What’s the relationship between U.S. and Canada feeder cattle prices?

Did MCOOL raise cattle prices during the boom years? Here’s a look at the data.

September 24, 2019

Focus on the USMCA (U.S., Mexico, Canada trade agreement, often referenced as NAFTA 2.0) has been heightened in recent weeks as Congress returns to work following the August recess. For some in the beef industry, that’s reenergized efforts to include mandatory country of origin labeling (MCOOL) in the final trade agreement.

Accordingly, last week’s column highlighted meat demand in reference to MCOOL. The discussion noted the following:

…the regression line (essentially a demand curve) during the COOL years (’09-’15) is nearly identical to the one which covers the entire ’00-’15 time period. In other words, COOL did NOT influence the price/consumption relationship.

However, since 2015, the relationship has changed! The regression line (i.e. demand curve) has moved up and to the right. That’s an indication of selling more product at higher prices – the very definition of improved aggregate demand – all the while COOL hasn’t been in effect.

That all addresses the meat side of the business. However, there’s also lots of discussion around the influence of market prices. For example, R-CALF recently posted a photo on Twitter highlighting the market’s historic run to the upside during the years of ’13,’14, and ‘15 and provided the following commentary: “Circled area shows when full #COOL was in effect. Look at cattle prices! When it was repealed, look what happened! #Rally$USMCA #WeNeedCOOLinTheUSMCA.”

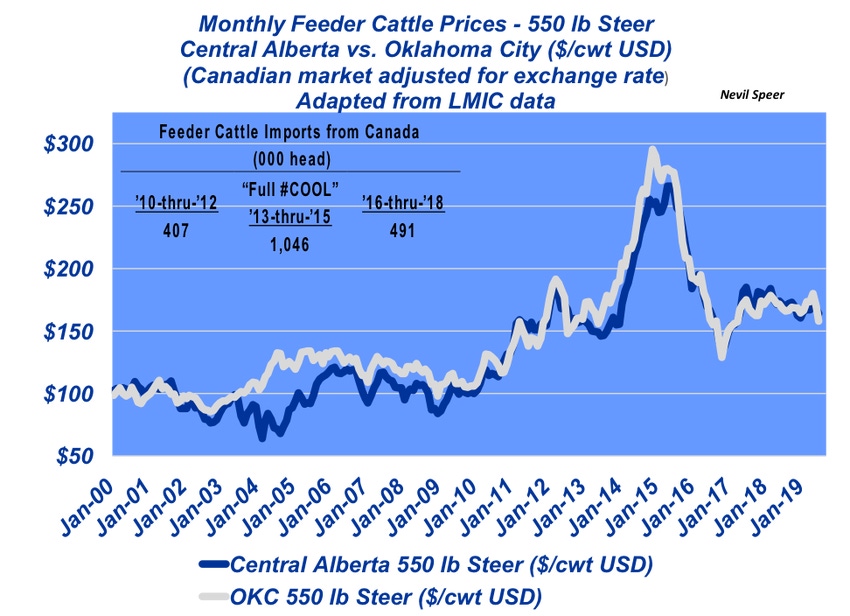

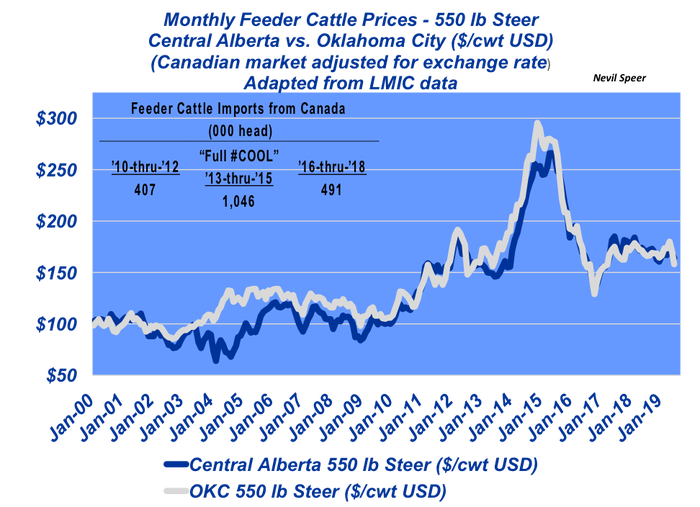

This week’s illustration includes the same data provided by R-CALF: Monthly prices for 550-pound steers, basis Oklahoma City. However, the graph also includes currency-adjusted prices for 550-pound steers, basis central Alberta.

Once the market got through trading adjustments following BSE, the influence of arbitrage is compelling. Most important to this discussion, during the MCOOL years (’09-’15), the correlation between the two markets is nearly perfect (.973).

COOL proponents often argue the law was beneficial to U.S. producers and utilize market trends as supportive evidence. That is, COOL provided U.S. beef producers a competitive advantage versus foreign suppliers in the marketplace. Therefore U.S. producers received better prices as a result of the law being in effect.

It’s that explanation that’s in play here; however, based on the data, it didn’t really turn out that way.

In the end, COOL was not market supportive in a differential way, or else the argument becomes it also benefitted Canadian producers to the same degree – which defeats the purpose.

Therefore, it proved to be a costly, ineffective non-tariff trade barrier.

That reality is further reinforced by import trends. Let’s look at them in three-year increments.

Feeder cattle imports from Canada totaled 407,000 head during the ’10-’12 timeframe when MCOOL was in effect. However, during the next three years (“full COOL” as defined by R-CALF), that number surged by 260% to 1.046 million head. In the years since COOL’s repeal (’16-’18), Canadian feeder cattle imports have faded back to total only 491,00 head. Leave your thoughts in the comments section below.

Speer serves as an industry consultant and is based in Bowling Green, Ky. Contact him at [email protected]

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)