245 per cwt in 2014. I suggest that this will be the most profitable beef cow in the current cattle cycle.

Now for the key point of this article: Are we about to duplicate this again if the next price cycle peaks in 2026? If so, this could be a heifer calf born in 2018!

Hughes is a North Dakota State University professor emeritus. He lives in Kuna, Idaho. Reach him at 701-238-9607 or [email protected].

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)