Fed cattle market enters the year on strong legs

Undoubtedly, 2019 was an important year, but there are 6 key takeaways that should provide some direction heading into the New Year.

January 9, 2020

Everyone likes markets that work to the upside—even the margin operators always seem to feel better when prices are trending higher. And so, at least for now, the markets have everyone feeling optimistic about 2020; the year is off to a good start and picking up right where 2019 left off.

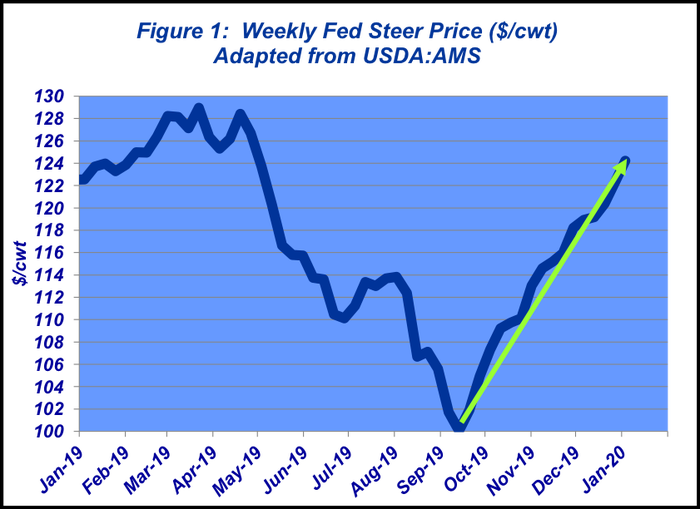

Ever since the low of mid-September (~$100 per cwt), the fed market has gained ground and scored better prices over the previous week. The bulk of business just ahead of Christmas ended at mostly $122.

And then, somewhat unexpectedly, fed prices tacked on another $2-3 in the final week of the year—all while boxed beef prices were trending seasonally softer. Based on that level of trade following Christmas, the market has tacked on roughly $25 over the course of about 15 weeks (Figure 1).

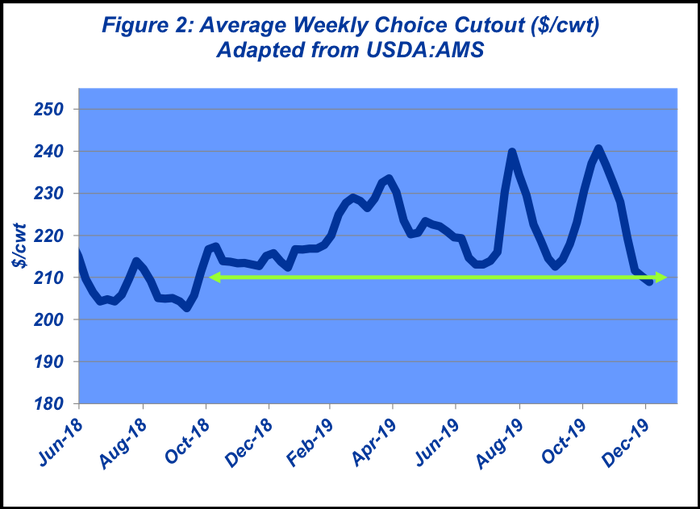

As noted, the wholesale market has been seasonally stagnant during the past month. Once the out-front holiday purchasing was completed, beef prices were subject to downward pressure.

Accordingly, the Choice weekly cutout slipped from $240 in mid-November back to ~$210. That’s especially important on the live side: Fed prices trended higher against negative pressure on the wholesale side. But there’s also an important component on the cutout side: The wholesale market has seemingly built a solid base of support right around the $210 mark (Figure 2).

To that end, once we fully get back to routine, wholesale prices should begin to improve and trend seasonally higher into the spring. That will help underpin fed cattle prices along the way. CME’s April live cattle contract bumped up near $129 in mid-December and is seemingly poised for a stab at $130 or better as spring progresses.

Give and take

That said, price runs like we’ve witnessed over the past several months often portend some sort of correction. Therefore, don’t be surprised if there’s some give and take along the way. That’s especially true in light of current feedyard inventories.

This biggest risk for the fed market comes on the supply side. USDA’s December Cattle on Feed report marked the largest inventory of cattle on feed 120 days or more —3.73 million head —surpassing last year’s record of 3.63 million head and 12% bigger than the five-year average. Moreover, total inventory was pegged at 12.03 million head—2% more than 2019 and 8% bigger than the five-year average.

