Cow prices stay strong through COVID-19

The cull cow and bull market has shown remarkable resilience throughout the market uncertainty brought on by COVID-19.

September 10, 2020

Business is slowly but surely getting back to normal—and the world is getting used to co-existing with COVID. However, amidst that process, several key trends stand out from normal expectations. For example, last week’s column highlighted the recent (and unforeseen) strength in wholesale beef prices even in the absence of (hotel, restaurant and institutional) HRI business.

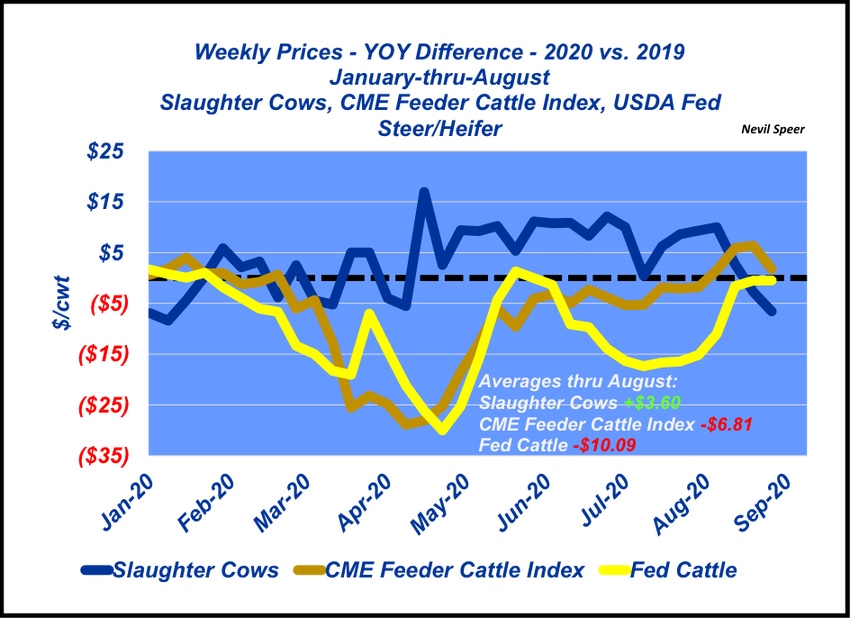

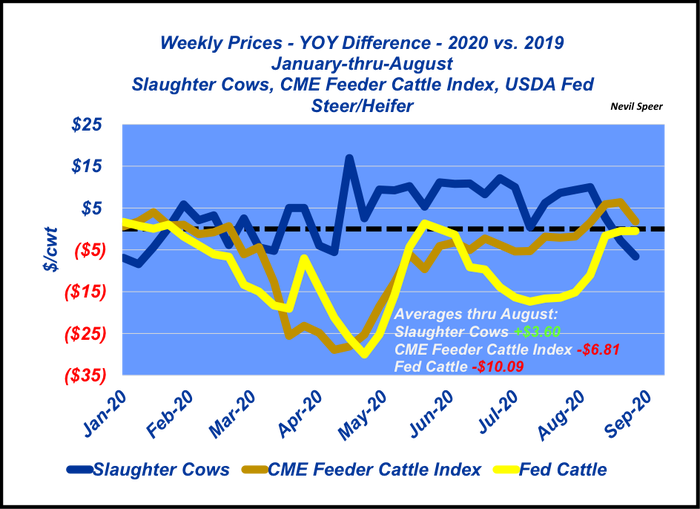

Similarly, the slaughter cow/bull market forged through the past four to five months with surprising resilience. This week’s illustration highlights weekly prices of slaughter cows, feeder cattle and fed steers/heifers—comparing this year’s mark versus last year’s levels—to highlight the divergent market patterns.

Through August, for feeder and fed cattle, the average deviation has run behind last year’s levels by roughly $7 and $10 per cwt, respectively. Conversely, slaughter cows are running ahead of 2019. The market forged through the first eight months of the year with a $3.60 per cwt advantage over last year’s prices. Most notable being the solid summer stretch with prices running nearly $10 per cwt better versus 2019.

Meanwhile, and perhaps most importantly, that’s occurred on bigger volume. Seemingly, higher prices have been effective in spurring producers to be sellers. Beef cow slaughter through August totals 2.1 million cows—about 50,000 head bigger versus 2019 and now on the fastest pace since 2013.

With respect to volume, the most critical dynamic now is wide-spread drought in the western U.S. That will likely force increased pace of liquidation and pressure cow prices from here. Occurrence of the first item inherently leads to consideration of 2021’s starting beef cow inventory. All this will be key to watch in coming months.

Nevil Speer is based in Bowling Green, Ky. and serves as director of industry relations for Where Food Comes From (WFCF). The views and opinions expressed herein do not necessarily reflect those of WFCF or its shareholders. He can be reached at [email protected]. The opinions of the author are not necessarily those of beefmagazine.com or Farm Progress.

[PJ1]What is HRI? Hotel and

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)