June’s fed cattle market: A slow burn into seasonally lower prices

The fed cattle market finds itself in the midst of the summer doldrums. And this summer could prove to be an especially long, tough grind.

July 6, 2018

Pay me now, or pay me later. Either way, there’s going to be a cost – it’s all a matter of when. So it goes with seasonality. Sooner or later there’s going to be some pain as the fed market transitions from spring into summer.

Last year, the market found an extra shot and remained fairly solid through May; the dues weren’t paid until June. This year’s been different with more of an upfront payment – the pain coming in May.

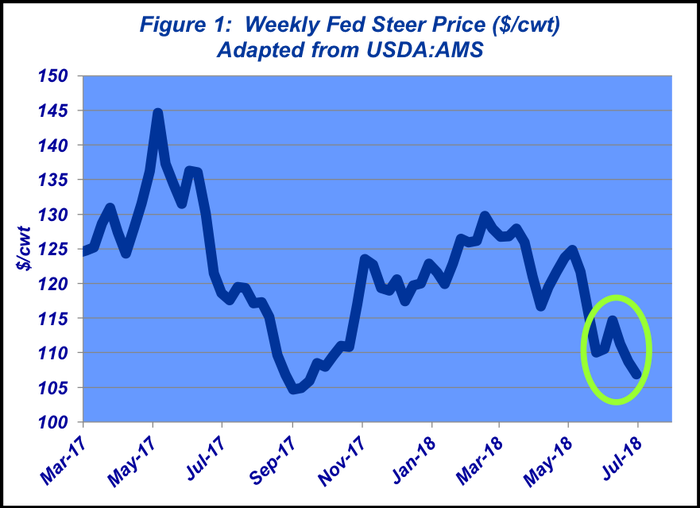

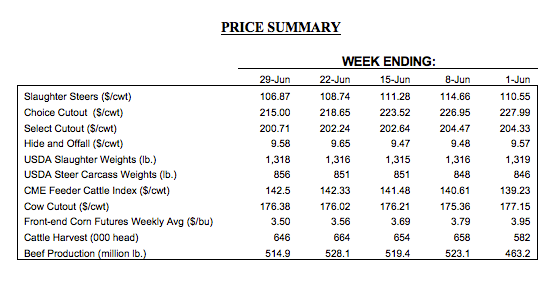

As a result, June’s market action was just sort of a slow burn. Fed steers and heifers gave up only about $3 per cwt front-to-back during the month, compared to $15 in just three weeks during May. Better yet, cattle feeders were able to score a couple of weeks with better prices following Memorial Day, despite downward pressure on the wholesale beef side (Figure1).

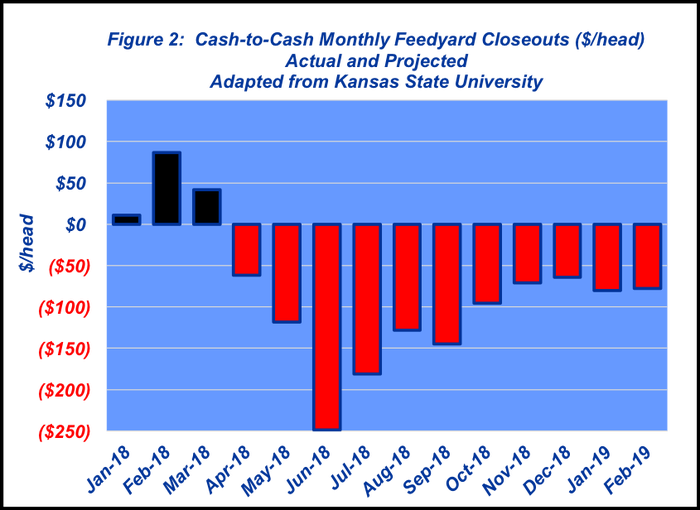

Nevertheless, the market finds itself in the midst of the summer doldrums. And this summer could prove to be an especially long, tough grind. Moreover, the market’s work through July and August (and September) will be especially important as we transition into the fall. All the while, there will be string of negative closeouts along the way (Figure 2).

With all that said, there really aren’t any new dynamics at work. That’s the good news. On the flip side, though, the challenge is that each of the major drivers is seemingly more important now than a month ago. All of them will be critical to monitor in coming months.

First, there’s the enduring supply pressure. USDA’s Cattle on Feed report marked the largest June 1 inventory in the series history; the month began with 11.553 million head on feed – nearly 300,000 head bigger than the previous record established in 2007. The biggest surprise from June’s report came in the form of May placements. Feedyards received 2.124 million head – in line with last year’s pace but well ahead of pre-report expectations – and the biggest May placement number since 2005. All-in, there’ll be marketing work ahead even as we transition beyond summer, maintaining pressure on the deferred futures contracts.

