Feeder and stocker cattle marketing venues

Should feeder cattle buyers and subsequently sellers be subject to cash marketing legislation similar to what’s being proposed on the fed side of the business?

August 6, 2020

As some background, the proposed 50/14 legislation is meant to increase weekly negotiation in the fed market – requiring each respective processing facility (over 125,000 head annual capacity) to purchase at least 50% of its weekly kill based on a negotiated spot price. The thought is that greater cash sales would subsequently mean reduced alternative marketing arrangements (AMAs) in the fed market.

There are several key reasons why feedyards have willingly moved away from selling on a negotiated cash basis over time and moved towards greater utilization of AMAs. One of the most important being the avoidance of time, hassle and cost associated with weekly negotiation.

With that in mind, let’s turn our attention to the feeder market. It’s impossible to exactly pinpoint the manner in which all stocker and feeder cattle are marketed in any given year. Nevertheless, analysis of feeder cattle receipts by venue, coupled with some additional calculations, help provide some longer-run trends.

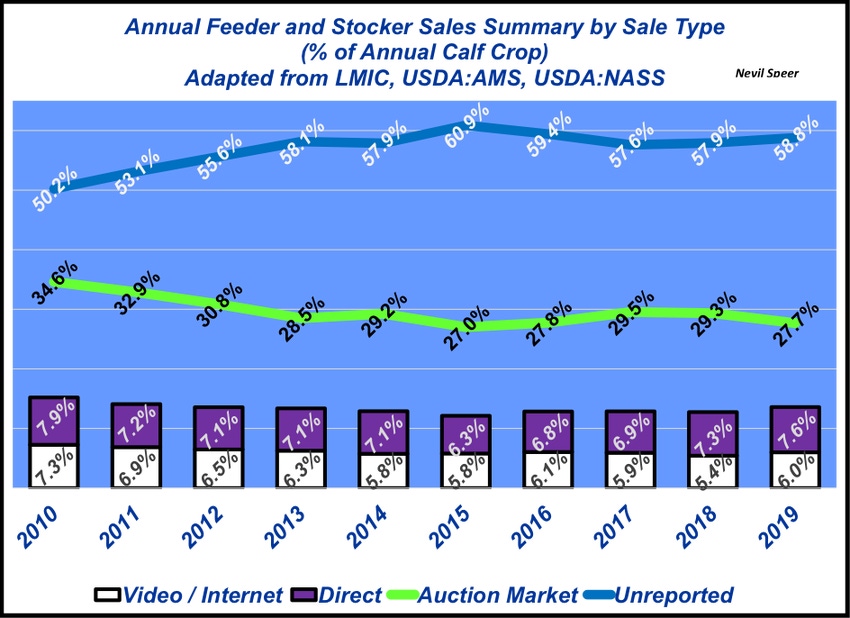

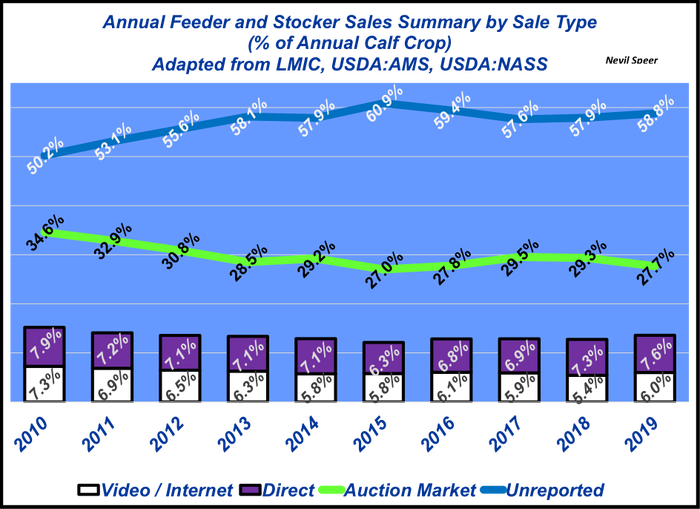

This week’s graph represents relative feeder and stocker cattle sales by sale type. The figures are representative of total receipts by marketing venue reported by USDA. Unreported sales (direct or auction) reflect the remainder of the estimated calf crop. What’s most important are the trends:

The proportion of cattle marketed through either direct channels or video/internet sales have remained relatively steady during the past 10 years.

The biggest change comes via declining auction market sales.

A greater segment of the feeder population is being sold and going unreported versus 10 years ago.

Last, it should be noted that direct sales don’t necessarily represent straight-up cash negotiation – they can occur based upon some sort of pre-arranged formula and/or pricing agreement. Direct sales that are reported all occur on a voluntary basis.

Nevertheless, based on the trends above, feeder/stocker cattle sellers are increasingly selling their cattle outside normal reporting venues – namely unreported direct sales now approaching 60%. They do so primarily for the same reasons feedyards choose to sell cattle through AMAs: avoidance of cost, time, and/or hassle associated with other marketing venues.

Has your marketing venue changed during the past 10 years? Or perhaps your neighbor? Should feeder cattle buyers and subsequently sellers be subject to cash marketing legislation similar to what’s being proposed on the fed side of the business?

Nevil Speer is based in Bowling Green, Ky. and serves as director of industry relations for Where Food Comes From (WFCF). The views and opinions expressed herein do not necessarily reflect those of WFCF or its shareholders. He can be reached at [email protected]. The opinions of the author are not necessarily those of beefmagazine.com or Farm Progress.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)