Winter weather (that just won’t stop) matters to cattle markets

From a market perspective, this winter has been somewhat of a double-edged sword.

March 6, 2019

Weather, weather, weather – it’s THE story of the past several months. It doesn’t matter where you go, most everyone’s tired of winter. If you haven’t been fighting cold, snow and wind, you’ve been fighting rain, mud and gray. All of which made February, the shortest month on the calendar, seemingly an especially long month.

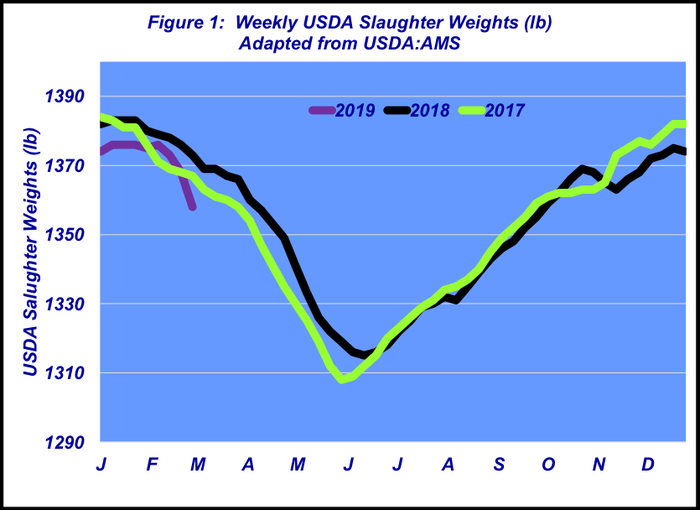

The influence of winter has definitely been felt by the feeding sector. Many feedyards have had their fair share of tough feeding conditions. As a result, closeouts have been challenged by reduced performance during the past 30-60 days. That’s best evidenced by the sharp decline in slaughter weights in recent weeks (Figure 1).

From a market perspective, this winter has been somewhat of a double-edged sword. On one hand, it’s added some additional support underneath the market.

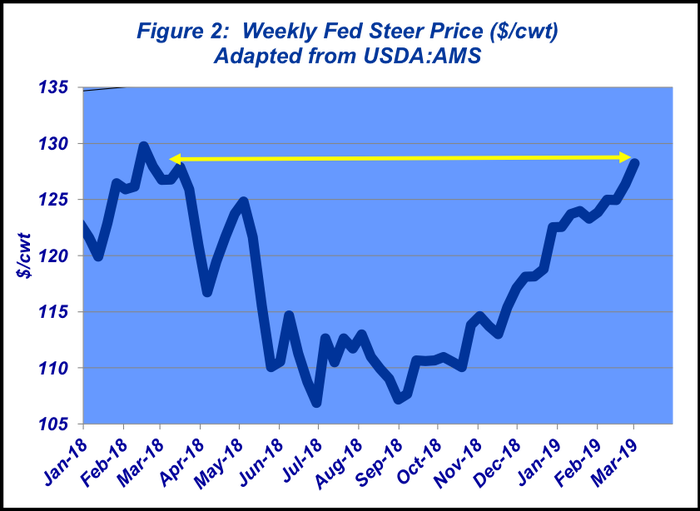

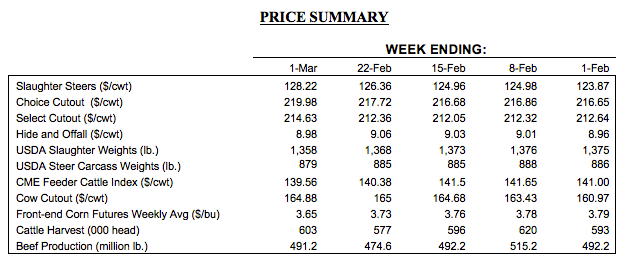

Fed prices finished January at $123-124 per cwt. From there, the market stepped up to $125 by mid-month, added another $1 the following week and finished out the last week of business with some $128-9 trade – that put cattle feeders ahead of last year’s mark at this time (Figure 2). But on the other hand, wide-ranging winter conditions have also hampered commerce.