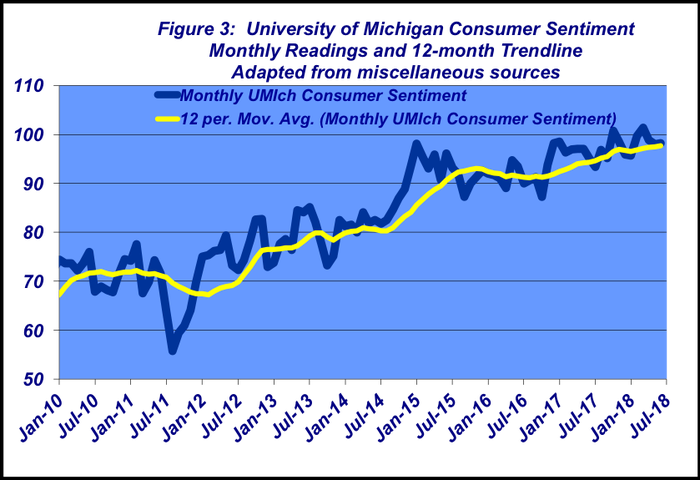

Second but more favorably, demand remains strong. As noted last month, domestic demand has been robust and continues to “pull the wagon.” Much of that due to beef’s favorable perception among consumers (more on that below). In addition, the economy (despite some trade headwinds – more on that below) is seemingly in good shape. Most important, consumers still feel pretty good about the overall direction of their prospects (Figure 3).

Meanwhile, the international demand situation is seemingly more complex. However, despite all the noise around international trade, beef export sales have been robust through the first half of the year. Global AgriTrends explains it like this:

Overseas demand for U.S. beef remains stellar in Japan and Korea with large shipments and large bookings continuing. In this dataset the beef export growth from a year ago is widening...With U.S. processors mostly through a surge in U.S. fed cattle supplies, exports have supported markets nicely. That surge of cattle will likely continue 3-4 more weeks. Exports appear poised to support U.S. beef prices through the year.

Of course, the challenge comes in all the uncertainty. While beef has been moving, the flow could potentially hit a major speed bump. Markets are generally unforgiving towards uncertainty. And so, moving the deferred futures to higher prices amidst supply pressure mentioned above, and current trade ambiguity, is going to be very hard.

Accordingly, trade is a major contributor of value that must be monitored going forward.

To that end, our weekly Industry At A Glance has focused on the importance of international trade in recent weeks. The highlights of some of those discussions are worthy of review:

Exports serve as a critically important source of revenue for U.S. beef producers. To that end, last year’s export value totaled $7.12 billion – a new record surpassing the previous record of $6.98 billion established in 2014. Japan, South Korea, Mexico, Hong Kong and Canada represent the five largest customers, respectively and collectively account for about 80% of all international trade.

As a side note, international trade is probably the single item from which I’ve received the most feedback over the years.

Now, coming back to the earlier reference regarding beef’s favorable perception in the marketplace – and the underpinning of beef demand. The June 29 edition of Iowa Public Television’s Market-To-Market included commentary from Naomi Blohm. She was asked about the potential foreign tariff assignments to U.S. pork and if trade slowdowns would mean more product remains here in the U.S. – and ultimately what impact that might have for the beef industry. Will consumers opt to buy pork instead of beef? Her response: “There’s not a substitute for beef.”

That’s precisely right; beef has been able to differentiate itself in the marketplace. That issue of “competing” meat supplies was highlighted back in January in Industry At A Glance. The column noted that:

The challenge with bigger production [or supply because of export slowdowns] is finding a market clearing price to ensure production keeps moving and prevent excessive buildup of inventory. However, that may be less of a concern [for beef] in 2018 given the acceleration of economic growth – both in the U.S. and across the globe. Moreover, while beef per capita supply is down compared to a decade ago, pricing power has increased significantly and it appears that consumers are increasingly purchasing beef on its own merits (versus making price-value comparisons to pork and poultry).

In other words, beef really doesn’t compete head-to-head with pork and poultry like we often traditionally perceive the marketplace – much of that is due to the gains in beef quality over the years and the industry’s ability to differentiate itself from other protein sources.

Cow/calf producers are especially encouraged to be on the watch in the coming weeks and months, to ensure they’re well prepared ahead of this fall’s marketing season. And as always, producers are encouraged to be vigilant about obtaining information and reviewing it objectively. Doing so ensures stacking the deck toward better decision making. Stay posted!

Nevil Speer serves as an industry consultant and is based in Bowling Green, KY. Contact him at [email protected].

About the Author(s)

You May Also Like