Class is back in session. Let's learn about open interest and how long and short positions work.

June 20, 2019

There’s often lots of misunderstanding around futures markets. For that reason, during the past several weeks, Industry At A Glance has been highlighting some basic principles around using futures and options contracts for hedging purposes, primarily from the cattle feeding perspective simply for example’s sake.

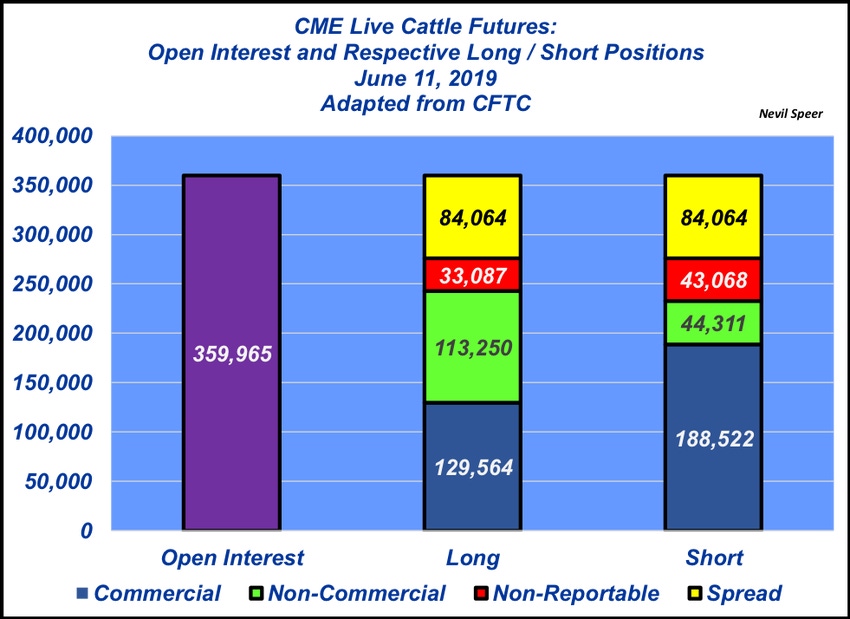

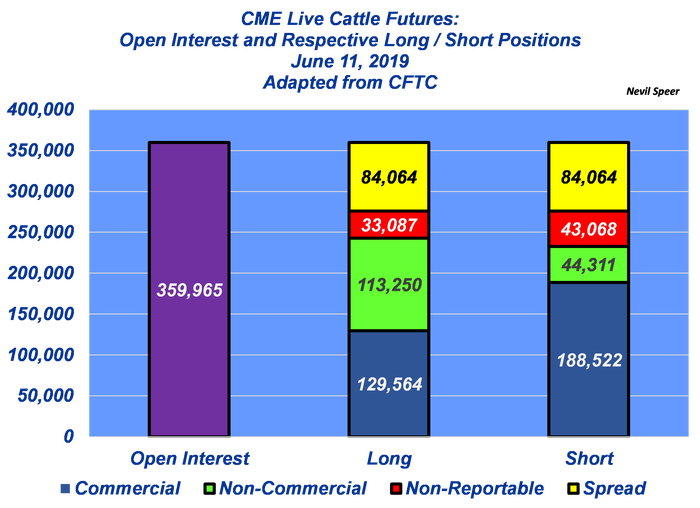

This week’s illustration highlights the differences between open interest and relative positions among the various classes of traders – that is, it delineates a weekly snapshot of aggregated positions among the respective stakeholders.

A couple of definitions are important to provide some context around the graph:

Open interest: Total number of outstanding futures contracts for a given commodity (ex. Live cattle)

Long: An initial buy position (obligation to accept delivery)

Short: An initial sell position (obligation to make delivery)

Speculator: Entity assuming price to potentially profit from price change (non-commercial)

Hedger: Entity using futures/options market to manage price risk (commercial)

Spread: Simultaneous purchase of one contract and sale of a separate contract

Non-reportable: Traders who fall below the specified CFTC threshold for individual reporting.

Live cattle futures open interest on June 11 was 359,965 contracts. Note the total of long positions exactly match the short positions: For every buyer there must be a seller, and vice versa.

To that end, there’s no limit to the number of contracts that can be traded – as long as there’s a willing buyer to match with a willing seller (and vice-versa). That’s an important concept and represents a fundamental difference from the equity market in which market participants buy and sell a finite number of shares for a given company.

However, the make-up of those futures positions won’t necessarily be the same. For example, commercial traders (hedgers) were long 129,564 contracts versus being short 188,522 contracts. Meanwhile, non-commercial traders (speculators) were long 113,250 contracts but short just 44,311 contracts. As a side note, the spread positions will always match – by definition, spreading entails the simultaneous purchase of one contract and sale of a separate contract.

These reports are updated weekly by the Commodity Futures Trading Commission for all commodities. You can access them by navigating to the Commitments of Traders tab on the CFTC website. Additionally, CFTC also publishes a disaggregated report providing greater detail among respective stakeholders – including delineation of positions held by “managed money” (i.e. fund positions). Next week we’ll look at how aggregate positions change over time and the inferences that follow.

About the Author(s)

You May Also Like