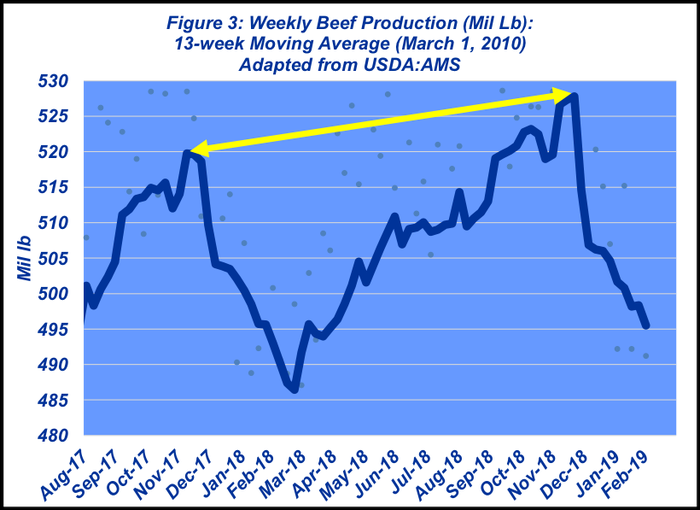

Meanwhile, cattle feeders continue to be challenged by several factors when it comes to marketing leverage. First, beef production and supplies remain ample. That’s largely the result of bigger year-over-year production heading into the holidays.

Weekly beef production peaked at nearly 528 million pounds (on a moving average basis) in 2018 versus 520 million pounds in 2017 (Figure 3). As a result, beef inventories in cold storage at the end of December were running ahead of both last year’s stocks and the five-year average.

Meanwhile, as noted above, winter’s influence also slows down beef purchases from end-users – boxed beef sales during the five weeks between Christmas and the end of January were behind last year’s pace by just over 260 loads. That trend finally reversed during February and helped boost the market in recent weeks.

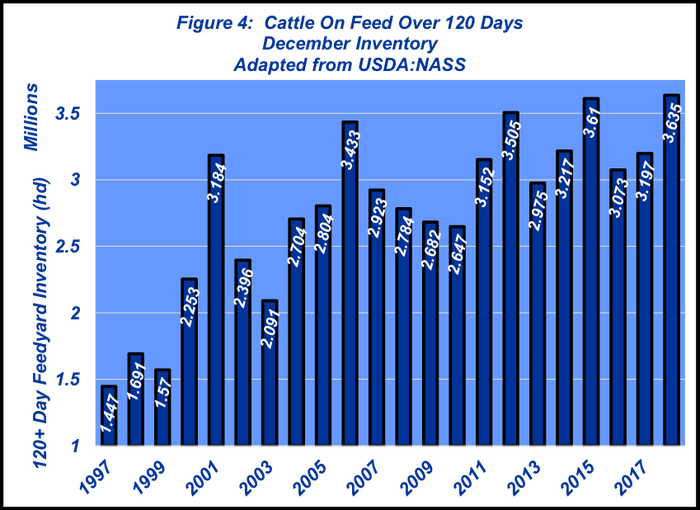

Second, feedyards are still front-end loaded. December’s 120-day plus on-feed population totaled 3.64 M head – the largest December mark in the series history (Figure 4). Given the pace of marketings thus far, the official January number will also likely rival the historical record.

Good news on the horizon

However, there’s good news ahead. One, cattle on feed inventories seem to be setting up favorably for the coming spring as we work through the front end. And two, spring weather will reappear and encourage better consumer activity as we emerge from winter hibernation (lots of cabin fever out there).

Accordingly, CME’s April live cattle contract is anticipating better days ahead. Traders boosted the contract to nearly $130 as February went off the board. As noted last month, “Additional good news about the economy, and/or a couple of good weeks in the wholesale market, should provide an additional boost for fed trade. And based on seasonal expectations, along with the current state of the economy (e.g. January’s employment report), it’s likely the market will retest last year’s highs.”

Meanwhile, consumer demand should be underpinned by renewed consumer confidence in February. The Conference Board explained that, “…consumers continue to view both business and labor market conditions favorably. Expectations, which had been negatively impacted in recent months by financial market volatility and the government shutdown, recovered in February. Looking ahead, consumers expect the economy to continue expanding.”

Supply situation

To that end, last month’s column provided some discussion around beef demand. This month, let’s take a deeper dive into the supply side of the price equation. The key drivers for supply include: The number of firms producing product (in this case, the beef and dairy cow inventory), price of other goods a firm can produce, price of variable inputs (labor, feed, etc.), technology (along with knowledge) and expectations.

