As the cycle turns: Heifer retention rates hit the skids

Beef cow slaughter is an important aspect to monitor. In the absence of major drought or other type of forced liquidation, it’s an important indicator of producer sentiment about the business.

November 25, 2019

Last week’s Industry At A Glance highlighted year-to-date beef cow slaughter amidst some historical perspective. All that as an attempt to provide some context with respect to next year’s starting beef cow inventory. As quick review, through October, cow slaughter is nearly on pace with last year and tracking towards a full-year total of around 9.6% of the starting beef cow inventory.

Beef cow slaughter is an important aspect to monitor. In the absence of major drought or other type of forced liquidation, it’s an important indicator of producer sentiment about the business. Meanwhile, equally important in determining the size of next year’s cowherd comes on the heifer side.

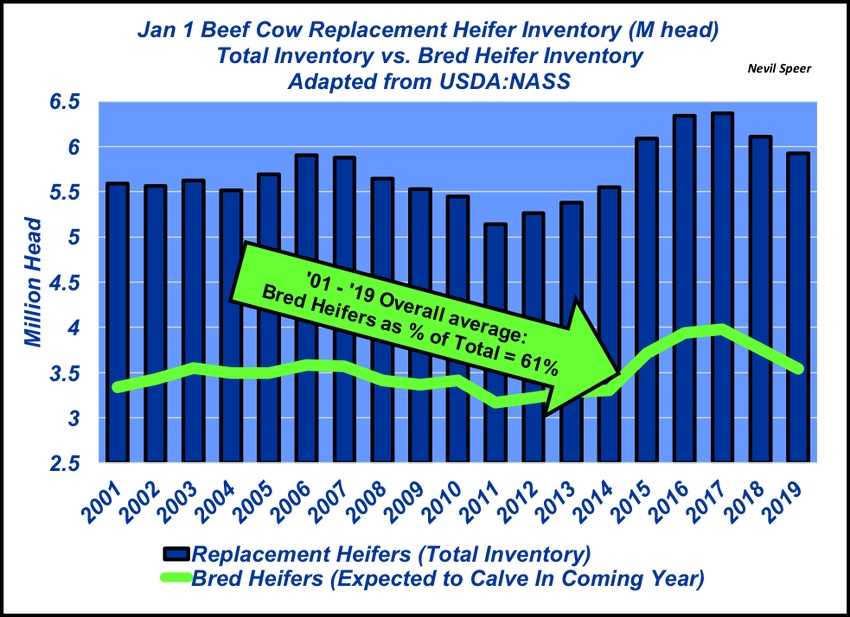

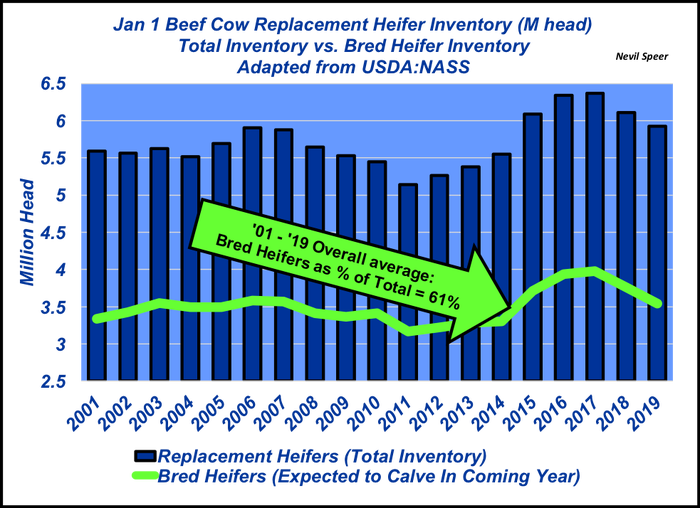

The numbers are often reported as a bulk total – that is, replacement heifers being retained. Generally, the reported number includes both open and bred heifers. However, the most important statistic is a subset of the data are heifers being held “expected to calve in coming year” (i.e. bred heifers). The distinction is important. The bred heifer component is the subset that becomes next year’s “beef cows that have calved.”

This week’s graph provides a historical overview since 2001 – the first year in which USDA provided some granularity and separately reported the inventory of bred heifers. Last year’s Jan. 1 totals equaled 5.925 million and 3.544 million head for total and bred heifers, respectively.

For some perspective, during the last five years, total heifer inventory has averaged 6.166 million head, while bred heifer inventory averaged 3.787 million head. Accordingly, it is clear producers are turning down the heifer retention rate. That’s further supported by this year’s heifer slaughter rate.

As noted last week, the beef industry has witnessed five straight years of expansion since the 2014 low of 28.966 million cows. Will 2019 be the turn-around year? A 2019 slowdown in bred heifer retention along with potential uptick in cow slaughter in the last few months of the year could result in a smaller cowherd. What’s your take with the size of the starting cowherd in 2020?

Speer serves as an industry consultant and is based in Bowling Green, Ky. Contact him at [email protected]

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)