Despite the positive trend of late, the supply component will need to be monitored carefully in the next few months; cattle feeders need to remain active marketers to maintain their current leverage.

Undoubtedly, 2019 was an important year but there are some key takeaways that should provide some direction heading into the New Year.

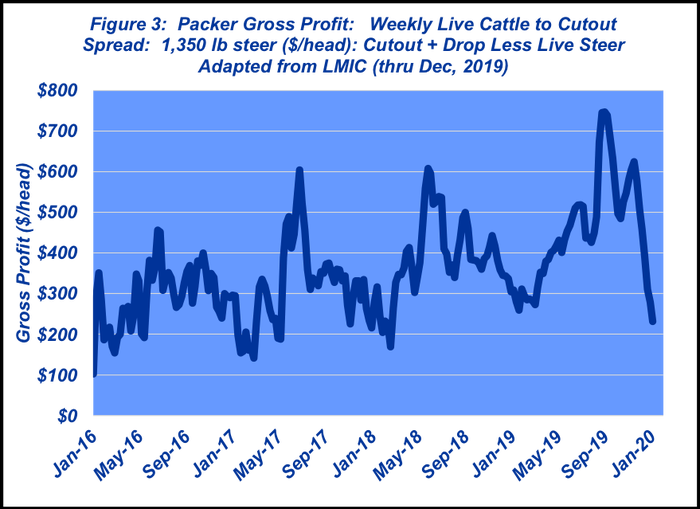

Resilience/collusion/emotion: Despite all rhetoric that occurred in 2019 following the Tyson fire, the beef business has proven highly resilient. There was lots of attention on packer gross margins at the time, but there’s been very little attention from those same critics on the current status of the market.

As the beef business shuffled around in dealing with a non-normal, the disparity between the live and fed markets widened, understandably so. But all hype about fair cattle markets and stealin’ and collusion has been remarkably silent in recent months once the trend reversed (Figure 3).

Cow slaughter: There has also been lots of discussion in the media regarding cow slaughter. And the final numbers remain to be seen. However, through November, beef cow liquidation was only 119,000 head bigger than 2018.

That number needs to be kept in perspective. As a percentage of 31-plus million beef cows in the U.S., it’s likely the 2020 starting beef cow inventory will be something similar (pragmatically speaking) to what we’ve seen during the past several years.

Economy: By all indications, the economy continues to run along without any major signs of slowdown and/or recession. Of course, as indicated by events in recent days, that’s all subject to change with any major geopolitical event. But in the absence of such disruption, analysts and investors are planning on solid economic growth in 2020. In the face of those prospects, beef spending on the consumer side should remain supportive for the cattle market.

Beef quality: Improved beef quality has been critical to the market’s ability to return to normalcy following the August Holcomb fire. It’s the key factor that underpins the industry’s resilience. Most significant, that’s no fluke. Improved beef quality and stronger spending at the top end of the market is a long-running phenomenon.

To that end, this week’s Industry At A Glance highlights total revenue growth that occurred on the wholesale side for both Premium and Branded products. The column points out, “Over and over, consumers are voting with their dollars; they want higher quality, more consistent beef and are willing to pay up for it. And best of all, the industry has proven successful in reacting to that demand signal.”

African swine fever: This topic has been covered at length in several Industry At A Glance columns. It will prove to be a critical component for global protein trade. The situation will most definitely impact world protein flow (pork, poultry, beef, dairy), be disruptive to markets, and likely influence trade negotiations – all in ways that are impossible to determine. Stay tuned!

Risk: Whatever the outlook, beef producers always need to be on the ready for unforeseen events. That was clearly illustrated in 2019 as the fire at Tyson’s Holcomb plan was hugely disruptive for a period of time – and very painful for those who didn’t have risk management measures in place. Producers at every level are encouraged to implement strategic plans to ensure some buffering against negative shocks—price risk measures, expanded working capital reserves, reduced operating costs, etc.

With the final point in mind, producers are always encouraged to remain informed, obtain objective information and review it carefully. Decisions should always be made in the absence of emotion and from a strategic standpoint. Doing so helps ensure long-term success for any operation or business.

Nevil Speer serves as an industry consultant and is based in Bowling Green, KY. Contact him at [email protected].

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)