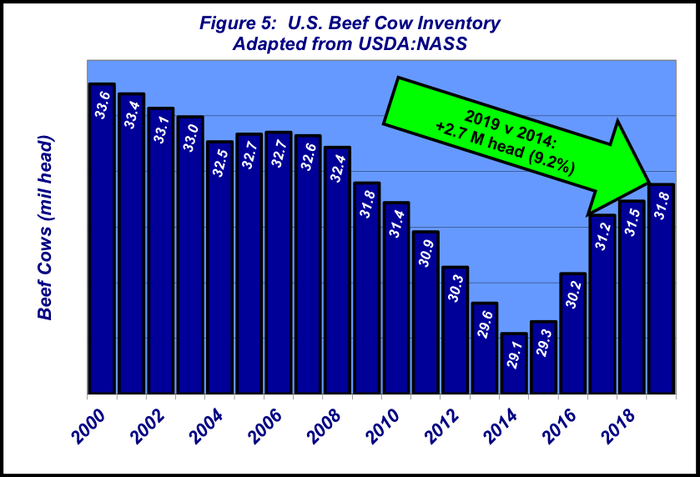

Clearly, we’ve seen major expansion in the beef industry in recent years. USDA pegged the Jan. 1 beef cow inventory at 31.8 million cows – that’s an increase of 2.7 million head vs. the cowherd’s low-water mark in 2014 (Figure 5) and the largest starting inventory in 10 years. For more discussion on inventories, see this week’s Industry At A Glance.

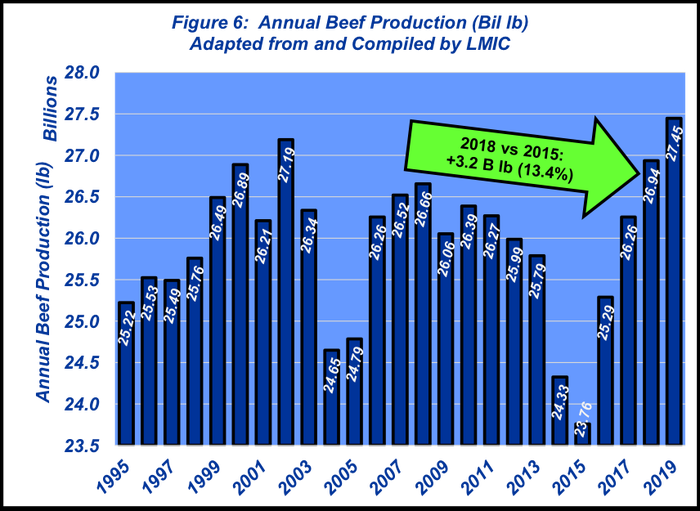

Cowherd expansion also means bigger production. Beef production in 2018 totaled 26.94 billion pounds, second largest total on record. That throughput represents an increase of 3.2 billion pounds compared to 2015 – or an additional 13% of product that cleared through the market compared to just three years ago. Meanwhile, LMIC is forecasting even bigger numbers for 2019 – record commercial production totaling nearly 27.5 billion pounds (Figure 6).

The U.S. beef industry has been very successful in applying better genetics, technology and knowledge management to become both increasingly productive and efficient over the past several decades. All that comes to fruition in 2019 in a major way.

Consider the industry started with 31.8 million beef cows in 2009 and produced 26 billion pounds of beef. We’re headed into 2019 with the same number of cows and projected to produce1.5 billion pounds more beef versus just 10 years ago.

Bigger supply means inherent negative pricing pressure. However, consider that 2018 was the second-largest production on record – second only to 2002 (missing by 250 million pounds – or about 1%). The fed market in 2018 averaged $117; in 2002, fed steers averaged $67.

Circling back around, that’s a great testament to the function of improved beef demand over time – more product moving at higher prices.

To close, it’s always important to stay focused on the market. But it’s even more important to understand the major business trends and fundamental drivers within the business. With that in mind, producers are encouraged to obtain and objectively review meaningful data and factual material—coffee shop talk doesn’t qualify. That process helps to ensure more successful decision making along the way.

Nevil Speer serves as an industry consultant and is based in Bowling Green, KY. Contact him at [email protected].

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)